"Grey" oil’s great migration: Four scenarios for circumventing anti-russian sanctions

New currencies and routes, shadow fleet and little-known traders. Who is ready to take risks for profits, and how

On February 5, the EU embargo on russian oil products and the accompanying price cap imposed by the G7 countries came into effect. These measures to reduce the kremlin's export revenues, financing the war against Ukraine, complemented the sanctions on russian oil that had come into effect in December. Observers do not have an unambiguous assessment of their consequences, but they agree that the negative impact of sanctions on the russian economy will be extended over time.

Changes in the global energy market are already more evident, triggered by russian aggression.

Logistics networks, trade flows, and delivery terms of cargoes are undergoing significant transformation. They are now delayed in transit due to the geography of new routes and, in part, several transfers to other owners during transportation.

For example, according to Lloyd's List Intelligence, two tankers with russian oil products have been sailing to South America for the first time since yesterday, heading for Brazil. The market is working out "grey" schemes, some transactions go into the shadows and become uncontrolled by the West, and carriers are looking for opportunities to optimize services. Therefore, businesses obviously have no intention of abandoning their interaction with russian oil and oil products.

Mind has explored how market players are adapting to the new conditions and what risks they are taking to increase their profits amid a full-scale war in Ukraine.

Local currencies instead of the US dollar

Indian refineries, which are the main consumers of russian oil, buy it from traders from the United Arab Emirates and pay most of their bills in dirhams instead of US dollars.

"Previously, such attempts were unsuccessful. However, now India's central bank is settling these payments in the UAE currency," Reuters reports.

In December, China and Saudi Arabia conducted the first transaction in yuan. Beijing has also offered Riyadh and other oil-producing countries from the Gulf Cooperation Council the opportunity to trade oil in Chinese currency and keep a larger share of their reserves in yuan.

In today's world of global tectonic changes, these two examples can only mean one thing – the beginning of the decline in the influence of the US dollar in the hydrocarbon market, where it is the main currency of payment.

In an op-ed for the Financial Times this week, economist Nouriel Roubini claims that "the greenback is bound sooner or later to feel the effects of intensifying geopolitical rivalry" with revisionist states such as China, russia, Iran, and North Korea.

Therefore, there is reason to believe that the dominant "exorbitant dollar privileges" will be replaced by a "bipolar currency regime" where the Chinese yuan will also have a strong position. However, for now, the global share of the US dollar as a unit of account, means of payment, and store of value has fallen slightly, despite "all the chatter about a terminal decline."

The Chinese yuan is not a full-fledged protective asset. It is the currency of a powerful rising country, but one with closed government institutions and significant government intervention in the economy. Without guarantees of free circulation, the prospects for an increase in the yuan's share of international trade transactions are also not an indisputable fact, as is its widespread use in payments for russian hydrocarbons under Western sanctions.

russia seems to realize this as well. To receive payment for oil and gas in currencies other than the US dollar, it is not enough to have a desire. It is necessary to stop being afraid of being cut off from the existing global financial system, and it is precisely the problem: "Fear has big eyes, and most financial institutions from friendly [to russia] countries shudder at the mere word 'sanctions,'" says Andrey Kostin, Head of VTB Bank.

"Scattering" of traders

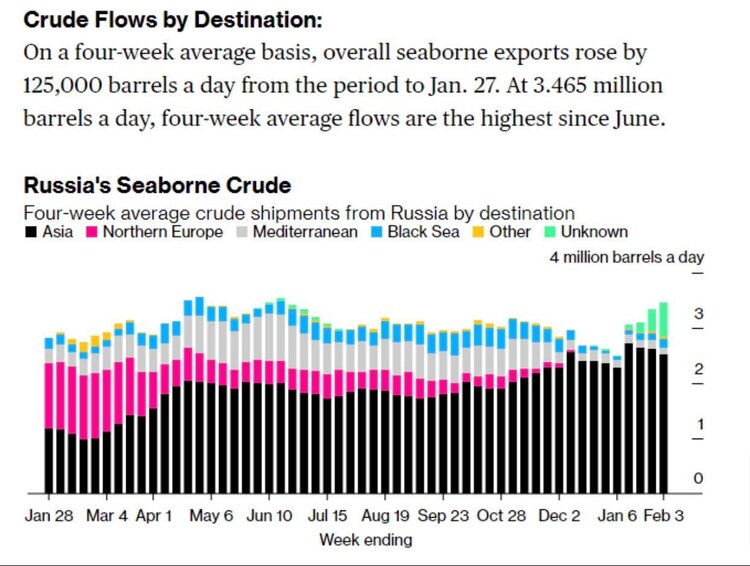

Accordingto Bloomberg, russia has significantly increased its crude oil supplies to Asia this winter. The record-breaker is India, which has not only started to "suck up" more Urals crude oil than in previous periods. Its refiners also began to accept russian Arctic oil delivered from Murmansk, which previously went to the EU.

Since the beginning of December, India has imported a total of about 1.4 million barrels of russian oil per day (data from the Kpler ship tracking system and Energy Intelligence). For comparison: in 2022, the average rate was 800,000 barrels per day, and before russia's full-scale invasion of Ukraine, it was 50,000 barrels.

A notable feature of this record has been that russian oil export is increasingly being carried out by a new group of little-known small traders using non-Western tankers. The details of the trade also remain largely hidden, as both shipping and trading move into the shadows and transparency around shipments deteriorates.

Most of the vessels involved in these shipments are either owned by russia's state-controlled carrier sovcomflot and its Dubai-based subsidiary Sun Ship Management, or belong to a shadow fleet of dozens of partially obsolete tankers controlled through intermediaries with ties to the kremlin.

Many of the vessels transporting russian crude oil are chartered by unknown trading companies, often based in Dubai and with no previous presence in russia. Some of these legal entities (Tejarinaft, Sunrise, Bellatrix, Samaria) have been transporting russian crude oil for several months on behalf of the state-owned giant rosneft.

"There will be more of these strange companies, it's inevitable," said an Energy Intelligence interlocutor who closely follows russian supplies.

These new unknown traders are replacing traditional influential players such as Vitol, Gunvor and Trafigura, which have stopped buying russian oil and oil products due to the embargo. However, it does not improve the financial situation of the russian federation.

In January, the russian budget deficit reached 1.76 trillion rubles. It is 60% of the annual plan. For the whole of 2023, the Ministry of Finance planned a deficit of 2.9 trillion rubles. According to Bloomberg, it is "the largest January deficit since 1998, which was marked by a default."

After the embargo and the accompanying price cap were imposed, russia was forced to sell its Urals crude at a discount to Brent, estimated at between $10 and $40 per barrel (Brent has recently been trading at around $85 per barrel – Mind).

The market expects that the shadow trade of russian oil will continue growing, as will the fleet of ships used to transport it, which is not controlled by the West.

The "shadow" fleet

The redistribution of the tanker transportation market is another significant consequence of sanctions against oil and oil products from russia. Western restrictions have effectively divided this business into two camps: one that has joined the EU ban and price ceiling, and the other that is fostering the flourishing of a separate fleet that operates outside the limits and Western logistics.

The shadow segment of tanker transportation has been growing significantly since last summer due to the involvement of ships manufactured more than 20 years ago. Ships that should have been disposed of are in demand. Ignoring the security risks, the owners of this "scrap metal" have the opportunity to get tens of millions of dollars for it, as shadow oil market operators go out of their way to violate rules and regulations.

The so-called "non-Western" fleet now includes approximately 350 "dirty" oil tankers, which allow russia to maintain exports of black gold at more than 4 million barrels per day (Energy Intelligence data). Unlike crude oil, simply counting the tonnage of clean tankers is not enough to understand the volume of shadow trade in russian oil products.

"Although there are 292 'clean' shadow tankers, most of them are small and unsuitable for long-distance travel on the high seas. We estimate the working capacity at about 77 million barrels. It is only 13.5% of the total shadow fleet tonnage," says Andrew Wilson, Head of Research at BRS shipbrokers.

The specificity is that the vessels used to transport crude oil cannot be easily used to transport light oil products: the longer a tanker has been transporting crude oil, the more difficult it is to clean it. Such a service, according to Wilson, is "extremely expensive," and "shadow fleet tanks are usually impossible to clean" because they have no protective coating inside.

It explains why the value of used "clean" tankers has "gone through the roof" over the past few months, and ship brokers expect this trend to continue.

Redrawing the shipping market

A less obvious consequence of the anti-russian sanctions is the redistribution of the oil transportation business. A sharp increase in shipowners' revenues has provoked the interest of influential players in taking over promising and successful competitors. It also led to a change in the jurisdictions where the fleet was registered to avoid Western control.

For example, the whole last year the Western business community was following the development of the struggle between two of the most influential dynasties in Europe that made their fortunes on oil transportation services. We are talking about the family of Norwegian businessman John Fredriksen, the beneficiary of Frontline, and Euronav, which is run by the Belgian family of Alexander Saveris.

In an effort to create the world's largest publicly traded oil tanker carrier, Fredriksen launched a merger with Euronav last summer. However, by January 2023, the parties were unable to reach a compromise and abandoned the controversial deal worth more than $4 billion.

One of the published reasons that has prompted Alexander Saveris to take a different path is related to his vision of the shipping business development strategy. He is going to turn his tanker fleet into an "ecological energy company" whose business is related to hydrogen technologies.

The Belgian tanker tycoon believes that this area can bring more benefits to shareholders than the transportation of oil and oil products, but the market has a different opinion. After the announcement of the merger, Frontline's shares rose by an average of 14.7% to $13 in over-the-counter trading, while Euronav's shares fell by 18.6% to $12.97.

This case clearly illustrates that businesses around the world continue to adapt to both large-scale anti-russian sanctions and the West's aggressive climate policy, which aims to reduce dependence on fossil fuels, which are produced mainly in countries far from democratic values.

Gas United. Svitlana Dolinchuk's original Telegram channel:

- About the real gas business, based on common sense.

- How energy resources are traded in Ukraine and the world during the war.

- Facts, trends, comments.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]