Over UAH 83 billion in revenue, almost 27 million 4G subscribers, and 5,544 complaints. And 15 more interesting facts from the telecoms regulator's report

Which mobile operators lured the most users from competitors, and how much ARPU of Internet providers grew

Recently, Ukraine’s telecoms regulator issued a huge report on the results of its activities in 2022 with the dynamics of various indicators. The survey was based on data from 3,264 players – mobile operators and Internet providers. Mind has selected the most interesting facts and figures from the document.

Financial and operational results are presented excluding VAT and statistics from the temporarily occupied territories and war zones.

83,213 billion UAH

These are the total revenues of the telecoms industry in 2022. Despite the great war, they grew by almost 3% compared to 2021.

The mobile communication sector is the leader in the revenue structure (67.6%, or UAH 56.192 billion). Fixed-line Internet access is in second place (19.1%, or UAH 15.928 billion). Services for the provision of channels, infrastructure facilities, etc. came in third (9.1%, or UAH 7.6 billion). This mini-rating is rounded off by the fixed-line telecoms sector, whose share is falling every year (4.2%, or UAH 3.493 billion).

5,1%

The total revenue of mobile operators grew by so much last year. Previously, the industry grew by an average of 14% year-on-year. The growth in 2022, according to the regulator, was driven by an increase in the consumption of two services: data transmission and international roaming.

Internet access is the top revenue generator (62.8%, or UAH 35.27 billion). It is followed by voice telephony (12.7%, or UAH 7.128 billion), services to other network providers (12%, or UAH 6.728 billion), SMS (5.4%, or UAH 3.061 billion), international roaming (5.2%, or UAH 2.91 billion), and other services such as number portability, national roaming, etc. (1.9%, or UAH 1.095 billion).

6,622 million

That's the number of subscribers mobile operators lost due to russian terrorism. The number of active SIM cards decreased by 12% to 49.304 million.

Dynamics of the number of active mobile network identification cards in 2020-2022, thsd. pcs.

26,824 million

This is the number of 4G subscribers. That is, only 54.4% of active SIM cards have access to fourth-generation communications. This low level can be explained by several reasons: lack of coverage in some areas, outdated phones/smartphones that do not support 4G, and the reluctance of some users to switch to new tariffs.

Dynamics of the number of active mobile network identification cards used to access the Internet, thsd. pcs.

3,462 million

And this is the number of active IoT cards. It also fell (by 6.4%) due to a decrease in the service area as a result of the temporary occupation of Ukraine, the regulator's report says.

Dynamics of the number of active mobile network identification cards under the M2M service in 2020-2022, thsd. psc.

143 SIM cards per 100 inhabitants

It is the national average. It means that Ukraine still has a very high level of mobile penetration. Many users have several SIM cards. The highest level is in Kyiv Oblast (186), and the lowest is in Ternopil Oblast (110). However, the figures for the partially and temporarily occupied Lugansk, Donetsk, Zaporizhzhia, and Kherson oblasts are not yet included in the study.

95 UAH

It is the average monthly revenue from the mobile services provided per user (ARPU). In 2022, it increased by 19.2%.

Average monthly revenue from mobile services per active ID card, UAH/month

2,4 times

It is how much international roaming revenues grew in 2022. "The forced migration of Ukraine's population to other countries, primarily EU member states, as a result of the full-scale invasion of russia, has led to a significant increase in revenues for these services," the report says.

Dynamics of revenues from international roaming services in 2020-2022, UAH million

71 300

As many subscribers used the number portability service in 2022. In total, 252,400 users have switched operators since the service launch in May 2019. Last year, lifecell lured the largest number of subscribers, while Kyivstar lost the most..

Less than 1%

That's how much the fixed-line Internet access market grew last year, to UAH 15.928 billion. However, given the huge number of networks destroyed and stolen by russian terrorists in the war zones, it is still a pretty good figure for the industry.

Dynamics of revenues from fixed-line Internet access services in 2020-2022, UAH million

7,191 million

It is the number of fixed-line internet subscribers (households and legal entities). During the year of the great war, it dropped by 5%. This data is not 100% accurate. The regulator says it has not received the full amount of reporting under martial law. However, there is a positive trend in rural areas.

Dynamics of the number of lines (points) of fixed Internet access, thsd. psc.

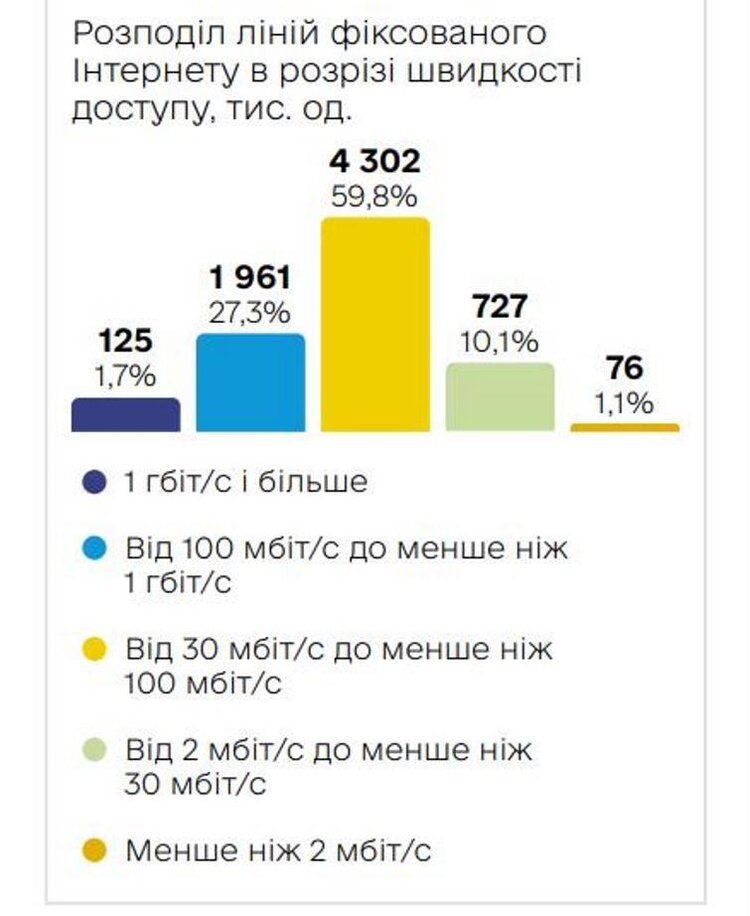

125 000

It is the number of subscribers who already have access to fixed-line internet at speeds above 1 Gbps. However, it is still a very small share of the distribution structure (1.7%). At present, the largest share (59.8%) is still occupied by access points with speeds of 30 to 100 Mbps..

In terms of technology, FTTx (51.4% of the market, or almost 3.7 million subscribers) and xPON (35.1%, or 2.5 million) are the leaders. They have become very popular during blackouts. "The largest share is made up of fibre-optic cable lines, which account for 86.5% of the total number of fixed access lines," the regulator explains.

.

184,6 UAH

This is the ARPU of Internet providers. By the way, it is almost twice as high as that of mobile operators. The figure grew by 6% over the year.

Average monthly revenue from the fixed-line Internet access services per fixed-line Internet access line (point), UAH/month

17,7%

That's how much the number of fixed-line subscribers dropped. At the beginning of 2023, there were only 1.739 million of them. "In 2022, the downward trend in demand for fixed-line services continued. The widespread use of mobile services, as well as software and mobile applications that allow consumers to replace traditional voice services with voice and video services (Google Meet, Zoom, Microsoft Team, WhatsApp, Telegram, etc.), does not contribute to the growth of the subscriber base of the fixed-line voice service provider," the regulator concludes.

Average monthly revenue from the fixed-line Internet access services per fixed-line Internet access line (point), UAH/month

Nearly 24%

That's how much the number of fixed-line subscribers dropped. At the beginning of 2023, there were only 1.739 million of them. "In 2022, the downward trend in demand for fixed-line services continued. The widespread use of mobile services, as well as software and mobile applications that allow consumers to replace traditional voice services with voice and video services (Google Meet, Zoom, Microsoft Team, WhatsApp, Telegram, etc.), does not contribute to the growth of the subscriber base of the fixed-line voice service provider," the regulator concludes.

Revenue dynamics from fixed-line services in 2020-2022, UAH million

.

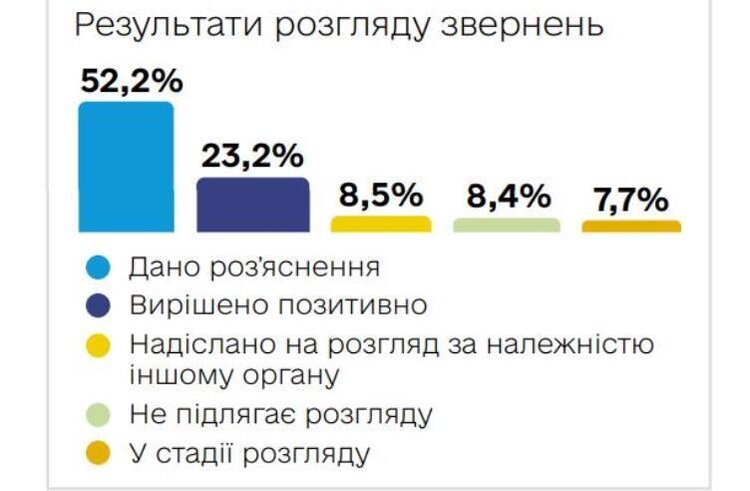

5544

Such was the number of complaints the regulator received from subscribers in 2022. "Compared to 2021, the total number of appeals decreased by 51.73%, which was caused by citizens' life priorities, changes in living conditions and migration processes due to the full-scale military aggression of the russian federation, as well as a decrease in the number of subscribers," the report says.

Most complaints were received against mobile operators: disagreements with withdrawals from personal accounts or tariff rates, lack of access, poor quality of communication, etc.

23% of these complaints were resolved positively... for the subscriber.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]