Ukraine's Business Ombudsman: "Since the Tax Service resumed its operations, the flow of appeals and complaints returned to pre-war levels"

Roman Washchuk – on the most acute problems of entrepreneurs, pressure from fiscal authorities, and the Canadian experience in fighting corruption

Roman Washchuk took over as the head of Ukraine's Business Ombudsman Council in January 2022. He came to this position with experience as Canada's ambassador to Ukraine (from 2014 to 2019). This sequence of events is not coincidental, as he is well aware of the problems faced by Ukrainian and foreign businesses in Ukraine.

The systematic pressure on entrepreneurs in our country is no longer a secret. This situation existed before the full-scale invasion by russia, and it continues to persist. Legal business in Ukraine continues to face political pressure and often falls victim to accusations (including unsubstantiated ones) from the tax and law enforcement authorities. Administrative and fiscal 'influence measures' alternate with 'ski masked raids', and so on. As a result, the investment climate, which was far from exemplary before, is being completely ruined. This, in turn, poorly affects the inflow of foreign investments, which the country crucially needs during wartime and will need even more after its conclusion.

Mind spoke with the head of the Business Ombudsman Council about Ukraine's successes and failures in protecting the rights of businesses, challenges for domestic and foreign entrepreneurs in wartime conditions, as well as the relationship between the government and entrepreneurship and the problem of trust between businesses and the state.

On the main distress of domestic entrepreneurs during wartime

– I would divide this time into two periods. The first one is from the end of February until July-August 2022 when there was a significant shift in the flow of appeals to us. During that time, the BOC didn't have the traditional capability to process business complaints because registries, courts, and many ministries were closed. We transformed into what could be referred to as a service providing free legal assistance for Ukrainian businesses.

At that time, people were approaching us for issues related to currency regulation, critical imports, labour reservations, and issues at the Polish-Ukrainian border. These were somewhat unusual issues for us. However, in some cases, we even assisted in restoring supply chains – providing advice on where to go to find specific components for the production process.

Since the State Tax Service of Ukraine (STS) resumed its operations in August-September 2022, the flow of appeals and subsequent complaints has returned to pre-war levels. Although my job depends on this, believe me, I state this trend with regret.

Overall, since February 24, 2022, until today, our system has recorded 848 complaints, out of which 359 have already been closed. Most of them were related to the actions of the STS.

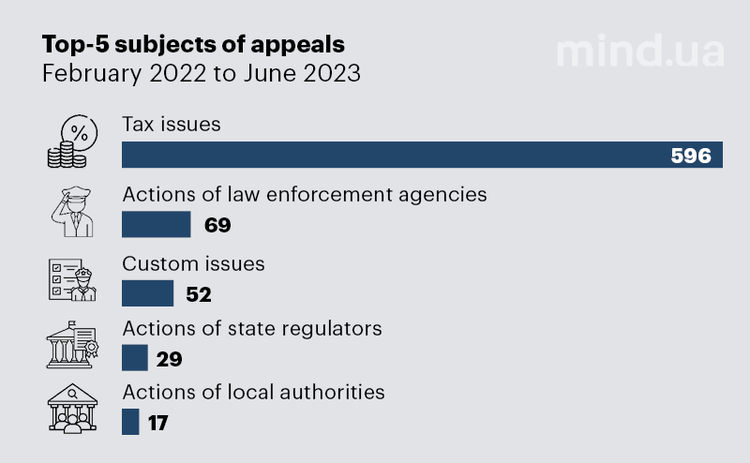

If we name the leaders in the total number of these complaints, it looks like this:

– When talking about complaints regarding the actions of law enforcement, who specifically are you referring to?

– Primarily, we receive complaints about the Prosecutor's Office (33 complaints out of the total number) and the National Police. We are starting to receive more complaints about the newly established Economic Security Bureau of Ukraine (ESBU). And, in comparison to the pre-war period, there are far fewer complaints about the Security Service of Ukraine (SBU). Although we never had complaints about the SSU in the tens, it was among the top law enforcement agencies we protected businesses 2–3 years ago. As for the State Bureau of Investigations (SBI), National Anti-Corruption Bureau of Ukraine (NABU), and the Antimonopoly Committee of Ukraine (AMCU), we rarely receive any complaints about them at all.

– What is the distribution of complaints from small, medium, and large businesses – their percentage share? In other words, have representatives of business leaders approached you, or are your main clients individual entrepreneurs and small businesses?

– Approximately 66% of the complaints come from SMEs, while 34% are from large businesses, which is also a significant figure. However, the primary focus of the BOC is to assist small and medium-sized businesses, which often lack their own internal administrative or legal resources to deal with large government institutions.

The BOC works with specific issues and disputes between specific businesses and the government.

On violations from the State Tax Service and State Customs Service of Ukraine

– When considering the nature of complaints received by the BOC, what are the main grievances of businesses?

– When talking about the STS, the number one complaint is the blocking of VAT invoices in the VAT system and the SMKOR (Monitoring System for Risk Assessment Criteria. – Mind). Additionally, there are issues with non-compliance with court decisions. Plus, there are so-called TND (tax notification-decisions), in other words – fines.

– Can you name some specific cases regarding the STS?

– For example, an agribusiness from the Chernigiv Oblast (we won't disclose the name at the owner's request) submitted all necessary documents for VAT budget reimbursement. However, STS, after the inspection, identified violations of the company's compliance with the legislation when declaring a negative value of VAT and refused the claimant the right to reimbursement of 1.3 million hryvnias. The reasoning was "an unbalanced company policy in managing organisational and economic relations."

The agribusiness appealed to the BOC, and we prepared a letter to the STS in support of the claimant. In it, we pointed out that the tax authority should not assess the appropriateness of expenses or decide whether the taxpayer had a reason to order certain services/goods. As a result, the STS revoked its order.

Another example concerns an electrical goods distributor who filed a complaint to the BOC against the capital tax service. Following the company's inspection, tax liabilities were assessed at almost 5 million hryvnias. STS believes that the company understated the amount of VAT and did not register tax invoices due to the sale of goods below the purchase price and the failure to charge VAT on discounted items. On the other hand, the company stated that the discounted goods were not sold, and therefore, they do not require VAT accrual and invoice registration.

The BOC took up this complaint, since the norms of the Tax Code of Ukraine do not require the taxpayer to accrue tax liabilities related to the sale of discounted goods, nor do they necessitate charging VAT on the discounted portion of the goods' value. Thanks to our mediation, the State Tax Service of Ukraine cancelled the tax liabilities imposed on the distributor.

Regarding complaints against the law enforcement, it depends on the complainant – either they complain about inactivity when their claims are not considered, or about excessive activity – 'ski-masked raids', for instance. By the way, I can provide a recent example with the Multiplex cinema chain: ESBU initiated a criminal case against them for untimely payment of USC (unified social contribution).

– And what is the stumbling block here?

– Multiplex used the law of 15.03.2022, allowing certain categories of companies not to pay a unified social contribution. And when the cinemas started operating again and making money, the cinema chain paid the taxes, including the previous unified social contributions. However, ESBU initiated a case under the tax evasion article, considering the company's actions deliberate.

The BOC is currently handling this case. However, the obstacle, as law enforcement officials tell us, is that lawmakers only stated the absence of penalties for non-payment of USC in the law, but did not specify that it wouldn't be classified as a criminal offence. However, from a common-sense perspective, when permission is granted not to pay USC, and it is communicated that no penalties will be applied, it is clear that this should not be treated as grounds for a criminal investigation.

– State Customs Service is among the top three mentioned government agencies with the maximum number of complaints. Considering the large volume of humanitarian cargo, the workload on this agency has significantly increased. How has this affected the quality of its work, based on the dynamics of the number of complaints?

– Speaking of the State Customs Service, there is an issue with adjusting the customs value. According to all the rules, the Customs Service should simply accept the documentation provided by the exporter/importer (if there are no significant doubts/inconsistencies), rather than independently determining the value of the goods. However, despite its overwhelming workload, this agency finds the time to unilaterally assess the value of goods. We often receive complaints where importers submit a whole package of documents certified by EU customs authorities, including the codification of the goods and their value, but for some reason, Ukrainian customs officers decide to change the product codes…

For instance, there was a peculiar incident with nicotine puffs, intended for recreational use and not meant to aid in tobacco cessation. However, the Customs Office strangely tried to reclassify them as "medical products for nicotine addiction treatment".

On complaints from foreign businesses

– Are there any complaints to the BOC from non-residents? What is the ratio of complaints between Ukrainian and foreign businesses during the pre-war/war period?

– First and foremost, we work for Ukrainian business. However, the ratio of complaints from Ukrainian and foreign businesses looks like this:

Thus, the difference in the number of complaints from foreign businesses before the start of full-scale military actions and during them is only 2%. When it comes to major foreign businesses, companies like American Philip Morris, French Verallia, and others have approached us for assistance.

Of course, we do not represent the interests of russian and belarusian businesses at the moment. I believe they do not deserve our services. It's a 'red line' for the BOC.

Regarding the specifics of foreign complaints, they are similar to the grievances of Ukrainian businesses. However, for instance, some branches of major international firms have been categorised as "high-risk" by the STS. Not because they are involved in suspicious business, but due to "viral risk". In other words, in Ukraine, a company can be classified as "high-risk" based on its contracts – who they buy from or sell to. If a partner they have a deal with is under scrutiny by the STS, the international company automatically falls into the category of "high-risk" because of its business relationship with the violating firm.

For instance, a well-known international tire manufacturer approached us, and the STS had categorised it as a high-risk taxpayer. During the investigation, the BOC found that the decisions regarding the taxpayer's risk status contained only general statements and lacked specific details. Additionally, the STS had halted a significant number of adjustment calculations, citing the enterprise's high-risk status as the reason.

The BOC filed a complaint with the Expert Group of the State Tax Service of Ukraine, which resulted in the STS agreeing that the decision on the taxpayer's riskiness was unreasonable. After the company submitted the requested documents, it was removed from the list of risky taxpayers.

On the effectiveness of the BOC's activities during the war period

– Since the establishment of the BOC in May 2015, we have returned almost 25 billion UAH to Ukrainian businesses. This includes cancelled fines, enforced court decisions, payments from government agencies for contracts, and more.

If we consider the period from the beginning of 2022 until now, 3.5 billion UAH have been returned to businesses. The largest case was related to DTEK, concerning the 'green tariff' of 3 billion UAH. As you may recall, at the end of 2021, all 'green bonds' were paid out except for DTEK. We took up this case, and in January 2022, DTEK received its funds.

Regarding micro cases, we had, for example, a case involving only a few thousand UAH. However, for an individual entrepreneur, such assistance is particularly significant. If we consider the period from June 2022 to June 2023, thanks to the BOC's intervention, 237 cases (66%) were successfully closed, and businesses were refunded 480,841,607 UAH.

– So, does that mean around one-third of the cases handled by the BOC end up being unsuccessful?

– About 34% of the total cases are unsuccessful. The recommendations of the BOC are not legally binding on government agencies. However, according to the Cabinet of Ministers' resolution, government bodies are obligated to respond to our requests and recommendations. In certain administrative appeals, they should consider the BOC's arguments. Still, they are not required to accept them.

In general, we are quite selective in the cases we take on. We reject approximately one-third or even more of the complaints that are submitted to us. This usually happens when, after reviewing the documentation, we conclude that the company complaining about the violation of its rights might be acting in bad faith itself. Or it could be that the company is genuinely mistaken, and the government agency's decisions against them are justified. Sometimes, there may be no option for administrative appeal, and the matter can only be resolved through the courts.

For instance, recently, the BOC received a complaint regarding a decision from the Ministry of Justice concerning "illegal re-registration". Such cases can only be appealed through the court..

Also, I'll add that according to our regulations, we do not consider cases that have already reached the court. BOC is the pre-trial dispute resolution body and sometimes – the post-trial one. First and foremost, we support firms when they deal with administrative appeals.

In the coming days, we expect the possibility of administrative appeals against inclusion in the lists of risky taxpayers and rejection of data tables to be opened. The relevant amendments to the Procedure for Suspension of Registration of a Tax Invoice/Adjustment Calculation in the Unified Register of Tax Invoices were made to Resolution No. 574 of the Cabinet of Ministers and entered into force on 08.07.2023.

– What do you mean?

– In its March report on the VAT system, BOC recommended increasing the possibilities for administrative appeals for businesses so that they wouldn't have to go to court right away. After all, going to court consumes time and money. Therefore, we hope that the changes to Cabinet of Ministers Resolution No. 1165 will expand the possibilities for administrative appeals, and this will help companies in their dealings with the STS.

On the problems of raidership, biassed judiciary, and corruption in general

– You mentioned the "illegal re-registration". In 2016, an anti-raiding law was adopted in Ukraine. What is your opinion on its success today?

– Today, we have significantly fewer such cases compared to the pre-war period. It can be said that it is not as widespread as it was in previous years. From 24.02.2022 by now, there have been only three complaints regarding raiding/unlawful property registration in the BOC. This could also be attributed to the fact that during the period of martial law, the list of registrars who could carry out registration procedures for businesses and real estate was limited.

Currently, we have a case pending against an agro company. The State Registrar changed the beneficial owner, the size of the founders' shares, and the authorised capital against the law, but there are justified doubts about the validity and legality of such actions. The company filed a complaint with the Ministry of Justice’s Anti-Raidership, and the review of the complaint is still ongoing, with the complainant awaiting a decision.

And here, we can say that certain signs of the problem of illegal registration actions are resurfacing in Ukraine. One of the elements to counter raiding before going to court is the Anti-Raidership Commission under the Ministry of Justice.

The Anti-Raidership Commission responded quite promptly to violations, while the court proceedings tend to be lengthy. However, some of its legal powers regarding the cancellation of registration actions regarding immovable property are temporarily limited. Therefore, some unscrupulous businessmen may take advantage of this temporary vacuum. The legislative gap has now been addressed, and the corresponding law is awaiting the President's signature. Afterwards, the Anti-Raidership Commission is expected to return to its usual working format.

– Your predecessor, Algirdas Šemeta, considered the non-enforcement of court decisions as one of the obstacles to attracting foreign investments to Ukraine. What is the situation with this issue today?

– In over 90% of cases, courts are issuing positive decisions in favour of businesses. And from the perspective of the State Tax Service of Ukraine, the enforcement of court decisions has improved, approximately doubling its compliance rate. This indicates progress because, in the past, there was an accumulation of thousands of ignored court decisions. However, it is still crucial to monitor and ensure that the STS fully complies with court rulings.

It is worth mentioning that it would be beneficial if law enforcement agencies also paid attention to court decisions and accordingly adjusted their administrative practices..

– Algirdas Šemeta emphasised in an interview a few years ago that "corruption in Ukraine has demand and supply". Is there really a demand from businesses, and is there a problem, particularly in tolerating corruption?

– In my opinion, with each passing day, businesses are becoming less tolerant of corruption.

Although this may not fully reflect in the statistics, we observe that 'strange things' are happening in the regions concerning law enforcement. Local leaders, taking advantage of the ongoing war, allow corruption to reach the scale of the Yanukovych era. That's why clear political and personnel signals from Kyiv are necessary.

– Do you believe that authorities in Kyiv are unaware of the scale of corruption within regional leadership? After all, a fish rots from the head down.

– That's precisely why the 'fish' must have enough working time and brains to send timely signals of discipline to the 'tail'.

On the advisability of a simplified taxation system

– Should Ukraine retain a simplified taxation system for small businesses, as it is one of the main loopholes for minimising taxation, in your opinion?

– I agree that Ukrainians are masters of creativity and have found ways to turn this system into all sorts of loopholes.

I remember when I was on holiday in the Carpathians at an expensive thermal resort. Everyone there was an individual entrepreneur – one registered as an entrepreneur for towels, another for beverages, another for hot dogs, and so on. Clearly, this is an abuse of the simplified taxation system. When a portion of businesses resorts to such cunning tactics, it pushes the State Tax Service to take radical measures – including forcing businesses to pay taxes using semi-coercive methods.

This reminds me of a comedian plot from the Tom and Jerry cartoon, where the mouse outsmarts and evades the cat, who employs various methods to catch her. In this metaphor, the mouse represents the business, and the cat – the STS. Therefore, it's better for businesses to create conditions in which they understand that it is more advantageous to 'play' by the rules rather than hide.

I believe that the simplified taxation system should be preserved in Ukraine, but it should be targeted primarily to those it was intended for. This means there should be proper control. At the same time, alternative options should be created, providing relatively comfortable transitions for people. Simply shifting millions of individuals from the simplified system to the regular one would cause a significant shock. Radical measures in this matter could lead to business closures.

About the comparable to the Business Ombudsman Council in Canada and 'Canada-style' of corruption

– You have strong connections with Canada, and you know this country well. Is there an absence of a corruptive gene in their mentality?

– There is no nationality or country where corruption is completely absent.

In Canada, perhaps there are fewer traditional regulations, which leads to fewer thoughts on how to bypass them. Moreover, a lot is determined by the inevitability and severity of punishment. For instance, if signing a permission document could result in years of imprisonment, a person would think twice about signing it and question its purpose. Therefore, the concept of exceeding official powers hardly even exists in the minds of Canadians.

However, I am certain that a significant number of current Ukrainian officials are constantly weighing the chances of being prosecuted and imprisoned.

– Is there an equivalent of the BOC in Canada? If so, how does it differ from the Ukrainian one, and how much demand is there for it?

– There is no specific entity solely focused on businesses like the BOC in Canada. They have a general ombudsman who deals with all issues arising for citizens, and only a small percentage of those relate to businesses. Canada does have a separate tax ombudsman, but they also handle tax matters for both citizens and businesses. Additionally, there are ombudsmen at the provincial and municipal levels – for example, Toronto has an ombudsman for municipal services, and the province of Ontario has one for provincial services. There is also an external investment ombudsman who deals with Canadian firms investing abroad.

When we analyse global experiences, I know that business ombudsmen exist in Poland, Australia, and Kyrgyzstan (by the way, the Kyrgyzstan institution was created based on the Ukrainian BOC model). Currently, Moldova is considering the establishment of a similar institution in their country.

By the way, the first ombudsman was created by King Charles XII of Sweden in 1713. Therefore, the term "ombudsman" is of Swedish origin. And in Sweden, ombudsmen still exist today.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]