Advertising market '2023: Humanity and support are back in trend

Consumers react to the position of brands on the war

Meta's activity has been under the scrutiny of the European Commission. The latter in December has warned the company that it violates EU antitrust laws and distorts competition in online advertising markets and abuses its dominant position. However, not only the internal rules of a particular company affect the development of the advertising market. In Ukraine, in particular, the war has become one of the key factors of change in this market. Experts note that in 2022 marketing budgets fell by 70%. Yuliya Sokolova, CEO of SIGMA agency, told Mind how this market would develop in 2023 and how its participants could stay afloat.

The advertising market in Ukraine grew rapidly, reaching UAH 31 billion in 2021 compared to the previous UAH 24.5 billion. Such data was cited by Maksym Lazebnyk, the General Director of the All-Ukrainian Advertising Coalition (VRK), in the annual report published on the VRK’s official website .

Media advertising market in Ukraine, 2021

| Results of 2020, UAH mln | Results of 2021, UAH mln | Percentage of change, 2021 compared to 2020 | Forecast for 2022, UAH mln | Percentage of change, 2022 compared to 2021 | |

| TV advertising, total |

12 175 |

13 642 | 12% | 15 600 | 14% |

| Direct advertising | 10 593 | 11 854 | 12% | 13 633 |

15% |

| Sponsorship | 1 582 | 1 788 | 13% | 1 967 | 10% |

| Advertising in the press, total | 1 466 | 1 599 | 9.05% | 1 773 | 10.89% |

| National press | 866 | 960 | 10.8% | 1 077 | 12.2% |

| incl. Sponsorship | 215 | 243 | 13% | 281 | 15.5% |

| Regional press | 243 | 268 | 10.25% | 303 | 13% |

| Specialized press | 357 | 371 | 4% | 394 | 6% |

| Radio advertising, total | 717 | 855 | 19% | 1 015 | 19% |

| National | 512 | 605 | 18% | 715 | 18% |

| Regional | 65 | 80 | 23% | 95 | 19% |

| Sponsorship | 140 | 170 | 21% | 205 | 21% |

| Out-of-home (OOH) Media, total | 3 159 | 4 098 | 30% | 4 769 | 16% |

| Outdoor advertising | 2 433 | 3 092 | 27% | 3 529 | 14% |

|

Transit advertising |

351 | 397 | 13% | 432 | 9% |

| Digital OOH advertising | 291 | 518 | 78% | 712 | 37% |

| Indoor advertising | 85 | 90 | 6% | 97 | 7% |

| Cinema Advertising | 20 | 26 |

30% |

35 | 35% |

| Digital (Internet) Media advertising | 6 980 | 10 833 | 55% | 13 510 | 25% |

| Advertising media market, total | 24 517 | 31 053 | 26.7% | 36 702 | 18.2% |

Source: a report on the website vrk.org.ua for December 2, 2021

In 2022, VRK analysts predicted a growth of 18.2%. However, after the start of a full-scale war, almost the entire advertising industry in Ukraine stopped.

Brands have reduced communication with the audience digitally, on television, radio, and in external media. In some places, only a single activity in social networks remained.

Reducing advertising costs and moving to a new level of quality and creativity

Back on February 24, SIGMA had a lot of tasks: to stop and remove all advertising campaigns, to coordinate further actions with clients, and the next day the work was paused. Less than two months later, in April, we began discussing with clients the possibility of returning to cooperation.

The business was already interested in returning to communication. Our clients needed to encourage and support the audience, as well as report on their own social activities. Therefore, at the end of April, we were among the first to launch an advertising campaign for our pharmaceutical client on television.

Advertising costs in the spring of 2022 decreased significantly for everyone. In pharma (pharmaceutical industry), the advertising budget decreased by 25-30%, and in some other industries – up to 70%. In addition, several companies cancelled all planned large-scale campaigns: on television, digitally, etc. And these services usually accounted for about 80% of the total advertising budget.

March – November 2022 brought us a controversial discovery: successful marketing companies in Ukraine, in particular, now depend not so much on the size of the business budget and analytics from international industrial research agencies, but on the professional intuition of our strategists, planners, and creatives.

Read also: Pharma at war: Reorientation from anti-COVID drugs to hemostatics, destroyed warehouses and migration of pharmacists

Other approaches towards studying audience needs

Until February 2022, we relied mainly on industrial research analytics and professional marketing software to improve planning efficiency, including our own developments. Thus, we believed that there should be no unconfirmed hypotheses and average temperature across the hospital, only Big Data.

However, with the beginning of a full-scale war, our industry lacked objective data about the consumer and the market. Most companies conducting research for our industry use traditional approaches, written questionnaires, and cold callings. Now they are almost impossible to implement because due to wartime conditions, respondents are constantly moving, and their life's challenges are changing rapidly.

There are also more modern and advanced research formats.

International companies specializing in marketing research offer online tools to measure people's consumer habits on digital platforms. However, unfortunately, such solutions are not yet widespread in the Ukrainian market. The number of companies that use research in the new conditions of martial law has halved. This is evidenced by the results of the survey "Trends 2022 in Marketing Communications Management" by the VRC.

Therefore, now, in the absence of data, we must rely on many years of experience and the data that is available to us. However, of course, we are all waiting for the restoration of quality measurements and access to the usual software.

We understand that the audience has changed. According to Gradus Research, as of early December, there are changes in the consumer sentiment of Ukrainians. Thus, due to the lack of work (37% of Ukrainians aged 18-60, cities of 50K+) lack of income (19%), and reduced income (78%), purchases are changing.

However, according to Anna Ilyenko, the company’s Head of Sales & Development, not all categories of daily demand are experiencing the same transition to the consumption of cheaper alternatives or even refusal from some categories. There are categories in which demand is less elastic, and even with the increase in the cost of goods, fewer people change the brand. These are primarily such sensitive categories as baby products and pet food.

Some categories traditionally grow in times of crisis: gadgets, appliances, jewellery. Ukrainians consider it an "investment", thus saving money from inflation.

Alcohol consumption is growing. It is perceived by some consumers as a sedative.

Nowadays, in order to study changes and make informed business decisions, it is impossible to get along without collecting insights due to changes in the brand landscape, access to retail, and the total change of the consumer, as well as the emergence of new consumer patterns.

How to adapt the tone of voice

40% of marketers surveyed in the Webpromo study note that the most significant changes in communication have affected the tone of voice and the message to the audience.

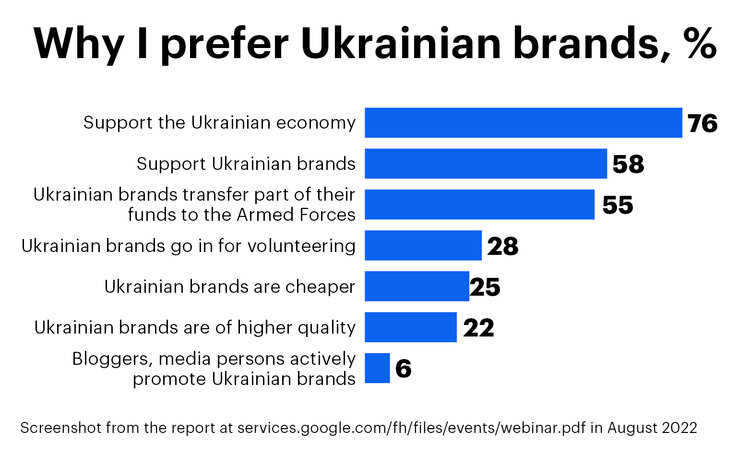

A study by Google and Kantar in August 2022 showed that for 55% of Ukrainians it is important that the brand transfers funds to the Armed Forces, and 28% are interested in the involvement of company employees in volunteering.

Therefore, every message should convey the idea that business continues working. This, in fact, is the patriotism of companies and their owners.

In each message that our clients communicate, we broadcast three basic values. These are a conscious social position and support of the audience by actions, as well as the responsibility to the economy of Ukraine.

For example, for the Ukrainian manufacturer Snack Production, together with colleagues from Brand Booster, we launched a TV campaign about the continuous operation of production despite the shelling, logistics problems, and power outages. In this way, customers learned that the company is working and demonstrates an active position – it is volunteering, supporting its own employees, and helping the Armed Forces and the economy of Ukraine.

Such an approach in the formation of the advertising campaign helped to demonstrate responsibility towards all target audiences of the brand at the same time.

It was difficult to conduct purely advertising communication, because the tone of the brands Flint, Chipster`s, Big Bob, and San Sanych is humorous, being about light everyday stories. At the beginning of the war, of course, consumers did not have a demand for such humorous sketches, to which they are used to. Therefore, in early March, the campaign focused on the social responsibility of brands. Humour again became the main tool of communication, but the theme and format have changed. Drawings of tasty gifts, and kind words from consumers handwritten on postcards, were passed with goodies to the defenders of Ukraine on the front line.

Thus, with the beginning of a full-scale war, all companies had to revise their business plans. Marketing – in the first place. Some companies significantly reduced their budgets, while others redistributed them. For example, for volunteer and charitable activities, staff retention, etc.

Six months after the full-scale invasion, all businesses in Ukraine that wanted to remain competitive and reach their audience through thousands of information messages were forced to return to advertising as the main tool of promotion.

In 2023, while the activity of the advertising market has not yet returned to the pre-February indicators of 2022, all brands without exception have a high chance of becoming more visible to consumers.

Brands can still become the only ones who started communicating on television in their niche. Therefore, even if the promotion budget has been reduced by 70%, it is worth considering the circumstances and managing the remaining funds carefully to tell the audience about yourself.

The OpenMind authors, as a rule, are invited experts and contributors who prepare the material on request of our editors. Yet, their point of view may not coincide with that of the Mind editorial team.

However, the team is responsible for the accuracy and relevance of the opinion expressed, specifically, for fact-checking the statements and initial verification of the author.

Mind also thoroughly selects the topics and columns that can be published in the OpenMind section and processes them in line with the editorial standards.