Calm or swings: What will happen to the exchange rate in Ukraine in autumn?

And to what extent will the termination of the grain deal affect it?

After almost two months of stagnation, the Ukrainian hryvnia's exchange rate has broken out of its sideways movement. In the period from 24 July to 28 July, the cash selling rate increased from 37.34 UAH/$ to 37.8 UAH/$, and the buying rate rose from 36.73 UAH/$ to 37.1 UAH/$, respectively. Over the next few days, there was a slight strengthening to the range of 37–37.6 UAH/$. However, the cash rate has not yet returned to its former corridor of 36.7–37.3 UAH/$.

The fluctuations of the hryvnia are related to several events. These include the actual termination of the Black Sea grain initiative (the 'grain corridor'), a key policy rate decrease, and concerns from the National Bank of Ukraine (NBU) that disruptions may arise with international financial assistance. Additionally, the US dollar is strengthening in the global market.

While experts believe that there are currently no grounds for serious exchange rate fluctuations, the calmness in the foreign exchange market seems to have come to an end. Mind has been looking into what exchange rate will be relevant in Ukraine in the next two to three months.

What happened with the currency market in June–July?

Cash market. During the first two months of summer, the hryvnia continued to strengthen. In April, the average cash exchange rate was 37.87 UAH/$, in May – 37.59 UAH/$, in June – 37.24 UAH/$, and in July – approximately 37.18 UAH/$.

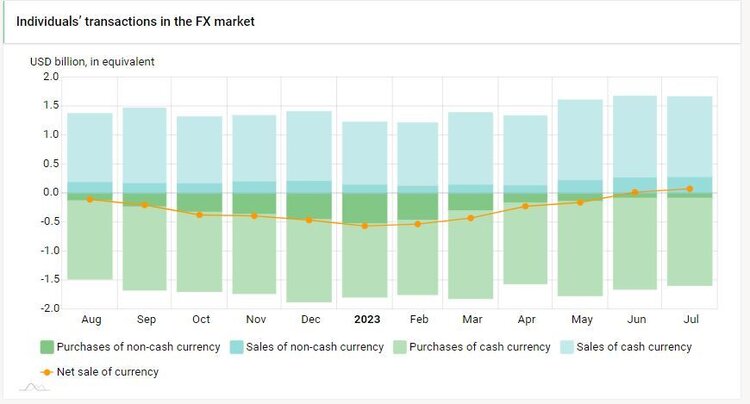

The cash segment was fuelled by the sale of currency by individuals. Among them, depositors who received dollars and euros from currency conversion deposits contributed to the supply.

The NBU managed to reduce the public's demand for currency by using hryvnia deposits. Banks significantly increased deposit rates to 18–20% since the beginning of the year. This profitability, against the backdrop of slowing inflation rates (consumer price growth of 11% in 2023, according to the latest forecast), became quite an attractive offer. As a result, the volume of deposits from individuals has been increasing for five consecutive months, thereby easing pressure on the cash market.

The volume of deposits of individuals in national currency in banks. UAH billion

| The period of 2023 | Volume of deposits |

| January | 580,4 |

| February | 586,1 |

| March | 589,1 |

| April | 596,4 |

| May | 607,5 |

| June | 634,7 |

Source: NBU data (as of the end of the month)

Consequently, in June, the market for FX purchase and sale transactions by individuals reached a balance for the first time in a year: a surplus of $0.02 billion. At the same time, demand for cash foreign currency exceeded supply by only $180 million.

The interbank market. The non-cash (interbank) market also experienced calmness. On one hand, the exchange rate for transactions by legal entities is tightly linked to the official rate (which is 36.6 UAH/$), thus significant fluctuations are excluded. On the other hand, stable inflows of foreign currency earnings (including those from the grain deal again) ensured an adequate currency supply.

Moreover, the activity in the interbank market decreased: in March, the volume of non-cash transactions was $12.8 billion, in June – $8.8 billion, and in July, approximately $9 billion.

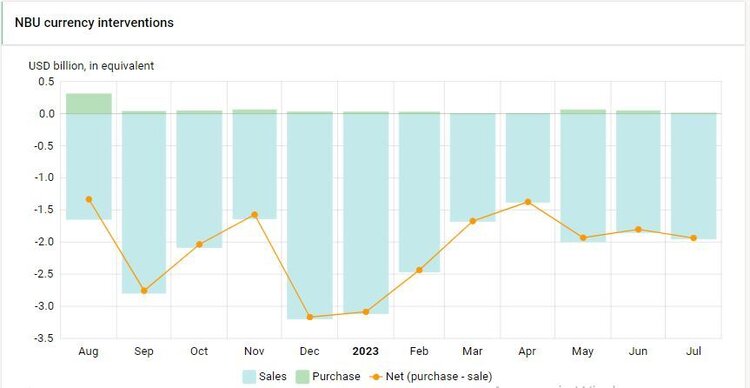

Furthermore, NBU meets the currency needs through interventions. The NBU spent an average of $430–450 million per week on interventions in both June and July. For comparison, in January, the central bank was 'draining' up to $700 million per week.

The volume of NBU interventions in June–July

| Period | Amount of interventions, USD million |

| 05.06-09.06.23 | 292.69 |

| 12.06-16.06.23 | 446.76 |

| 19.06-23.06.23 | 435.82 |

| 26.06-30.06.23 | 532.97 |

| 03.07-07.07.23 | 478.51 |

| 10.07-14.07.23 | 401.58 |

| 17.07-21.07.23 | 594.66 |

| 24.07-28.07.23 | 350.47 |

Source: NBU data

In June, the total volume of interventions was $1.85 billion, and in July it was slightly higher at $1.95 billion. Since the beginning of the year, between January and July, the NBU has sold more than $14 billion on the interbank market.

Why did fluctuations occur in the currency market? The exchange rate surge in late July and early August resulted from the coincidence of several factors.

On July 18, the grain deal expired. On a short-term basis, this did not impact the market in any way, but it added nervousness. According to the estimates of the Ukrainian Institute for Public Policy, during the 10 months of the Grain Initiative's implementation, Ukraine received around $13.5 billion, which means an average of $1.3–1.4 billion per month. Even accounting for exporters' expenses and losses from ship downtime in ports, the interbank market might now lack over $0.5 billion per month.

This is not fatal. Moreover, agricultural producers are seeking alternative ways of product supply. However, the burden on the National Bank regarding interventions will likely increase in August.

The second factor is the NBU's decision to lower the key policy rate by 3 percentage points to 22%. This move was a logical continuation of the shift towards a free (floating) exchange rate. Although in practice, the National Bank still continues to influence market conditions and manually regulate the exchange rate.

Additionally, a situational factor was the suspension of operations by a large currency exchange network. As one of the banking market representatives told Mind, it was a significant grey network that conducted operations, including those involving cryptocurrencies. This event created a temporary currency shortage in the market, leading to an increase in demand for it.

Furthermore, there was a strengthening of the dollar in the global market. The USD index (DXY), which reflects its strength against other currencies, increased by 2.7% from mid-July to early August, reaching 102.4 points. This was influenced by data showing a 2.4% growth in the US GDP in the second quarter, surpassing analysts' expectations, who had forecasted a growth of 1.8%.

However, the impact of global movements on the Ukrainian market is unlikely to be significant. "Moreover, in the currency structure of Ukraine's settlements, the share of the dollar accounts for 67% of inflows and 54% of outflows. Therefore, the strengthening of the dollar should, in turn, contribute to the strengthening of the hryvnia against the euro and other currencies," commented economist Hryhoriy Kukuruza from Ukraine Economic Outlook.

How will the currency market behave in the autumn? Two scenarios can be considered for the next two to three months.

Scenario №1: Returning to the former range of 36.7-37.3 UAH/USD. According to experts, the resilience in the currency market has not been exhausted yet. "There are currently no prerequisites for significant (exchange rate) changes," believes Taras Lisovyi, Head of the Treasury Department at Globus Bank. According to him, at least until the end of summer, the currency market will experience a period of stability, with exchange rate fluctuations possible only within the range of 37-38 UAH/USD.

Despite the National Bank's announcement of a gradual transition to a floating exchange rate, it is unlikely to happen in the third quarter. Moreover, there is no certainty that it will happen at all in 2023.

"We do not see any grounds for changing the exchange rate regime by the end of 2023 and returning to a floating rate with a correction to 39.6-41.4 UAH/USD. Considering the current priorities of the National Bank, the main efforts of the regulator are currently focused on expanding bank lending. The lifting of capital movement restrictions has taken a back seat," explains Hryhoriy Kukuruza.

The National Bank holds a similar viewpoint. In the commentary on the decision to lower the policy rate, it was mentioned that the decision was made against the backdrop of a rapid deceleration of inflation rates and a "stable situation in the currency market." Additionally, the economy is adapting to military realities faster than expected. According to the National Bank's estimates, the GDP growth in 2023 may reach 2.9%.

Andriy Pyshnyi, Head of the National Bank, believes that the increase in the attractiveness of hryvnia instruments has positively influenced exchange rate stability. "Increased mandatory reserve requirements and a change in the operational design of monetary policy contributed to a significant increase in bank rates on term deposits and the strengthening of the hryvnia cash exchange rate," he stated.

Pyshnyi pledged that the National Bank would continue to ensure stability in the currency market and maintain an adequate level of attractiveness for hryvnia assets, noting that the NBU had sufficient resources for this purpose. In particular, the volume of reserves reached $39 billion in July.

Scenario №2: Exchange rate fluctuations and reaching 38 UAH/USD, with a potential risk of going beyond. There are still some threats to stability in the FX market.

The main risk is prolonged hostilities. The new NBU forecast predicts the winding down of the active phase of the war by mid-2024. However, this is considered to be an optimistic projection. According to Pyshnyi's opinion, military escalation could lead to worsening exchange rate and inflation expectations.

The National Bank is concerned about the reduction in international aid volumes and potential delays in its disbursement. According to NBU data, from the beginning of the year (January to July), Ukraine received around $27 billion from foreign partners. Overall, for the year 2023, promises were made to disburse $42 billion. Therefore, there is still approximately $15 billion to be received.

Among other threats, the regulator sees the possibility of an electricity deficit in autumn and winter, which could lead to production stoppages and a slowdown in economic activity. Additionally, there may be issues with the export of agricultural products.

In simpler terms, prolonged hostilities, coupled with reduced international aid and decreased business activity due to the energy deficit, could destabilise the currency market. It's worth noting that in September, Ukraine has to make payments of almost $1.4 billion for external debts, which will also put pressure on the currency market.

"If indicators such as currency interventions, agricultural exports, and external aid start deteriorating rapidly in August, the NBU might reconsider the exchange rate. However, it is unlikely to happen before the fourth quarter. If negative trends continue to rise, the cash market will react with an exchange rate increase towards 40–41 UAH/USD," predicts economist Andriy Shevchyshyn.

However, given the NBU's accumulated reserves, a sharp devaluation is unlikely. Moreover, agricultural exporters have the potential to increase their exports by about 30% without relying on the maritime corridor. According to the Ukrainian Grain Association, 2 million tonnes of grain currently pass through the ports of Danube monthly, but there is potential to export up to 3 million tonnes per month through this route. When combined with railway and road transportation, exports could reach up to 5 million tonnes per month.

Therefore, in the next two to three months, the possibility of fluctuations in the currency market remains. However, the likelihood of the exchange rate surpassing 38 UAH/USD is minimal.