The giant is falling. WeWork is preparing for bankruptcy that could affect the entire market

The company, recently valued at $49bn, is 12 months away from bankruptcy

Last week, one of the world's largest co-working operators, WeWork, announced that it has "serious doubts" about its continued operations. The company is losing money, and clients are increasingly rejecting its services. Unless a miracle occurs and the company manages to improve its liquidity and profitability within 12 months, bankruptcy awaits.

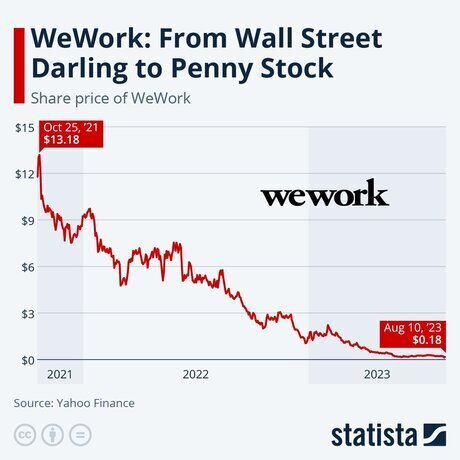

On the morning of 9 August, at the start of the next trading day after the announcement, WeWork's shares plummeted by 26% to $0.18. The company's market capitalisation fell to $150 million. Ironically, this day marked World Co-working Day. Mind explains what has happened to the former 'darling' of Wall Street and what to expect for the young but promising market of flexible workspaces.

The WeWork saga has been ongoing for several years. Since the company went public in October 2021, its shares have lost 98%, decreasing its market value by $9 billion. As of the end of June 2023, the company's overall liquidity stood at $680 million. Considering its long-term debt obligations of $2.9 billion and a negative cash flow of $530 million for the first half of the year, the situation appears doubtful.

The history of the stock's decline from the 'good times' of October 2021 (going public) to the present

Source: Statista.

In the good times, back in 2019, WeWork secured $6 billion from the investment fund SoftBank, was hailed as a unicorn with a valuation of $47 billion, and was considered one of the future stars of the stock market. However, during the preparations for its IPO, after analysts delved into the company's inner workings, the valuation dropped to a more realistic $9 billion. Following the public offering of shares (via a merger with a SPAC company), CEO Adam Neumann was 'asked' to step down, given a 'golden parachute', and replaced by commercial real estate veteran Sandeep Mathrani, who failed to cope.

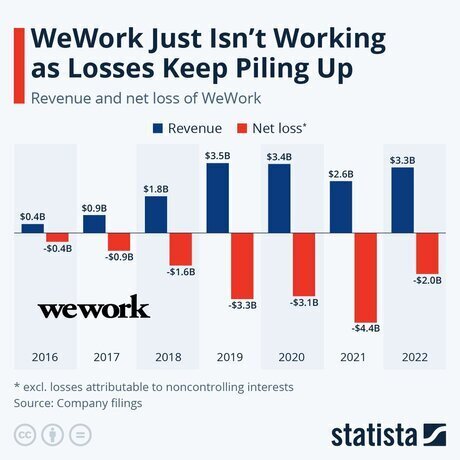

Demonstration of the dynamics of WeWork's expenses, which have grown in parallel with its revenues, reaching as much as $15 billion since 2016

Source: Statista.

During his tenure, after severe cost-cutting, the abandonment of numerous directions and projects, and the sale of non-core assets like Neumann's aeroplane, the company desperately needed some good news.

When it became clear that COVID-19-related lockdowns would last for a while, WeWork, with a mix of anxiety and a somewhat upbeat tone, assured that the upcoming transition to hybrid work would improve the company's situation rather than harm it. They suggested that employers would opt for flexible WeWork conditions over long-term lease contracts.

As of the past week, the optimism hasn't panned out. More and more residents are leaving WeWork's locations, and new clients are not taking their place. Well, and the new CEO also departed.

How does WeWork make money?

In reality, WeWork's model is simple and ingenious. Businesses don't want to deal with property management, so the company-operator buys or long-term leases commercial real estate, refurbishes it, and rents it out in a 'flexible format', sharing space according to the tenants' needs. For freelancers, WeWork offers individual workspaces: hot desks (not assigned to a resident) and fixed desks (reserved for visitors). For startups, there are smart offices that can expand as the team grows. For large corporate clients, nearly any option is possible, from large offices or placing employees in different locations to leasing and managing buildings 'turnkey'. WeWork operates in this way with Google, Microsoft, investment banks, and other global giants.

What is next?

In order to stay in business, WeWork's management is developing a four-step plan aimed at increasing liquidity and profitability in the short term:

1. Reducing lease payments and rental expenses.

2. Increasing revenue by reducing the outflow of existing tenants and attracting new ones.

3. Implementing maximum feasible cost controls.

4. Attracting new capital through issuing debt obligations, securities, or asset sales.

How will this impact the market?

The co-working market worldwide is relatively young. It's evolving at an evolutionary pace, increasing the number of locations and the square footage of commercial real estate it covers.

Any significant fluctuations, such as the fall of a $47 billion giant, have a negative impact on the market, increasing investor distrust and making it costlier for players looking to develop their businesses to acquire investment capital.

And in the event of WeWork's bankruptcy, there will be a residue of dissatisfied tenants who have cooperated with the world's largest coworking operator.