Big Ideas: Site Weights Ukraine’s Nuclear Operator Plans to Boost Number of Reactors

Where will they be and how realistic these statements are

Monday, November 22, two agreements were signed between the Ukrainian NPP operator NNEGC Energoatom and the US Westinghouse Electric Company, the owner of generation III+ reactor technology AP1000. Earlier, Energoatom spoke of its intentions and plans regarding the abovementioned agreements, however no one was aware of what exactly was going to be signed, until the last moment. To say even more, it was largely unknown, what NNEGC was going to build and where. Since the signing ceremony was part of the Agenda of the International Conference on the occasion of Energoatom’s 25th Anniversary marked on October 16, the signatories had an opportunity to share details of what, when and where Energoatom was going to build. Mind looked into feasibility of such plans and how exactly these are to be implemented.

What will Energoatom build with Westinghouse?

To understand what the agreements signed between Westinghouse and Energoatom are all about, its’ worth catching up on what specifically Energoatom plans to build, and where. After all, this has been unclear at least since the end of August, when in the ceremonial setting, in the presence of the President of Ukraine Volodymyr Zelenskyi, NNEGC Energoatom leader Petro Kotin, and Westinghouse President and CEO Patrick Fragman signed a Memorandum of Cooperation, which provisions for deployment of five Westinghouse AP1000 reactors in Ukraine.

It was then articulated that two AP1000 reactors will be built at the Khmelnytskyy NPP site. As you may know, there are two power units at KhNPP site intended to accommodate VVER-1000 reactors installations have been staying incomplete since 1980s, but their design, thermal and mechanic features are different to those of ÀÐ1000. And while unit 4 is merely 25% complete, the construction status of civil structures of unit 3 goes up to 75%.

Thus, for almost three months nuclear power engineers and experts have been racking their brains over Energoatom’s intents. What is most disturbing, is that the condition of unit 3 civil structures is unsatisfactory, which was communicated by the nuclear regulator, State Nuclear Inspectorate of Ukraine, as far back as in 2011-2012.

Petro Kotin’s presentation just after the document signing got it straight, yet, didn’t relieve the concerns over the potential utilization of the existing civil structures. These will be utilized without the involvement of the US party.

Slide 1: Ukraine’s Perspective Nuclear Generation Capacities

Above is a slide from the presentation of the acting president of Energoatom, wherefrom it can be inferred, that unit 3 of Kmelnytskyi NPP will be completed based on the Soviet-design VVER-1000 reactor installation. In his report Mr.Kotin mentioned, that construction will not involve the Russian Federation, but the only owner of this technology in Europe, the Czech Skoda JS (the owner of Skoda JS is the Russian “Gazprombank” via the “OMZ” group (Unified Heavy Machines Plants). And that’s true. Recently the Ukrainian Power Machines JSC (former“Turboatom) has informed of holding a meeting with the design developer Kyiv Research and Design Institute Energoproject JSC (71% of stocks held by Mark Dubovyi, son of the former parliament member Oleksandr Dubovyi (Yulia Tymoshenko’s Bloc). The meeting objective was to establish whether former Turboatom’s turbines can be used to complete units 3 and 4 of Khmelnytskyy NPP. The press release prompted that the turbine for unit 3 to be based on VVER-1000 technology was almost ready, and for unit 4 it would be modernized to fit the Westinghouse AP1000 design.

Very passingly, Petro Kotin added that the draft law on unit 3 construction was to be submitted to Verkhovna Rada in the short term.

Slide 2: Nuclear Generation Capacities vs Income, Taxes, Workplaces

This is another slide from Petro Kotin’s presentation implying that Energoatom plans to complete unit 3 of the Khmelnytskyy NPP in just four years. The global practice of new nuclear build over the recent decades calls such plans in question: each step in this process shall be coordinated and approved by the national regulatory bodies, the public etc.

Thus, the construction plans for two power units at the British Hinkley Point NPP have been extended, construction was started back in 2018. The power start-up of unit 1 is scheduled for 2026, which is seven years.

Another bright example is the US Vogtle NPP, with two Westinghouse AP 1000 units under construction (just similar to our case regarding the other five units Energoatom plans to commission in 2029, see Slide 2). The construction of the two Vogtle units commenced in 2013, and its completion is scheduled for 2022 QI. This being said, as recently as these days, the US regulator NRC informed of its intent to reinforce the construction oversight, which also has a potential to shift the completion dates rightwards.

Over-regulated procedures, anticorruption efforts and the reinforced public involvement in any large-scale construction projects, even more so when it comes to new nuclear build, hold back on construction of new nuclear capacities in countries with developed democracy. Notwithstanding the above, plans for new nuclear build have already been declared by many European countries.

Further to these arguments, the situation over completion of KhNPP unit 3, on the one side, has been negatively affected, as mentioned earlier, by the condition of the existing civil structures, which raises questions with the national regulator. On the other side, however, availability of the major part of equipment is encouraging, such equipment being manufactured and procured as far back as in 1990s – early 2000s, when Khmelnytskyy unit 2 was at a completion stage. It specifically refers to the full equipment package for the reactor primary circuit, except for the pressurized vessel as such (which is planned to be ordered from Skoda JS).

Yet again, the situation is getting more complex due to the manner in which the equipment has been stored. Part of it has been stored just in the open. The argument is significant, as evidenced by the fact that just following his recent visit to Khmelnytskyy NPP with the Westinghouse delegation, Petro Kotin instructed to identify and punish those responsible for the inappropriate equipment storage, as points of contact in NNEGC Energoatom inform.

What are the agreements signed by Westinghouse and Energoatom?

Now, let’s get closer to the five nuclear power units announced by Westinghouse and Energoatom on the last day of August 2021. A reminder, during the visit of President Volodymyr Zelenskyi to the United States, Energoatom signed a memorandum with Westinghouse Electric on construction of five nuclear power units based on AP 1000 reactor technology to USD 30 bln.

During the International Conference “Nuclear Capabilities for the Country’s Development” of November 22, Westinghouse and Energoatom executed two agreements on construction of two new power units at Khmelnytskyy NPP based on ÀÐ1000 technology. One agreement involves the procurement of services from the US company on power units design, the other is for the procurement of a full-scope simulator for personnel training and other long lead-time equipment for the first AP1000 reactor installation of Westinghouse design at KhNPP site.

In other words, according to the agreements signed, Westinghouse will design KhNPP units four and five. The remaining three units of Westinghouse design will be deployed at operating NPP sites – one at each. As mentioned by the signatories, there’s no talk about the construction yet.

To the point, as far as the Mind is aware, the agreements have not received all (approval) procedures required in such cases. There remains a question, whether Energoatom has had them agreed by all the ministries involved, and even inside the company.

Who pays the bill?

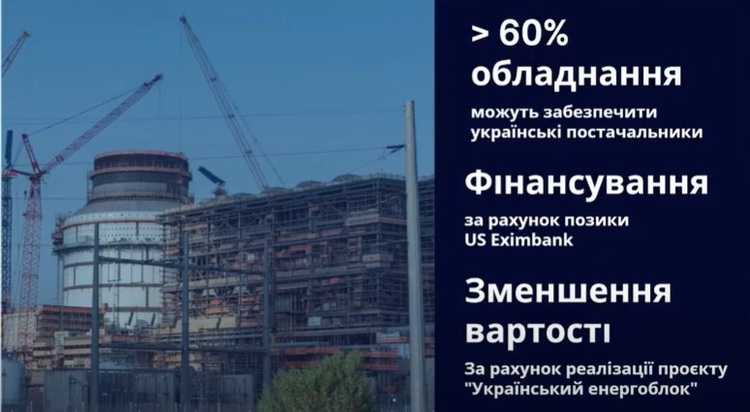

Slide 3: Ukrainian Suppliers to Provide up to 60% of Equipment, Financing through the US Eximbank Loan

This is still another slide from Petro Kotin’s presentation. However, do not take it literally. As Mr.Kotin mentioned himself, these localization factors only apply starting from the second AP 1000 power unit (i.e. Khmelnytskyy NPP unit 5). And the “Ukrainian Power Unit” project will basically start after all five Westinghouse power units are completed, he said.

Yet, even the construction of KhNPP unit 4 will involve Ukrainian suppliers: “Even at the first unit, the turbine island will be built in cooperation with the Ukrainian contractors, while Westinghouse’s responsibility will be the reactor”, Petro Kotin informed. By the way, earlier he claimed that the reactor for KhNPP unit 4 was already existent – it had been manufactured for the Virgil C Summer NPP in the USA, but the project had gone “down the drain” due to the increased cost and extended licensing terms of the new power units. As you may know, in March 2017 Westinghouse could not survive the over-expenditure under its AP1000 construction projects (Vogtle and V.C. Summer reactors) and went for the bankruptcy proceedings.

The signatories to the agreements informed that the construction of power units would be funded from the US Eximbank loan to be granted for 18 years. The loan amount was not articulated. However, it was mentioned casually, that the other funding source could be issuance of Eurobonds by Energoatom. The truth is that the US Eximbank can only grant a loan to Westinghîuse. And most likely, only in the amount of the cost of equipment to be supplied by the US company.

At the same time, as soon as on November 23 a news was spread by the State Enterprise Guaranteed Buyer that Energoatom had won a payout of UAH 4 bln debt for the electricity supplied, and could proceed to enforce this judgement and debit the amount. The amount includes the UAH 3 bln. intended for settlements with DTEK for the “green” electricity, and raised by NEC Ukrenergo early November through the issuance of “green” Eurobonds.

The newly appointed Head of the Guaranteed Buyer Vadym Ulida is now proposing a peace deal to Energoatom. If the proposal is ignored, and the debt is recovered, the issuance of Eurobonds by Energoatom gets even more delusive. In the meantime, however, the nuclear operator is reconciling the wording of the soon-to-be agreement with FinpPoint investment banking company, the one to have arranged for the issuance of Eurobonds for Ukrenergo.

Thus, it is not impossible that for the delivery of the agreements already signed, Energoatom will seek to abolish its public service obligations (PSO) (ca. 50% of the electricity produced is sold at the price significantly below the production cost). This can be effected either through increased electricity prices for households (which is very doubtful in the light of Zelenskyi’s intent to run for the second term), or through shifting of commitments to other market players, which will ultimately undermine the current market model, already having substantial deficits and hardly functioning as it is.

In general, the construction of 15 power units announced in the first slide is nothing but a delusion. Even completion of just one unit is questionable, of which a draft legislation can be submitted by the Cabinet to the Parliament shortly. Not mentioning the claimed eight power units (two NPPs from the green field) before 2040.

For instance, the French power generating company Électricité de France (EDF), also a state-owned company employing 50 000 people and operating 70 GW of installed capacity (not only nuclear), has an annual income of EUR 67 bln. With that, EDF has been very cautious constructing just a single unit at the Flamanville NPP since 2007 (to note, based on the French Framatom technology). Recently, the French President Emmanuel Macron made a statement of intent to build new power units (the French government is expected to announce construction of up to six new EPR reactors in the short run). Note, it is not the NPP operating company (albeit state-owned), but the country’s senior leadership who deliver such statements.

Instead, Energoatom’s 2021 Financial Plan estimates the income of merely UAH 56 bln. (less than EUR 2 bln., 35 000 employess for 14 GW of installed capacity). On top of that, the company’s debt goes up to more than UAH 20 bln. And it is the company, not the national leadership, who announce the plans to construct 15 new nuclear power units by 2040. How the Western community should construe these statements, and whether they even take the leadership of the Ukrainian nuclear power sector seriously, after such statements, remains an open question.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]