No more credit at 1000%: MPs propose limiting interest rates on microloans

How will this affect the terms of issuing quick loans?

The Finance, Taxation, and Customs Policy Committee of the Verkhovna Rada has decided to address the market of unsecured loans. Danylo Hetmantsev, the committee's chairman, expressed outrage at the fact that microfinance institutions (MFIs) issuing quick loans set interest rates on them at levels of up to 1000% per annum or more.

In light of this, Hetmantsev and a group of MPs have prepared a draft law that limits the level of interest rates on loans issued by MFIs and imposes certain restrictions on lenders to protect the rights of borrowers.

Mind has looked into what the MPs propose and how their initiative could impact the microcredit market.

How do the MPs want to change the rules for issuing quick loans? The draft law mentioned by Hetmantsev is currently not registered in parliament, but the chairman of the tax committee outlined its main provisions. They can be summarised as follows:

- limit the interest rate on consumer loans to a maximum of 1% per day (based on the total loan amount);

- prohibit lenders from demanding any payments not specified in the loan agreement entered into with the borrower;

- prohibit lenders from unilaterally extending the term of credit usage. Loan extension is only possible through an additional agreement and with the consent of both parties;

- mandate that microfinance institutions (MFIs) provide information about all consumer loans, regardless of their amount, to the Ukrainian Credit Reference Bureau.

Based on these proposals, it can be concluded that interest rates on microloans could decrease by tens or even hundreds (or thousands) of times. The maximum rate will be capped at 365% per annum, which is still considerable. However, it is significantly lower than what some companies currently charge for loans (more details below)..

Additionally, MFIs will not be able to extend the term of the credit agreement without the knowledge of the borrowers. This, in turn, prevents lenders from stretching the debt for an indefinite period, turning it into an 'eternal' loan and charging servicing fees on that basis.

Inclusion of all loans in the Credit Bureau will benefit both loan organisations and borrowers. MFIs will be able to see information about individuals applying for a loan in advance, and their clients will not be unjustifiably denied loans if their credit history is in good standing.

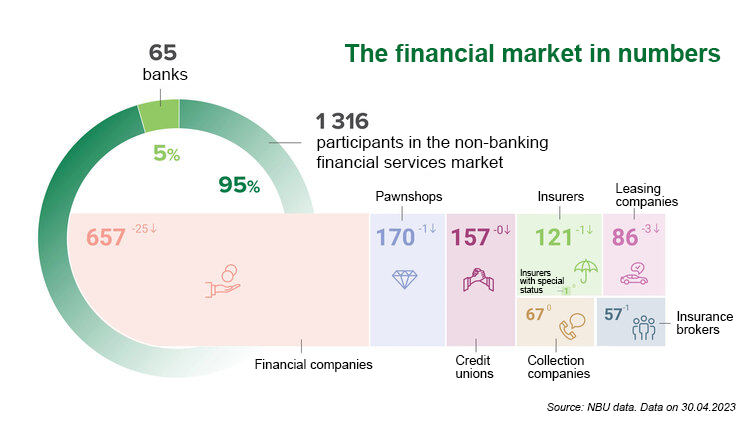

Under what conditions do MFIs currently issue loans? The lending market in Ukraine is extremely diverse. According to the National Bank of Ukraine data as of May 1, 2023, there were 657 financial companies registered. It is these companies that provide microloans.

Source: NBU data

Among them are quite large players with well-established names, including those with a vast network of credit issuance throughout Ukraine – Moneyveo, CreditKasa, ShvydkoGroshi – and dozens, if not hundreds, of companies that operate exclusively online and lend money based on online applications.

Unlike banks, MFIs are not subject to such strict regulation. Moreover, these institutions do not raise funds through deposits. Therefore, in the event of their bankruptcy, there will be no line of depositors waiting to retrieve millions or billions of hryvnias.

MFIs provide loans only to individuals, offering small amounts ranging from 5000 to 50,000 hryvnias for a period of 14 to 60 days, and they do not require collateral or proof of income. Essentially, anyone, even the unemployed, can obtain a loan. This specific nature of their operations results in exorbitant interest rates on loans..

Financial companies offset the risks of non-repayment. Roughly speaking, if out of 10 borrowers, nine default on the loan, the one conscientious borrower who repays compensates for the lender's losses and allows them to make a profit.

Regarding interest rates, the 1000% per annum mentioned by Hetmantsev is far from the limit. Here, for example, are the conditions of some MFIs as stated on their websites.

Real interest rates on microloans

| Name of MFI | Real interest rate, % p.a. |

| Moneyveo | up to 196, 868 |

| CreditKasa | up to 279,354 |

| Ye-groshi | up to 65, 5721 |

| CreditPlus | up to 115, 757 |

| ShvydkoGroshi | up to 138, 822 |

| MyCredit | up to 502, 508 |

Source: MFI data (the indicated rate is indicative and does not constitute a commercial offer of a specific loan product)

The maximum interest rate on loans can be calculated in hundreds of thousands of annual percentage rates. This is not a mistake. At first glance, the borrower may not feel the impact of this because they borrow, let's say, 1000 hryvnias and repay them in 14 days.

Often, MFIs offer preferential rates to new borrowers during prompt repayment, such as 1-2%. It is a way to get people hooked on credit. However, if for any reason the client fails to repay the loan on time, various fees start accumulating, along with penalty sanctions. The actual interest rate then increases to those hundreds of thousands of percentages.

By the way, many companies do indeed have hidden commissions (this is something that the draft law should also correct). For example, when taking out a loan of 5000 hryvnias, one may have to pay double the amount as a commission. This is simply for the arrangement of the loan agreement and the company disbursing the funds. Naturally, the lender tries to conceal it and include it in the loan payments. But in reality, the borrower ends up paying twice as much, just in the form of commissions (not to mention the interest), as they initially borrowed.

What will happen to the MFI market in case of legislative changes? The National Bank of Ukraine has been trying to bring order to the fast loan market for quite some time now.

As early as the autumn of 2021, the NBU demanded that financial companies disclose full information about their credit products. This includes basic conditions such as loan amount and term, as well as interest rates, fees, penalty sanctions, and so on. In general, this information can be found on the websites of MFIs. However, sometimes it is hidden deep within the website or written in a complex manner that an average client still wouldn't be able to understand.

After the martial law was imposed, the NBU began carrying out mass inspections of non-banking credit institutions, imposing fines for violations (usually for non-compliance with the terms of credit agreements or unethical behaviour when dealing with problematic borrowers), and revoking licences.

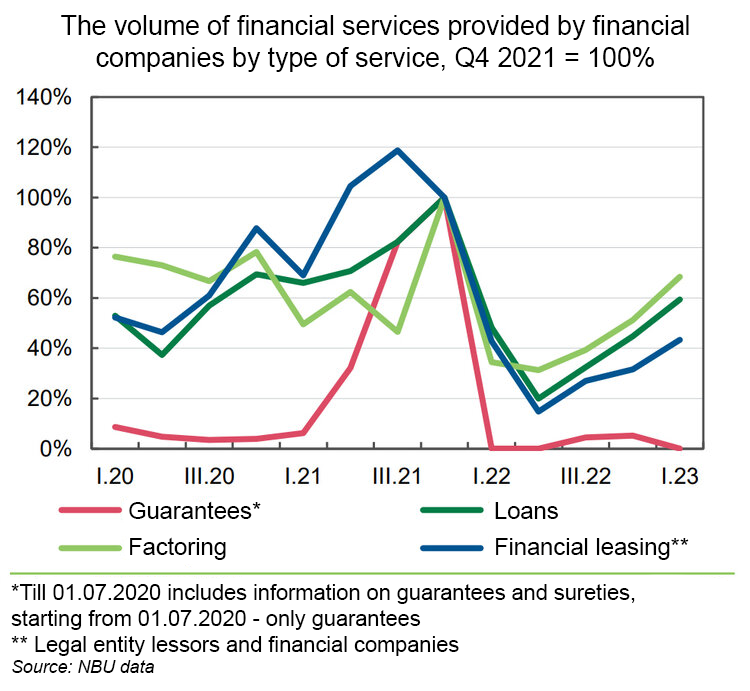

As a result, if there were 935 MFIs operating in the market as of January 1, 2022, by May 1, 2023, that number had decreased by a third. Of course, some companies ceased operations due to the war, as there were simply no borrowers available (see the graph). However, many were shown the door by the NBU due to violations.

In the context of the ideas voiced by the MPs, the number of market participants will continue to decrease.

- First, for most of them, their business relies on the fact that profitability allows them to earn even in the case of non-repayment of 60-80% of loans.

- Second, if the maximum interest rate is limited at the legislative level, it is evident that many companies will still try to bypass these regulations. Sooner or later, this will become apparent, and the NBU will revoke the licences of such MFIs.

Moreover, changes in lending conditions cannot be ruled out. Forced reduction of interest rates will lead to financial companies becoming stricter in screening clients. This means that it will become much more difficult, and sometimes impossible, to obtain a loan without any income, guarantor, or collateral.

Additionally, MFIs may further reduce loan amounts and terms. If today it is possible to obtain loans ranging from 25,000 to 50,000 hryvnias for a couple of months, in the future, the maximum a client can expect would be 5,000 to 10,000 hryvnias, which would need to be repaid within 2–3 weeks.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]