Ukraine's national debt increased by almost 70% in hryvnia and by 36% in dollars during the war. What should be done about this?

How does a country repay its external debts, and should the default be feared?

Ukraine received $32 billion of international financing in 2022. It is expected to receive $40-45 billion throughout 2023. According to the Ministry of Finance, Ukraine has already managed to attract approximately half of this amount, around $20 billion, since the beginning of the year.

Very often, the funds transferred by various foreign partners – governments of different countries, international institutions, etc. – are for some reason classified as financial aid.

However, if we consider that assistance is non-repayable support, such a classification is not entirely accurate. Grants, which represent free financing, account for about 30% of the total funds received in the first five months of 2023 (according to the Ministry of Finance). The rest consists of loans and funds obtained through the issuance of foreign currency government bonds. In other words, debt financing needs to be repaid, along with interest.

Considering that the lion's share of the funds transferred by partners is used to cover the budget deficit, repaying debts is not an easy task for Ukraine. While the repayment of credits accumulated during wartime will have to be addressed in the future, the old debts must be repaid today. This creates an additional burden on the state budget.

Mind has investigated how Ukraine manages its debts and which external creditors have agreed to restructuring.

What is happening to the national debt in general? The total amount of Ukraine's public or publicly guaranteed debt, from February 28, 2022, to May 31, 2023, increased by more than 68% to 4,594 billion UAH in the hryvnia equivalent, and by 36% to $126 billion in the dollar equivalent. The ratio of the national debt to GDP exceeds 80%.

In the structure of the government debt (excluding guaranteed debt), the share of domestic debt, mainly represented by government bonds, is about 34%. External debts are significantly higher, at about 66%.

54% of the external debt is formed by borrowing from international financial organisations such as the International Monetary Fund (IMF), the European Bank for Reconstruction and Development (EBRD), the European Investment Bank (EIB), and others. Another 30% represents Ukraine's debt to foreign creditors through Eurobonds issued from 2013 to 2021 inclusive. The remaining debts are represented by financing provided by governments of various countries (Great Britain, Italy, Canada, Germany) and foreign companies (Cargill, Deutsche Bank).

Considering the pace at which Ukraine is absorbing external financing, the total amount of government debt by December 31, 2023, may reach 6,197 billion UAH (such an amount is enshrined in the 2023 budget law). It is more than 100% of the projected nominal GDP of Ukraine for 2023.

In the following years, the national debt will continue to accumulate. Based on IMF estimates, in 2024, it will amount to almost 125% of GDP, in 2025 – 139% of GDP, and by 2026, it will reach 150% of GDP.

Structure of Ukraine's public or publicly guaranteed debt as at 31 May 2023

| Amount | Share of total | |

| Public or publicly guaranteed debt | 4593 billion UAH | 100% |

| Public debt, including: | 4257 billion UAH | 92,68% |

| - domestic debt | 1453 billion UAH | 31,64% |

| - external debt | 2804 billion UAH | 61,05% |

| Guaranteed debt, incl: | 336 billion UAH | 7,32% |

| - domestic debt | 70 billion UAH | 1,52% |

| - external debt | 267 billion UAH | 5,81% |

Source: MoF data

Who provides the most funding to Ukraine? According to the data presented by the Ministry of Finance at the Ukraine Recovery Conference in London, the largest volume of grants in 2022 was provided by the United States ($12 billion), the European Union ($8 billion), and Canada ($1.9 billion). The largest external creditors were the IMF ($2.7 billion) and the European Investment Bank ($0.7 billion).

In 2023, the funding situation from external sources has not changed significantly. The main contributors remain the United States and the EU, which have provided Ukraine with $6 billion and $8.1 billion respectively since the beginning of the year, in the form of both grants and concessional loans.

The main creditor among international financial institutions remains the IMF, with which Ukraine signed a new agreement in early April for a total of $15.6 billion over a 4-year period. The first tranche from the fund amounted to $2.7 billion. Another $1.8 billion is expected to arrive by the end of the year in two equal instalments.

How much debt does Ukraine need to repay in 2023? According to the data provided to Mind by analysts in the Ukraine Economic Outlook, the total repayment plan for 2023 is nearly $12 billion. This amount accounts for about one-third of Ukraine's overall international financing expected for the year. However, not all of the debt is being repaid. Out of the mentioned amount, a debt of $2.8 billion has been successfully deferred to a later date (more details below). Therefore, the total amount of debt that needs to be repaid in 2023 is approximately $9.2 billion.

Schedule and Amounts of Foreign Currency External National Debt Repayments in 2023, $mln

"Expected foreign currency inflows in 2023 of $51 billion – in addition to financing from partners, $4.1 billion will be received through foreign currency government bonds – cover expected foreign currency repayments of $6.8 billion and another $1.8 billion for debt service," explains Adrian Pantiukhov, an economist at Ukraine Economic Outlook.

During the first half of 2023 (even though June has not yet ended, payments for this month are also included – Mind), Ukraine has already repaid approximately $4.6 billion. The main payments are attributed to foreign currency government bonds and servicing of IMF loans. Therefore, about half remains for the second half of the year. In this case, the largest amount will again be received by the IMF and Eurobond holders, approximately $1.9 billion.

"Moreover, out of the $2 billion of sovereign debt due for repayment in 2023, Ukraine has already repaid 67%. A similar situation exists for the servicing of other debts, where only loans from international financial organisations (IFOs) are actively being repaid, which may indicate their substitution in case of increasing total debt. In other words, the new loans received by Ukraine are partially used to repay old loans," explains Viktor Shulyk, the Director of the Project Management Department at the IBI-Rating rating agency.

Which sovereign debts were subjected to restructuring? Ukraine managed to alleviate a portion of its debt burden through the restructuring of Eurobonds. In August 2022, the Ministry of Finance, on behalf of the Cabinet of Ministers, reached an agreement with the owners of the Eurobonds to defer payments and extend the repayment term by two years, from 2024 to 2026. The agreements were reached for approximately 75% of the circulating papers' value.

"The debt from external bond obligations has effectively frozen at the level of $22.7 billion, and their restructuring was carried out based on the Cabinet of Ministers' resolutions No. 805 and 806," clarified Viktor Shulyk.

Thanks to the reached agreements with the owners of these papers, Ukraine saved $2.8 billion in 2023 alone. Moreover, experts do not rule out the possibility that due to the challenging situation with the budget deficit, the government may make another attempt towards the end of the year to negotiate with the owners of Eurobonds in order to obtain another deferral.

Additionally, the Cabinet of Ministers managed to secure deferrals for GDP warrants. Let's recall: these are securities that Ukraine issued in the amount of $3.2 billion in 2015 as part of the external debt restructuring. The unique feature of the warrants is that their profitability is linked to the country's GDP. The higher the economic growth rate, the greater the payments for the papers.

"Deferrals were agreed upon with the owners of GDP warrants. Ukraine included the option to redeem them at face value in the issuance terms. The payment, which was scheduled for May 31, 2023, was postponed to August 1, 2024. The maturity of the warrants was extended by one year, until 2039," comments Adrian Pantiukhov.

By the way, Ukraine managed to revise the payment schedule for credit debts to the IMF. It is not a pure restructuring, but rather an opportunity to slightly 'spread out' the debt burden.

"The payment amounts for the nearest year have decreased in the payment schedule to the IMF. Nevertheless, the programme with the fund has quite stringent requirements and structural benchmarks, as well as a relatively high-interest rate at 6.9%," explains financial analyst Andriy Shevchyshyn.

Which state-owned companies had their debt repayments deferred? Besides Ukraine's external obligations as a state, there are also external debts held by state-owned companies. The largest borrowers include Naftogaz oil & gas company, Ukravtodor motorway agency, Ukrenergo power line , and Ukrzaliznytsia (Ukrainian Railways). All of them (or almost all) have successfully negotiated a restructuring of their Eurobonds.

The easiest to achieve this was for Ukravtodor and Ukrenergo. In late summer 2022, the companies reached agreements with creditors to defer payments for Eurobonds issued in the amounts of $700 million and $825 million, respectively, shifting the repayment terms from 2026 to 2028.

In December 2022, Ukrzaliznytsia carried out the restructuring of Eurobonds worth $895 million. The bond repayments issued in 2019 were shifted from 2024 to 2026, while those issued in 2021 were moved from 2026 to 2028. Additionally, the company rescheduled the payments for these papers, originally due in 2023-2024, to January 2025.

The most challenging situation arose for Naftogaz, which failed to obtain permission from the Cabinet of Ministers to restructure its debt obligations.

"For two issuances of $500 million and $335 million with repayments due in 2026 and 2022, the company declared a default. Currently, Naftogaz is in negotiations regarding the restructuring of the defaulted issuances. The latest proposal, rejected by investors, included the repayment of the overdue coupon-2022 and the accrued interest, as well as the repayment of Eurobonds-2026 in 2027-2028 with a 0.5% premium," says Adrian Pantiukhov.

What are the chances of Ukraine avoiding a 'debt pit'? Taking into account the levels of financing the country has been receiving for the second consecutive year, as well as the agreements reached with creditors, the threat of default on external debts is minimal.

The maths is simple. The peak payment in 2023 of $3.2 billion was supposed to be due in September. However, the deferral of Eurobonds allowed reducing this amount by more than half to $1.4 billion.

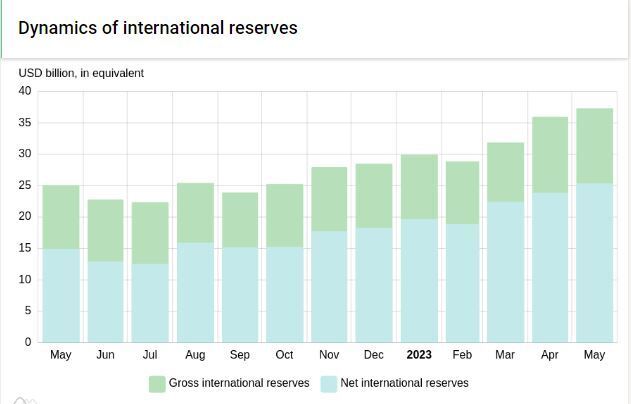

Considering the record level of gold and currency reserves of the National Bank since 2011, which exceeded $37 billion by June, and the confirmed funding from partners that can be expanded if needed, Ukraine has secured a reliable foundation for debt repayment in 2023.

Source: NBU data

"There are definitely resources available for current debt payments. However, we should continue negotiations on restructuring. The situation remains quite challenging, and we need to use all available tools for the recovery of Ukraine and its economy," concludes Andriy Shevchyshyn.