The new homes market shrinks only to one segment. New buildings of what type experience a demand recovery now?

And what are the developers doing to withstand the conditions of the war?

The primary real estate market has picked up after a record decline in demand that occurred in the fall and winter due to rocket attacks and blackouts. However, this recovery only applies to a specific segment. The war has clearly divided the primary market into three categories: construction at the pit level, projects that are more than 80% complete; and luxury housing. The first and third categories are currently 'off the market', while some movement can be observed only in the second category.

Mind was investigating why this happened, who is buying flats in new buildings during the war, and whether there are enough sales to support construction companies.

Who buys dwellings in new buildings? Prior to the full-scale invasion of Ukraine by russia, the demand for real estate consisted of two groups of participants: speculative and passive ones. The first group considered purchasing property as a means of making money: they bought at high risks and later sold at higher prices. Others chose homes for themselves.

During wartime, speculative interest disappeared as the risks became too high. Passive investors also prefer flats that they can move into and live in immediately. As a result, demand plummeted, and the sales funnel narrowed rapidly.

Since March 2023, the situation has slightly improved. "Speaking in terms of sales, March-May were the best months in terms of transactions for the purchase of square metres since the beginning of the full-scale invasion. Of course, these are not the volumes we had before the major war. But compared to last year, the growth in demand is significant," emphasised Anna Layevska, the commercial director of Intergal-Bud company, in a comment to Mind.

The profile of the average buyer has also changed. Currently, it mostly consists of displaced persons and families of military personnel who have relatively high incomes and credit privileges.

What are they buying? The cheaper the housing and the higher the project's readiness level, the greater the demand. Currently, buyers are not aiming for premium or business-class flats but are choosing options priced up to $100,000.

Speaking specifically about Kyiv, buyers are more active in the suburban areas on the primary market rather than in the capital itself. Suburbs offer more affordable prices and greater opportunities to meet the preferences of buyers in privileged categories.

"According to our estimation model, as of April, there were around 600–700 transactions in Kyiv and about 800–900 in the metropolitan area. For comparison, during the same period in 2021, monthly demand amounted to nearly 4,500 flats," says Volodymyr Danylenko, director of M4U company.

Buyers' focus is primarily on already completed or nearly completed housing. Since they buy mostly for themselves, rather than to invest 'extra' money, they prefer two- and three-bedroom flats where they can arrange comfortable living, explained representatives of Intergal-Bud. Like before the major war, residential complexes with developed infrastructure inside – such as shops, kindergartens, schools, and more – remain popular.

Excavation-stage projects are left for more risk-taking buyers. More such deals are concluded, once again, in the suburbs, but they account for no more than 10% of total sales. As for luxury real estate, there are only sporadic sales. In the absence of demand, this segment has depreciated by 15-18% over the past six months, according to Oleksiy Koval, project manager of Perfect Group.

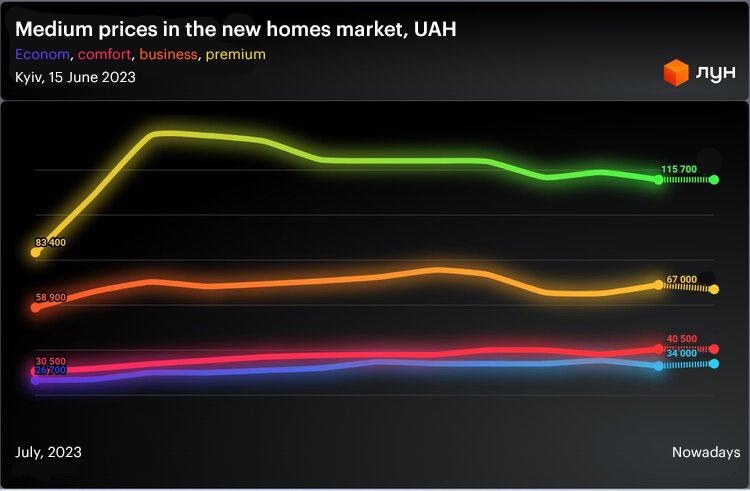

Prices in other categories for flats in the capital have stabilised.

However, the market behaviour now directly depends on news from the front: if the counteroffensive is successful, developers expect an increase in demand. Otherwise, there will be another stagnation because all the material reserves have already been depleted.

At the beginning of the project implementation, most developers traditionally do not have the entire necessary amount and rely on sales to fuel their financial base. However, the realities of the war – declining demand, inflation, rising construction material costs, and logistical complications – have made this business model extremely risky.

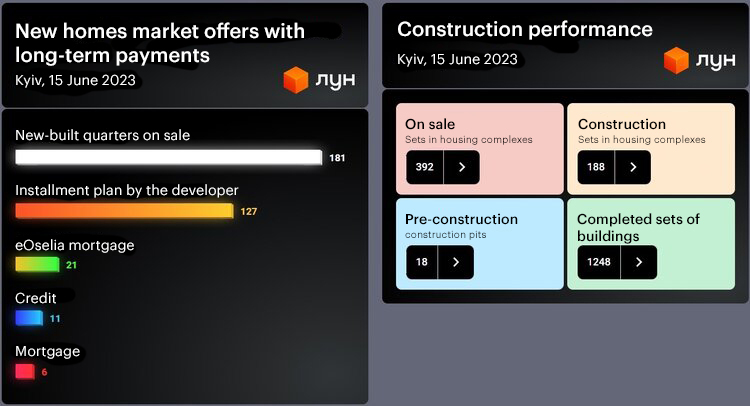

There were high expectations for market revival after the launch of the eOselia (eHousing – Mind) mortgage programme. However, it has not lived up to its promise thus far due to significant funding limitations. Moreover, in Kyiv, this mortgage is currently only available in 15% of residential complexes. The number of approved loans since October 2022 amounts to only 0.5% (out of over 46,000 applications), and it only accounts for a few dozen deals in the primary market. Furthermore, funding for eOselia has practically been halted since February. It was only in May that the issuance of preferential mortgages resumed.

Developers are left face-to-face with their difficulties and dissatisfied investors. The existing sales are only sufficient to support operational activities. Therefore, in order to withstand the situation, construction companies are abandoning excavation-stage projects and focusing on the implementation of already partially completed objects that are popular among buyers.

Discounts and instalment plans are being used to increase sales volumes. Intergal-Bud admits that they are trying to maintain property prices. They have not changed significantly in dollar equivalent. "Although the economic factors of construction projects justify price increases, we understand that to stimulate real demand, it is necessary to limit the growth of pricing offers," says Anna Layevska.

According to her, the percentage of deals for purchasing flats on instalment plans for more than a year accounts for 15-20% of the company's total sales volume.

There are other options being explored to improve the financial situation as well. For example, as reported by Mind, Kyivmiskbud (Kyiv City Construction – Mind) turned to its largest investor, the Kyiv City Council, for help due to a severe lack of funds. The discussion revolved around the purchase of flats worth 300 million UAH and additional financing of 1 billion UAH.

Initially, the developer halted work at all construction sites but later resumed operations at four of them. The city authorities did not provide the money but instead established a temporary commission (composed of 16 MPs) to investigate the activities of Kyivmiskbud. The commission was headed by Myroslava Smirnova, an MP from the Udar (The Vitali Klitschko Ukrainian Democratic Alliance for Reform – Mind) political faction.

What can support the market? Strengthening the new houses market could be achieved through a state housing restoration programme aimed at rebuilding properties destroyed by combat actions. It should be noted that within the eRecovery framework, the government allocated 4.4 billion hryvnias to compensate for damages. However, there is currently no mention of issuing certificates for purchasing housing in exchange for lost property.

According to the Kyiv School of Economics (KSE), in Ukraine, 150,000 tower blocks and private houses have been destroyed or damaged, with the total damage to the housing stock amounting to $53.6 billion. There are high hopes for this direction, but such an impact is currently highly speculative.

"In many cases, the damages are limited to 'only' broken windows, which people have already repaired at their own expense, without expecting support from the government. Unfortunately, considering the slow system and the human factor in decision-making regarding the amount of reimbursement (corruption element), the payouts will take years. Therefore, it is not necessary to speak of a significant impact on the real estate market. Furthermore, much of the damaged property belonged to legal entities, whose compensation is currently not envisaged," says lawyer Volodymyr Kopot.

In his words, the legislative mechanism for compensation is ready to be launched, but the question is whether the state has enough funds. The war is still ongoing, and the scale of destruction increases daily. Meanwhile, the maximum payout amount is 500,000 hryvnias per object, which currently amounts to only $13,500. Therefore, the lawyer does not recommend placing excessive hopes on the compensation process.

During the war, many internally displaced persons relocated from the war zone to relatively safer regions – just in the capital alone, there are tens of thousands of such people. These people could potentially become homebuyers. However, according to Oleg Prykhodko, CEO of the development company Greenol, real momentum for market activation will only come with good news from the front.

"All market participants have adopted a wait-and-see approach. Depending on the course of military actions, all markets, including the housing market, will react. Significant shifts are only possible as the end of the war approaches," he says. Therefore, according to analysts in the development market, there will be no significant changes in terms of prices for newly constructed buildings in the coming months.