Strengthening energy independence through decentralized generation: where Europe is heading and how Ukraine can catch up

What are the plans and which benchmarks should be considered?

Ukraine's energy infrastructure remains a frequent target of Russian missile and drone attacks. While generators have helped Ukrainians adapt to blackouts, these temporary solutions are not enough. The key question remains: how can the country rebuild its energy system in a safer and more resilient way?

Where does decentralized generation fit into this picture? Why is the EU heavily investing in it, and how is this sector developing in Ukraine? Mind discussed these issues with Andrii Koval, head of physical business development at Elementum Energy.

Russia’s aggression and the weaponization of gas supplies as a tool of blackmail reinforce the conclusion that fossil fuel dependence must decrease, and the future of energy lies in low-carbon, widely accessible, and decentralized generation, with minimal reliance on fossil fuels for system balancing.

The EU expects Ukraine to accelerate its renewable energy expansion – and is actively supporting this transition. According to the latest Energy Union report, as of July 2024, over 40% of all donations from EU member states have been directed toward Ukraine’s energy sector. The EU Civil Protection Mechanism has contributed more than €900 million, while the Ukraine Energy Support Fund (UESF) mobilized over €500 million by June 2024.

Where is Ukraine’s Strategic Energy Potential Hidden?

Last year, Ukraine’s Cabinet of Ministers approved the National Energy and Climate Plan (NECP), designed until 2030. Over the next six years, the plan includes:

- Reducing greenhouse gas emissions by 65% compared to 1990 levels.

- Achieving 27% share of renewable energy sources in total final energy consumption.

- Deepening diversification of energy sources and supply routes – no more than 30% from a single supplier.

- Limiting primary energy consumption to 72.224 million tons of oil equivalent (toe) and final energy consumption to 42.168 million toe.

According to the Ministry of Energy, from October 2022 to September 2024, Ukraine’s energy infrastructure was attacked 1,024 times by Russia. As a result, in just the past year, total capacity losses exceeded 9 GW. Additionally, 18 GW of generation remains occupied, including hydropower plants (HPPs), thermal power plants (TPPs), and Europe’s largest nuclear power plant – Zaporizhzhia NPP.

In the spring of last year, UkraineInvest (the government office for investment attraction and support) estimated that damage to Ukraine’s energy infrastructure caused by Russian attacks since the full-scale invasion amounted to $56 billion.

At the beginning of 2024, according to UkraineInvest, Ukraine’s renewable energy capacity stood at 8.7 GW. Overall, based on estimates, Ukraine has the potential to build at least 10 GW of wind energy.

Given that in September, the National Bank of Ukraine (NBU) estimated an electricity deficit of 7%, and the prospect of stopping the war and attacks on key energy facilities remains uncertain, new facilities must be built as quickly as possible. Accordingly, significant funds are needed.

At the same time, renewable energy projects in Ukraine face a number of challenges, including:

- Managing wartime risks

- Market debt issues

- Logistics adjustments

- The need to accelerate the issuance of technical conditions

- Improvements in certain regulatory aspects

Since the full-scale Russian invasion, four wind power plants (WPPs) with capacities ranging from 10 MW to 114 MW have been commissioned, while another 4 GW of projects are under development. Over the next one to two years, up to 2 GW is expected to be commissioned.

In December last year, Elementum Energy acquired a 200 MW wind power project in western Ukraine. The total investment is estimated at over €300 million. The expected annual generation of the new WPPs will be about 700 GWh, equivalent to the annual electricity consumption of approximately 600,000 people. The company plans to bring this facility to construction-ready status by the end of 2025.

Several other projects are located in southern Ukraine, including Lymanska WPP and "Dunay", which together could add over 200 MW to the energy grid.

On the other hand, Europe’s success in renewable energy clearly demonstrates what results can be achieved today if investors have favorable conditions for launching new renewable energy projects.

How the EU is Moving Toward Energy Independence: Lessons for Ukraine

In January 2025, two key events highlighted the importance of renewable energy development for the EU.

First, on January 20, Donald Trump was inaugurated as the 47th President of the United States and immediately declared a state of emergency in the energy sector. His policy aims to strengthen the role of fossil fuels by reviving liquefied natural gas (LNG) exports, withdrawing from the Paris Climate Agreement, lifting drilling restrictions, and increasing strategic oil reserves. Trump also stated that Europe must increase its imports of American oil and gas to avoid trade tariffs.

Second, during the World Economic Forum in Davos, European Commission President Ursula von der Leyen announced a new EU energy plan aimed at completely phasing out Russian energy resources. She emphasized that investing in renewable energy and innovative technologies is the key to lowering energy costs and achieving energy independence.

These events illustrate two different approaches to energy policy. Unlike the U.S., the European Union is actively developing renewable energy sources (RES) as the foundation of its strategy to achieve climate neutrality by 2050.

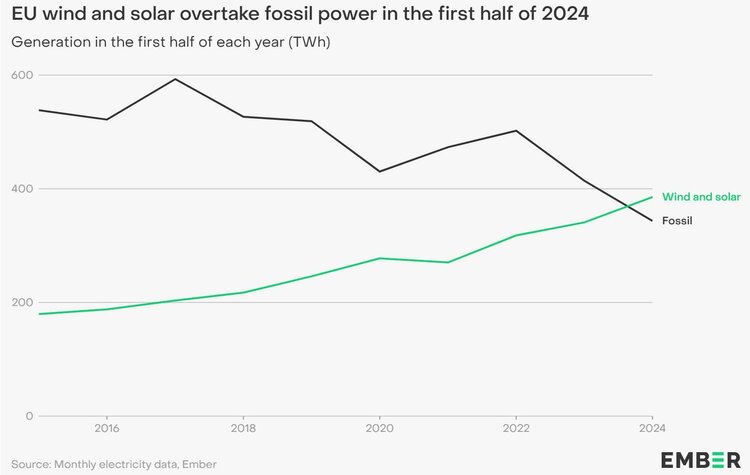

In 2024, for the first time in history, electricity generation from renewables in the EU exceeded fossil fuel-based generation. The share of RES in the EU reached 30% of total generation (386 TWh), while fossil fuels accounted for 27% (343 TWh). The rapid expansion of solar and wind energy has made these technologies more affordable and competitive.

A systematic approach to RES development is now defined by key programs such as:

- Renewable Energy Directive – a legal framework for RES development, setting a target of 42.5% renewable energy use by 2030.

- REPowerEU – an initiative launched in 2022 in response to Russia’s invasion of Ukraine, aimed at gradually ending imports of Russian fossil fuels and accelerating the transition to RES.

Source: EMBER report

As of 2023, Russia’s share of the EU’s natural gas imports dropped from 45% to 15%, while natural gas consumption in EU countries decreased by 18%. Between 2022 and 2023, renewable energy capacity grew by 96 GW in solar power and 33 GW in wind power.

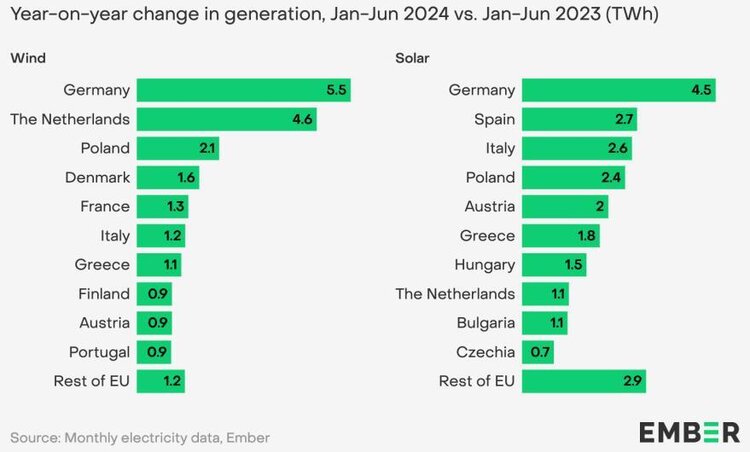

According to the EMBER report, in the first half of 2024, solar generation in the EU increased by 21% (+25 TWh), while wind power grew by 9% (+20 TWh). Almost half of the wind energy growth came from Germany (+5.5 TWh) and the Netherlands (+4.6 TWh). In solar energy, the leading countries were Germany (+4.5 TWh), Spain (+2.7 TWh), Italy (+2.6 TWh), and Poland (+2.4 TWh).

Source: EMBER report

These figures contributed to lower energy prices compared to the crisis peak of 2022 and a 32.5% reduction in greenhouse gas emissions in the EU (from 1990 to 2022), while the EU economy grew by 67%.

Thus, the potential of renewable energy sources (RES) is evident, as is Ukraine’s role in the European renewable energy market. Now, the key task is to demonstrate to investors that they are welcome and that the government is ready to ensure transparent business conditions.

If achieved, the first results of this strategy could become visible within the next few years, marking progress in one of the most promising sectors of Ukraine’s economy.

The OpenMind authors, as a rule, are invited experts and contributors who prepare the material on request of our editors. Yet, their point of view may not coincide with that of the Mind editorial team.

However, the team is responsible for the accuracy and relevance of the opinion expressed, specifically, for fact-checking the statements and initial verification of the author.

Mind also thoroughly selects the topics and columns that can be published in the OpenMind section and processes them in line with the editorial standards.