Chronology of the Fall: What the Fed Report on the Silicon Valley Bank Situation Revealed

And how this experience may help other banks and their depositors

We offer readers a continuation of the topic, analysing the processes that have been taking place in American banking recently.

The bankruptcy and asset buyout of First Republic Bank are not isolated problems of one bank. They have become the next element in a chain of events initiated long before 2023: active stimulation of the economy during the pandemic, followed by a rollback and transition to a policy of restraint, put banking institutions in an unusual and difficult position.

Understanding their key role in these processes, the US Federal Reserve System (Fed) conducted a study of the reasons for the fall of one of the big banks – Silicon Valley Bank. The goal was to find out why regulation and oversight of the financial institution's activities did not prevent bankruptcy.

Mind has thoroughly studied this document and tells what conclusions the Fed reached and how relevant they are for other banks.

Read also: Next one down: Why did the US First Republic Bank experience a collapse?

Why did SVB fall – according to the Fed's opinion?

The published results (posted on the Federal Reserve's website) formulated four main conclusions:

- The SVB Board of Directors and management did not manage risk effectively.

- The Federal Reserve's supervisory authorities did not fully assess the scale of vulnerabilities that increased as the bank grew rapidly.

- Even after vulnerabilities were acknowledged, sufficient actions were not taken to correct them.

- The 2018 Economic Growth, Regulatory Relief, and Consumer Protection Act (EGRRCPA) led to excessive easing of oversight over the bank.

Even a cursory review of these provisions gives an understanding of the overall direction of the Fed's position. It looks something like this: "We are to blame for not keeping an eye on bankers and are ready to be more vigilant in the future. However, for this, our powers must be expanded because we cannot rely on the professionalism of bank management." And if such a summary seems too categorical, one can be convinced of its validity by reading further in the 118-page report.

Once again, it becomes clear that despite the complex predictability of financial markets, they have several indicative factors. Namely, there is no doubt that the crisis situation will be used to strengthen regulation and supervision. And if at the same time it is possible to blame the previous government, then 'predecessors' are obviously a popular archetype not only in Ukraine.

The report discusses the negative consequences of changes in legislation, in particular regarding enhanced supervision and prudential standards. The threshold for bank assets that must comply with these conditions has been raised from $50 billion to $250 billion. SVB falls into this category and has been able to rapidly increase its assets under eased regulation, underestimating risks.

Mind's reference:

Prudential regulation is a system of banking supervision in which the main focus of supervisory authorities is on conducting a regular assessment of the overall financial condition, performance, and quality of management.

The situation was worsened by the bank's overly concentrated business model and dependence on uninsured deposits. There were also other problematic moments, including the fact that while regulators had pointed out shortcomings in SVB's operations (there were 31 current warnings, three times as many as in comparable banks), their ability to prevent a collapse proved to be limited.

What else did the Fed analysts 'dig up'?

No less interesting than the report itself are the accompanying materials, also publicly available. One of the most interesting is "Impact of Rising Rates on Certain Banks and Supervisory Approach Background Materials" (the file is posted here).

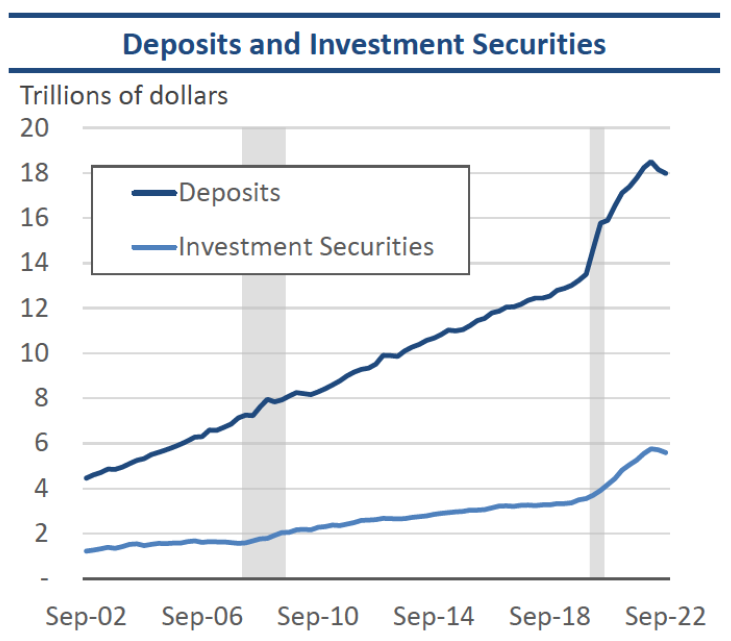

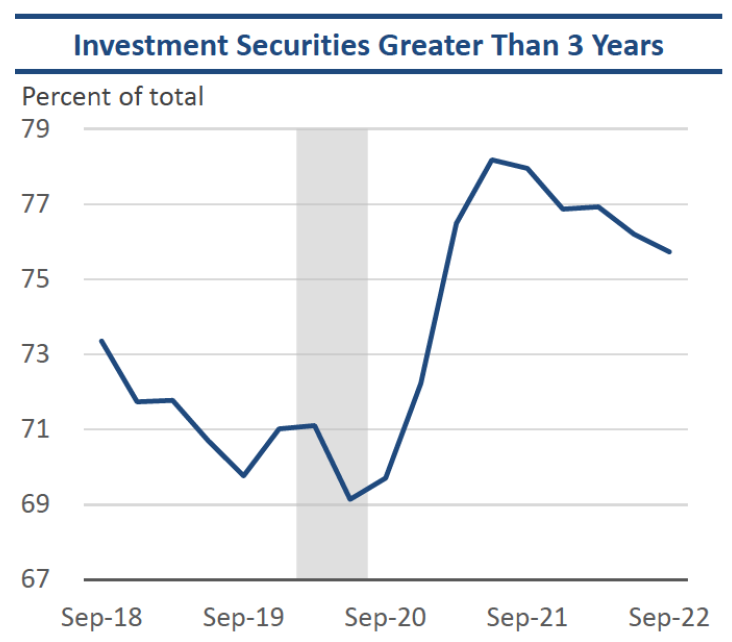

The report states that the rapid growth of deposits during the COVID-19 pandemic was largely converted into investments in securities.

Literally: "The bank used significant deposit growth to purchase longer maturity securities." This statement sounds like an accusation. However, the question arises: where else were bankers supposed to invest this money?

Deposits and investments in securities

Investments in securities with maturity of over 3 years, as a % of all securities

Why did the situation develop this way?

Let's recall 2021:

- the economy was in an uncertain state due to the pandemic;

- interest rates were rapidly declining – precisely due to the activities of the Federal Reserve;

- the stock markets were experiencing ups and downs, absorbing excess liquidity (along with cryptocurrencies).

Under these circumstances, what is more rational – to lend to businesses that may not survive the pandemic or to buy, for example, US Treasury bonds? After all, the latter are considered assets with minimal risk and are used as a source of quick liquidity, equivalent to cash.

And since few people seriously expected a US default, such bonds (or, say, bonds of state mortgage organisations) had high liquidity. Thus, they allowed getting at least some income at almost zero market rates on short-term papers.

The yield of 2-year US Treasury bonds over the last 5 years: during 2020-2021, it was close to zero

So, the bond portfolios of banks were growing, and everything was fine until the cycle of rate hikes began in 2022. As Mind has repeatedly written, when rates rise, the market price of debt securities decreases. And the longer the period until maturity, the lower the current price falls. Thus, the market adapts to changes in interest rates – regardless of the borrower's financial condition.

Whose fault is it more?

Of course, if central banks did not interfere in setting interest rates, they would more accurately reflect reality, but we have something else. The decline in the value of securities led to the accumulation of unrealized losses (when bonds, for example, are worth $100 on the balance sheet, but their current market price is $70).

Unrealized losses on securities (as a % of Tier 1 capital)

Certainly, we can join in the Federal Reserve accusations, using the template: asset maturities should match liabilities maturities if a bank wants to be financially stable. However, by buying highly liquid debt securities rather than providing loans, this function is precisely realised. The market allows assets to be sold and liabilities to be paid off at any time.

However, when interest rates started to rise and bond market prices started to fall accordingly, banks were left with two choices: sell and realise the loss, or hold on and continue to receive interest, leaving the loss 'in their heads'.

Let's take another step. If financial institutions are consistently required to maintain the balance between asset and liability maturities, then we would essentially have to abandon the fractional reserve banking system.

Thus, all demand deposits and checking accounts cannot be used for lending because the bank must return the money upon the first request of the client. And, although this option will help avoid 'runs' on banks, we will have to forget about the magical effect of the banking multiplier and the surplus business in this sector. The banking system is unlikely to agree to this..

Therefore, the Federal Reserve confirmed that rising interest rates increase financial risks for many banks. They expressed concern about banks with significant portfolios of unrealized losses. They also noted that instead of being a source of liquidity, portfolios of securities become a problem under conditions of deposit outflows. However, they did not offer any real solutions to the situation, other than injecting liquidity.

What was decided at the May meeting of the Fed?

At the latest meeting of the Open Market Committee of the Fed, it was predictably announced that the target rate would be raised by 0.25% to a range of 5-5.25%. Expectations on the eve were giving an 88% probability of this scenario, so it was more interesting not so much the decision itself, but the accompanying comments and answers to questions.

Journalists were interested in the Fed's future steps. Despite all the direct and indirect measures to avoid future banking bankruptcies, the most effective and simplest could be to stop raising rates and return to the cycle of monetary easing.

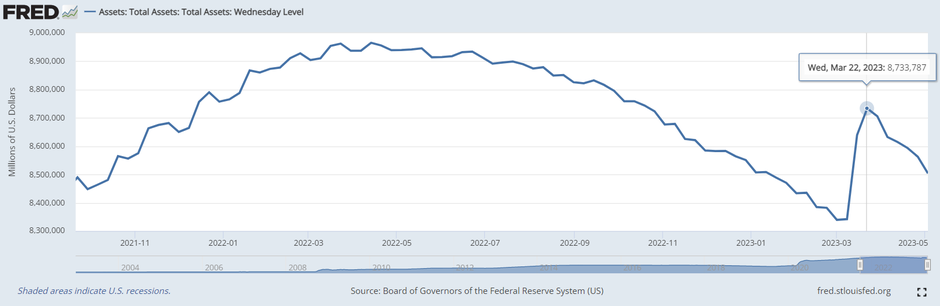

Thus, it's not just about rates, but also about the Fed's balance sheet. It was gradually decreasing before the March events with SVB. However, on the other hand, it will be difficult to reconcile the reversal with the goal of slowing inflation.

Federal Reserve balance sheet, $ billion

Source: FRED data

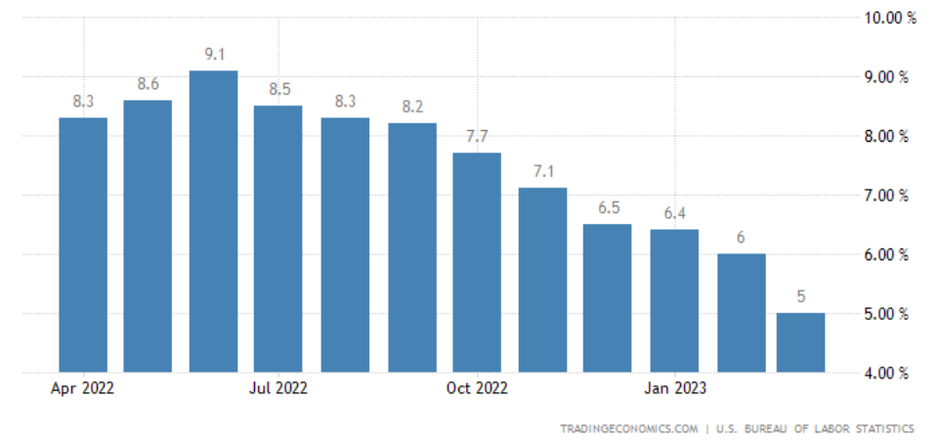

The Fed chair's speech confirmed that the banking crisis (although the Fed may not consider this wording correct) is not a top priority as before. It was emphasised that the primary goal remained the same – to return inflation to the targeted 2% per year. The current slowdown in price growth rates (from 9.1% to 5% in annual equivalent) does not reassure Fed Chairman Jerome Powell. He stressed that inflation has often accelerated again after slowing down in the past.

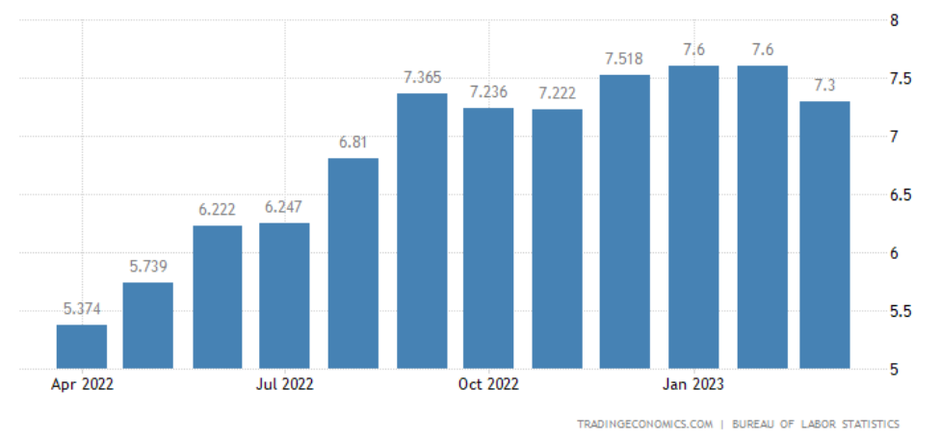

Inflation in the United States of America

Source: TradingEconomics data

And if we look at the dynamics of prices in the services sector, there is no slowdown at all.

Inflation in the US services sector

Source: TradingEconomics data

Answering questions about economic realities, Powell did not hesitate to emphasise the "too strong labour market" and high wage growth rates, which hinder the fight against inflation. Cynical, but at least sincere.

What profit is there for banks and depositors in all of this?

Combining the first and second parts of our review, we have a situation in which the Fed will try to simultaneously solve several problems that contradict each other:

- restrain inflation;

- prevent the economy from entering a recession phase;

- maintain the stability of the banking system..

And even the expected pause in the cycle of rate hikes will not solve the problem. That is why the Fed may emphasise significant changes in regulating banking activities and further reforming the industry. In support of such actions, we will hear comments on the "inability of the market to regulate itself" from many financiers. However, it will be important to distinguish where there are real market shortcomings, and where they have been actually introduced by external intervention.

Studying the fall of banks, we have seen that risks can have different natures: poor asset quality, falling market quotes of securities, sudden outflow of deposits, etc. Moreover, the entire set of risks may remain hidden until the last day. Therefore, when investing funds, it is important to try to see the whole picture, rather than relying solely on current topics that are 'highlighted' in the media or social networking sites.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]