Australia threatens to strike – Ukraine risks freezing: How the globalisation of the gas market manifests itself

And why is it too early for Naftogaz to relax?

European gas futures (front month) jumped by 40% this week – the largest increase since March 2022. On Wednesday, 9 August, prices at the TTF hub surpassed 43 euros per MWh-year, compared to nearly 30 euros the day before, reaching the highest point since mid-June. The reason for this is negative market expectations about the consequences of a potential strike by workers at four Chevron and Woodside LNG facilities on a continent far from Europe, Australia.

Mind analysed what features of the modern gas market this situation can reveal and how it can affect the 'well-being' of the Ukrainian energy sector.

Rapid growth in gas futures on the TTF due to industry news in Australia has demonstrated that gas trading has become global. It is no longer constrained by the limited geography of pipeline networks or the location of gas extraction.

On one hand, the globalisation of the LNG market smooths out regional geopolitical risks, but on the other, it does not guarantee price stability. Prices in the spot exchange market fluctuate due to the pressure of unpredictable factors. Therefore, in gas trading, "even the flap of a butterfly's wing can trigger a tsunami on the other side of the world."

What does the Australian gas workers' strike threaten? Traders are concerned that the strike by Australian gas industry workers, who have decided to demand higher wages and better working conditions, will disrupt nearly half of Australia's export LNG capacity – which accounts for 10% of the world's production of liquefied natural gas.

China and Japan purchased around 26 million tonnes of Australian LNG in the first half of 2023, constituting over 60% of Australia's exports. The strike will force many Asian buyers to seek gas suppliers outside the island continent and to purchase the resource at higher prices, which was originally destined for Europe. This will intensify the competition for LNG cargoes between regions.

Why is it still too early to talk about overcoming the energy crisis? As noted by the Financial Times, markets remain cautious about any potential supply disruptions in gas even though current prices are significantly lower than the peak levels of last summer, when reduced russian pipeline supplies led to records of over 340 euros per MWh-year.

“Even if gas storages are full, that doesn’t necessarily mean everything is fine. It comes down to the winter we have, which is unknown at the moment,” said Callum Macpherson, head of commodities at Investec.

Last year, the European Union became the world's largest importer of LNG as it had to quickly seek alternatives to russian pipeline gas, which satisfied about 40% of demand. The gas storages of EU countries that are crucial for meeting winter demand are now filled to almost 90% capacity – a level the European Commission aimed to achieve by early November.

However, Citigroup analysts believe that if the risks from Australian strikes intensify or materialise and persist throughout the winter, the gas storage limits in the EU will "avoid breaching." Furthermore, due to the strikes in Australia, European prices could double by January, reaching 62 euros per MWh-year, as Europe will have to compete with Asian buyers for resources during a period of increased demand.

How is the Ukrainian gas market faring? The gas market in Ukraine is also experiencing unrest.

This summer, gas consumption reached record levels – according to Naftogaz, it increased by 30%. The abnormally high demand was driven by the fact that thermal and combined heat and power plants are using more natural gas to generate electricity, which is also experiencing increased consumption due to hot weather.

"Unfortunately, today the main flow of gas is used to solve local energy hub problems – that's 76% of the gas. We need to replace gas consumption with fuel oil, but some power plants have destroyed their fuel oil facilities, so they are forced to burn gas there," explained Kostiantyn Ushchapovskyi, head of the National Commission for State Regulation of Energy and Public Utilities.

The Trypillia Thermal Power Station (the most powerful power station in Kyiv Oblast, owned by Centrenergo PJSC) and the Sloviansk Thermal Power Station (owned by Donbasenergo PJSC) are not adapted for the use of fuel oil. Both stations operate exclusively on natural gas.

The recommendations of the Ministry of Energy for using fuel oil in certain combined heat and power plants (CHP) and thermal power stations (TPS) are not being promptly implemented for economic reasons. Despite the fact that fuel oil is cheaper than gas and producing electricity from it is more cost-effective due to its higher calorific value, companies using fuel oil are subject to an environmental tax, which leads to additional costs.

Furthermore, fuel oil generation is a relatively complex technology, increasing the likelihood of emergency shutdowns. This could lead to additional problems for the economy due to the already damaged infrastructure resulting from hostile attacks.

How much gas does Ukraine need to accumulate? According to Naftogaz of Ukraine, in the first half of 2023, 1.2 billion cubic metres of gas were burned for electricity production. Before the start of the heating season, the company needs to accumulate at least 14.7 billion cubic metres of gas in underground storage facilities (taking into account the increase in summer demand).

As announced by Oleksiy Chernyshov, the head of Naftogaz, as of July 31, the company purchased 0.7 billion cubic metres of domestically extracted gas from private companies at the UEEX (Ukrainian Energy Exchange). He emphasised that Naftogaz bought everything that was offered. He assured that this year the state holding would also be able to increase its own extraction – "plus 8% compared to last year."

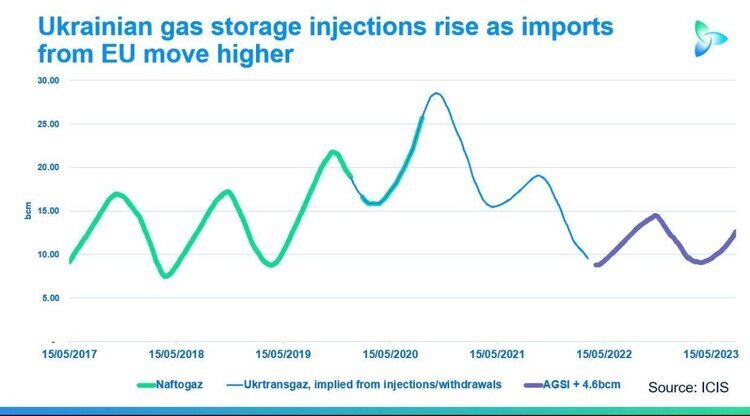

How much gas is currently available? Currently, there is about 12.6 billion cubic metres of gas in Ukrainian storage facilities, but the ownership structure is unknown.

This volume is 6% lower than the average for the period of 2017-2018, which included the COVID-19 pandemic when there was a global supply surplus, and before the full-scale russian invasion when domestic demand in Ukraine was significantly higher and the economy had not suffered damages.

However, if Naftogaz is forced to import gas during the heating season, it would likely have to do so at peak prices due to intensified competition in the European market.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]