Cryptocurrencies go underground: NBU bans withdrawals from crypto wallets. Why is it a sign that the market is being prepared for strict regulation?

And how the industry will react to the new requirements

Since 2 March 2023, Ukrainian cryptocurrency wallet holders have been unable to withdraw funds from them by transferring fiat currency to bank cards. It is also impossible to deposit funds to wallets from bank accounts. "At the moment, fiat channels, namely deposit and withdrawal via bank card and other payment services, are temporarily suspended among cryptocurrency exchanges across Ukraine," Binance, one of the largest cryptocurrency exchanges, said in an official statement.

Mykhailo Chobanian, the founder of the Kuna cryptocurrency exchange, also confirmed the blocking of withdrawals and deposits.

Whitebit's customer support team has reported that transactions between cryptocurrency wallets and bank cards are not possible due to technical issues.

The restrictions are the result of a campaign to fight illegal gambling launched by Ukrainian MPs. As a result, cryptocurrency exchanges have also been affected.

Mind has looked into what this ban means for the Ukrainian crypto market and digital asset owners.

Casinos are to blame. Back in January, MPs together with law enforcement officers reported the disclosure of a large-scale miscoding scheme involving gambling organisers and banks.

The essence of miscoding is as follows: a player sends money to a gambling organiser to place a bet, say, in an online casino; the funds are transferred to a pass-through bank, which runs the payment, changes its purpose (the so-called MCC code), and withdraws the money to card accounts of individuals, in particular for the payment of "envelope wages".

This scheme minimises the tax base. Instead of personal income tax at the rate of 18% and 1.5% war duty, which are charged on winnings, the payment is not taxed at all because it is disguised as a regular card-to-card transfer.

A month and a half later, on 28 February, the Temporary Investigation Commission on Economic Security held a meeting to discuss the issue of miscoding. Commenting on the results of this meeting, Danylo Hetmantsev, Сhairman of the Parliamentary Committee on Finance, Taxation and Customs Policy, told Mind:

- due to tax evasion in the gambling business involving banks, the state budget lost UAH 25-30 billion in taxes in 2022;

- nine banks participated in the above-mentioned miscoding scheme, through whose accounts funds were transferred to casino players as a payout of winnings or to card accounts of retailers as a payment of under-the-table wages. The cash from the networks was transferred to illegal agricultural traders, who used it to buy grain, exported it abroad, and returned the money to gambling establishments in cryptocurrency or to foreign accounts;

- The Bureau of Economic Security (BES) has already opened a criminal case involving representatives of gambling organisers and bank employees;

- The State Tax Service will estimate the amount of budget losses, assess additional tax liabilities, and each gambling operator and bank that have participated in the scheme will have to pay the arrears.

What does this have to do with cryptocurrencies? Danylo Hetmantsev explained to Mind that the operations of cryptocurrency exchanges were sanctioned for a reason. The fact is that on 2 March, the National Bank amended the procedure for authorising financial payment service operators and set additional requirements for business reputation, technical conditions of operation, absence of violations, etc.

"These steps were taken as a result of the NBU's response to the violations detected in the calculations of the gambling business. Cryptocurrency exchanges, along with financial companies and banks, served the gambling industry. After the transaction, the credited funds were often transferred to crypto and withdrawn abroad to confuse the traces. Actually, it (the National Bank's decision – Mind) is a re-licensing and/or new authorization of such payment operators," commented the Chairman of the Tax Committee.

Indeed, on 2 March, the NBU published on its official website Resolution No. 14 dated 1 March 2023 on amendments to certain regulatory legal acts of the NBU regarding the authorization of financial payment service operators and comments to this document. Although there is no direct mention of cryptocurrencies and crypto exchanges, the regulator has established new, more stringent rules for payment market operators.

As representatives of two Ukrainian banks explained to Mind, the revision of regulatory conditions by the National Bank led to the fact that from now on, banks would consider transactions for the exchange of fiat funds for cryptocurrency, as well as the withdrawal of cryptocurrency into traditional money, to be high-risk. In other words, they simply do not pass the financial monitoring framework. Thus, banks block them to avoid problems with the regulator later on.

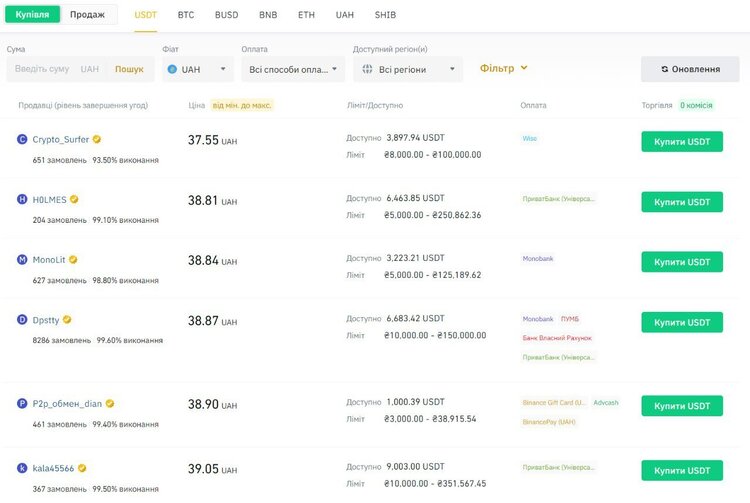

There is still an alternative. It is still possible to deposit money into crypto wallets and withdraw cryptocurrency into fiat. You can use p2p transactions for this purpose. Their difference is that the currency (fiat and digital assets) is exchanged between users directly.

In other words, replenishing a wallet through an exchange or withdrawing money from it directly is a financial relationship between a private individual and a legal entity. Peer-to-peer transfers are the transfer of funds from one individual to another individual. Such transactions are not prohibited. At least for now.

By the way, p2p services are available on almost all major exchanges. Binance, Kuna, and Whitebit, for example.

Such transactions have the following algorithm (it may differ from platform to platform, but the general principle is the same everywhere):

- the user chooses the cryptocurrency he wants to buy for hryvnias;

- in the appropriate section for p2p trading on the exchange, he examines offers from sellers;

- the buyer chooses the seller who offers the best conditions (exchange rate, bank cards to which money can be sent, etc;)

- the buyer places an order to buy the cryptocurrency and transfers the required amount to the seller;

- the seller, who has received the hryvnia on his account, sends the cryptocurrency to the buyer.

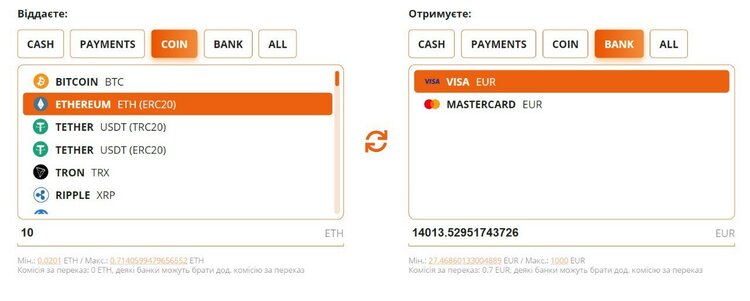

Cryptocurrency exchange offices, which operate separately from exchanges, operate under the same mechanism. Essentially, they simply bring buyers and sellers together.

The disadvantage of any p2p exchange is that the exchange rate will be worse than the market rate. If a unit of cryptocurrency is worth $100 on the exchange, the rate for buying it through p2p will be $105, and when selling it, you will be able to get $95. This difference is used to earn money by participants of p2p services.

Furthermore, while a crypto exchange can guarantee at least some transaction integrity, all transactions between private sellers and buyers are based on the word of honour, which means there is a high risk of fraud.

Regulation of the crypto market is just around the corner. This whole situation certainly concerns both crypto platforms and their participants. Basically, the main channel for depositing funds into and withdrawing them from the exchange is closed. Although representatives of crypto exchanges claim that there is no outflow of investors, it is too early to draw conclusions. "Exchanges will definitely lose their volumes, even if temporarily," said Ruslan Kolodiazhny, a crypto entrepreneur and former CTO at British fintech company Wirex.

The market is on hold, waiting for things to happen. And its further reaction will depend on the scenarios that will take place.

The first one is an optimistic one, which involves the separation of cryptocurrency payments and miscoding. In other words, exchanges will need to prove somehow that their members are not involved in money-cashing and tax evasion schemes. In this case, the National Bank may again revise its regulatory framework and lift restrictions on crypto wallet transactions.

Unfortunately, this scenario is highly unlikely. The trend of fighting money laundering with the help of cryptocurrencies is gaining momentum around the world. At the end of December 2022, more than 60 people were arrested in China for laundering 12 billion yuan (about $1.7 billion) using digital assets.

At the end of February 2023, the New York State Department of Financial Services (NYDFS) in the United States announced that it intends to strengthen the monitoring tools of organisations that conduct operations with crypto assets. By the way, the NYDFS has already caught the crypto exchange Coinbase in the wrong. It has pledged to pay a $50 million fine for the fact that its security system has revealed gaps that could lead to the use of wallets for money laundering and even drug trafficking.

"The probability that the restrictions will be lifted is close to zero. Other mechanisms of crypto input and output will be created. It may include the expansion of the p2p market, the entry of new market players with new merchants, and an increase in the volume of cash transactions. In my opinion, miscoding is the ‘official’ reason for such a ban. Although miscoding itself will not disappear, only other merchants and MCC codes will be used," says Ruslan Kolodiazhny.

Ukraine is also trying to keep up with the trend of fighting schemes involving cryptocurrencies. After all, the Ukrainian crypto market ranks third in the global ranking of countries in terms of the rate of crypto spread.

Therefore, the second scenario – the pessimistic one – is the most likely. And the words of the ideologues of the fight against miscoding confirm it. "Until this process (re-licensing of payment operators – Mind) is over, payments – replenishment of crypto wallets and withdrawal of funds from them – will be put on hold and limited," Danylo Hetmantsev assured.

In general, everything that is happening looks like another step towards legislative control of the cryptocurrency market. As a reminder, back in February 2022, the Verkhovna Rada passed Bill No. 3637 on the virtual asset market, but it did not enter into force because MPs had not yet approved the necessary amendments to the Tax Code.

The relevant committee continues working on these amendments. And blocking operations with crypto wallets fits into this process quite well.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]