What's behind the bitcoin drop and how EXMO.com can help investors

At the beginning of August, the cryptocurrency market took a big hit. The total market capitalisation dropped by 17%, with bitcoin falling below $50,000 and dragging other coins down. Sergiy Zhdanov, CEO of EXMO.com, explains what caused this drop and how you can still make money during market instability

What happened in the crypto market?

On 5th August, bitcoin's price fell below $50,000, hitting a low of $49,052. This was the lowest point since February 2024 and the steepest decline since 2021. Bitcoin's dominance in the market slumped to 58%, leading to a 17% drop in the total market capitalisation of cryptocurrencies.

Ethereum, the second-largest cryptocurrency, also took a significant hit, losing almost 18.5% of its value in just two hours.

Between 2nd and 5th August, the market experienced its most significant sell-off, losing over $500 billion in three days. On 5th August alone, the market cap dropped by $300 billion, from $2.09 trillion to $1.76 trillion.

Key reasons for the crypto market crash

Stock market volatility

Wall Street saw significant volatility and sell-offs at the end of July and the beginning of August, with declines in key stock indices, futures and bonds.

First, the earning season – when public companies report their second-quarter results – was underwhelming. Reports presented disappointing profits and other key figures which were below the expectations of analysts, leading to pessimistic forecasts. As a result of the disappointing turn of events, investors reacted unfavourably to the reports.

Secondly, investors are nervous about the market, driven more by expectations of a Federal Reserve rate cut, advancements in Artificial Intelligence, and other factors rather than solid fundamentals. Consequently, they are looking to lock in profits. For instance, Warren Buffett – one of the most prominent and well-known investors – sold 50% of his Apple shares.

Finally, events in Japan played a significant role in the market downturn. On 9th July, the Japanese government ordered the Japanese Government Pension Investment Fund (which holds $1.5 trillion in assets, including $400 billion in U.S. stocks) to sell off a significant portion of its international investments and focus on Japan.

Market participants initially dismissed this news event, thinking the implementation would be delayed and coordinated with the Fed. However, between 10-11th July, during the market's peak, the Japanese received orders from the government to divest from American securities. In addition to the pension fund, other funds also sold off their assets, resulting in massive sales.

Additionally, on 2nd August, the U.S. Bureau of Labor Statistics reported that the unemployment rate had risen to 4.3%. Furthermore, non-agricultural employment grew by only 114,000 in July, one of the lowest increases observed since the pandemic.

All these factors contributed to a sell-off in cryptocurrencies.

The Fed rates are high

Although a rate cut by the Federal Reserve is anticipated during the fall, rates remain high – over 5%. Since the crypto market is closely tied to the stock market, these high rates contribute to its volatility and affect traders' sentiment.

Fear and panic among crypto investors

The drop in major cryptocurrency prices triggered fear. The Fear and Greed Index fell by nearly 50 points weekly, from 74 (extreme greed) to 26 (fear). It has since risen to 30 points but remains in the fear zone. The panic led to large-scale liquidations of long positions, totalling over $900 million by 5th August.

Geopolitical risks

Ongoing geopolitical risks in the Middle East have negatively impacted the markets, even overshadowing expectations of Fed rate cuts. Investors quickly moved into "safe-haven" assets like the dollar and gold.

Pressure from Mt. Gox exchange

The bankrupt Mt. Gox exchange is continuing to settle debts with its creditors. It has already paid compensation in bitcoin and BCH to 17,000 of its 24,000 creditors, leading to significant crypto inflows to exchanges. The exchange has also made large transactions, including sending 33,964 bitcoins ($2.25 billion at the time of sending) to an unknown address and transferring 47,229 bitcoins ($3.13 billion) internally.

Large liquidations by Jump Crypto

There is speculation about Jump Crypto's involvement in the market downturn. On-chain analysts suggest that Jump Crypto unlocked 120,000 WETH in Lido and sold a large portion, which impacted DeFi token prices.

How to profit from market drops with EXMO.com's Earn

Even with market fluctuations, you can still earn from cryptocurrencies. The Earn program on EXMO.com offers a way to generate passive income by locking assets in a crypto wallet, providing stable and regular rewards, especially during periods of financial instability.

To participate, register on EXMO.com, subscribe, and lock a certain amount of assets for 30, 60, 90 or 180 days. The longer the lock-in period, the greater your profit! Rewards are automatically credited at the end of the subscription period, and you can set up auto-renewal for regular payouts.

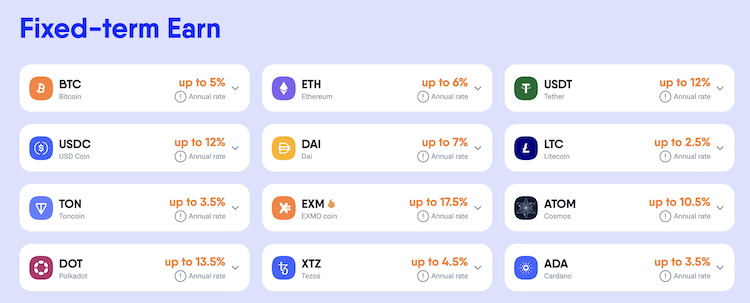

We offer over 20 assets in the program, including bitcoin, ethereum, stablecoins, DeFi tokens and popular meme coins. Earn allows you to diversify your investments across different cryptocurrencies.

You can earn up to 12% on stablecoins without trading and up to 5% and 6% per year on bitcoin and ethereum, respectively. Check the table below for more rates.

Rates for some assets in the Earn program on EXMO.com

Additionally, on EXMO.com, you can get enhanced rates of up to 17.5% per year with Standard and Advanced packages if you hold a certain amount of our native token – EXMO Coin.

When you start an Earn subscription, invite friends using your referral link and earn additional rewards – between 5 and 60 USDC – from their first subscription.

Don't wait! Join the program while the market is unstable and secure guaranteed income.

Support Ukraine together!

Despite the market situation, EXMO Save Ukraine continues to support Ukrainian children in need. We organise celebration events and rehabilitation retreats, offer support by gifting essentials and helping Ukrainians who require the most help.

Thousands of Ukrainian children need urgent assistance – let's join forces to make a positive change! Support EXMO Save Ukraine with a crypto donation or become a volunteer. Follow the link for more details.

Serhii Zhdanov

CEO of EXMO.com crypto exchange