The season ended: How agricultural exports managed to hold up at pre-war levels

Despite disruptions in logistics and the Black Sea being effectively blocked, Ukrainian agricultural trade reached volumes comparable to the previous season

On June 30, the 2022/23 marketing year in the agricultural market came to a close. This is a conventional period that encompasses both crop production and its sale. The season that just ended started on July 1, 2022, so it can be characterised as one that took place entirely during the war. However, that's not entirely accurate: the foundation of last year's harvest was laid in the fall of 2021. A successful winter sowing campaign helped mitigate the shock of spring 2022 and a significant decline in volumes in the spring group.

According to the data from the State Statistics Service and the State Customs Service, the export of major grain crops from Ukraine in the 2022/23 season amounted to over 49 million tonnes (as of June 28), compared to 48.4 million tonnes in the previous season. The absolute majority of shipments accounted for corn, with 29 million tonnes exported, nearly a quarter more than in the 2021/22 marketing year.

In 2022, the share of agro-food products in Ukraine's total exports increased to 53% from 41% in 2021.

Mind dissected how such a performance was achieved, given that practically everything was against Ukrainian exports.

What formed the resource for exports if the harvest likely decreased? Indeed, in 2022, grain production in Ukraine decreased by 37% compared to the 2021 figure and amounted to approximately 53.9 million tonnes.

The largest losses, 75-80%, were experienced in the crops in the front-line Zaporizhzhia, Donetsk, and Lugansk oblasts. Additionally, the Kherson Oblast, which was under occupation for most of 2022, was excluded from circulation.

However, despite the significant decline, the overall harvest result was not a failure. Firstly, because the comparison base was initially inflated (in 2021, Ukraine harvested a record-breaking 84 million tonnes in its history). Secondly, due to the occupation of certain territories and the outflow of people abroad, there was reduced demand in the domestic market, which allowed for redirecting additional volumes for export.

Another equally significant factor that contributed to the overall export figure was purely statistical. Due to the blockade of Black Sea ports from the end of February until August 2022, a significant portion (estimated at approximately 20 million tonnes) of the record harvest remained unexported and was actively exported in the new season, thereby impacting the statistics.

How much was exported by crop? As of June 28, the export compared to the previous season amounted to:

- Wheat – 16.8 million tonnes compared to 18.7 million tonnes;

- Barley – 2.7 million tonnes compared to 5 million tonnes;

- Rapeseed – 3.4 million tonnes compared to 2.7 million tonnes;

- Maize – 29 million tonnes compared to 23 million tonnes;

- Soybeans – 3.2 million tonnes compared to 1.1 million tonnes.

Exports of certain agricultural products from Ukraine in 2021/2022 and 2022/2023 marketing years

| Product category | Exports in 2021/2022, tonnes | Exports in 2022/2023, tonnes | Exports in 2021/2022 thsdUSD | Exports in 2022/2023 thsd USD |

| Wheat and meslin | 18,738,778.9 | 16,776,898.7 | 4,871,467.8 | 3,502 214.9 |

| Rye | 161,523.0 | 17,944.0 | 34,446.5 | 3,582.6 |

| Barley | 5,748,946.5 | 2,695 487.2 | 1,315,559.6 | 511,555.5 |

| Oats | 12,456.9 | 5,009.6 | 2,920.0 | 1,150.3 |

| Maize | 23,402,525.3 | 29,073,356.6 | 5,828 271.3 | 6,125,670.9 |

| Rice | 4,106.8 | 58.1 | 2,567.5 | 113.4 |

| Grain sorghum | 67,309.5 | 69,351.3 | 16,340.3 | 15,460.9 |

| Buckwheat, millet, and canary grass seeds | 98,781.6 | 74,528.1 | 29,807.6 | 22,652.1 |

| Soybeans, crushed or uncrushed | 1,152,998.1 | 3,236,842.4 | 639,281.6 | 1,239,390.7 |

| Flax seeds | 32,825.5 | 15,144.3 | 23,172.4 | 8,656.6 |

| Seeds of winter cress or rapeseed, crushed or uncrushed | 2,709,877.7 | 3,400,664.3 | 1,727,513.5 | 1,668,583.5 |

| Sunflower seeds | 1,079,692.8 | 2,369,383.8 | 610,229.6 | 896,431.6 |

| Seeds and fruits of other oilseeds, crushed or uncrushed | 24,710.8 | 23,428.3 | 41,829.4 | 45,415.8 |

| Sunflower, safflower or cottonseed oils and fractions thereof | 4,337,266.4 | 5,277,604.8 | 5,826,835.3 | 5,538,947.9 |

| Oilcake and residues obtained during the extraction of soybean oil | 420,223.8 | 546,841.8 | 230,180.0 | 252,980.9 |

| Oilcake and residues obtained during the extraction of vegetable fats and oils | 3,391,794.4 | 3,965,174.4 | 956,063.3 | 829,807.5 |

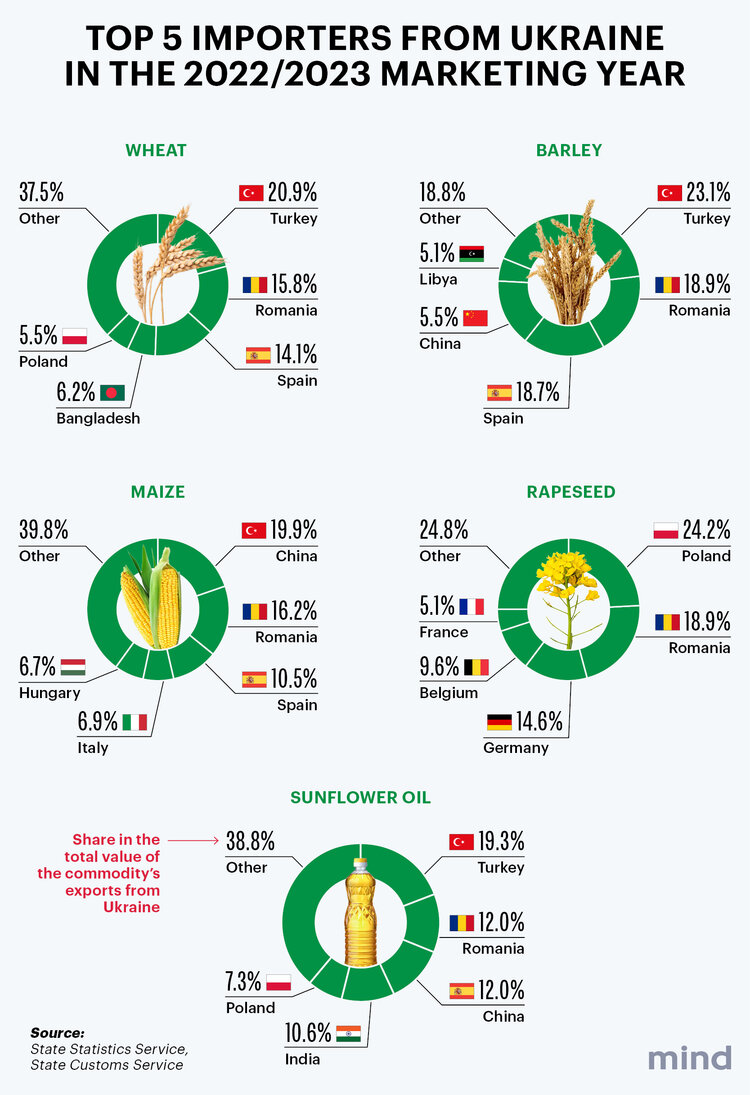

How has the agricultural export vector changed (if it has)? Prior to the full-scale invasion, Ukrainian agricultural exports were focused on Asian countries, particularly China, which accounted for 30% of the agricultural export structure. This was a significant figure considering the substantial monetary and commodity volumes of Ukrainian agricultural trade. Some analysts interpreted the purchasing activity of the previous season as China preparing for a European war, which would inevitably lead to an increase in food prices. As we can see, they were completely correct, and on February 24, 2022, China met historical-record levels of food reserves.

Everything changed after the blockade of the Black Sea ports.

In 2022, Asia lost its position as the main importer of Ukrainian agricultural products for the first time in over 10 years and moved to second place. In terms of monetary value, exports to countries in this region amounted to $7.3 billion last year.

As expected, collective Europe and Turkey took the first place on the list of importers of Ukrainian agricultural products.

In 2022, the supply volumes of Ukrainian agricultural products to EU countries increased by 66% compared to 2021 and amounted to $13.1 billion. Moreover, the share of the EU in domestic agricultural exports exceeded half of the total Ukrainian agro-export for the first time, reaching 55.5% last year.

The ratio remained the same at the end of the season.

So, are the accusations that Ukraine primarily supplied grain to wealthy countries rather than Africa justified? No, they are not justified when considering food categories.

For instance, in the list of major wheat buyers, Bangladesh ranks fourth with an import volume of over 1 million tonnes worth $216.012 million. Egypt, Indonesia, and Lebanon are also among the top ten buyers of this crop.

As for barley, Lebanon, Tunisia, and Libya are among the top ten buyers.

However, it is true that technical crops like rapeseed are mainly purchased by European Union countries, but this doesn't harm buyers from African countries in any way.

It is worth noting that according to the forecast by the Food and Agriculture Organisation of the United Nations (FAO), Egypt will become the world's largest wheat importer in the 2023/24 marketing year, purchasing 12 million tonnes compared to 11.2 million tonnes in the previous year. The driving force behind this trade is the decrease in domestic harvest and the growth of the population, for whom bread, the production of which is subsidised, is a staple food item.

Did European farmers protesting against Ukrainian grain have valid reasons for doing so? Yes, but not the ones who protested the loudest.

Polish farmers have been considered the headline makers of agricultural protests in the EU. Starting from the autumn of 2022, they systematically complained about the influx of Ukrainian grain. These complaints were expressed through large-scale protests at the borders and road blockades.

Among the buyers of Ukrainian barley, Poland ranks eighth, and for corn, it ranks seventh.

In terms of imported rye (number one with a purchase volume of 9,000 tonnes), sorghum ranks third (around 7,000 tonnes), buckwheat ranks first (10,000 tonnes), and Poland is also the leader in rapeseed imports with 0.745 million tonnes.

It is worth noting that on May 2, the European Commission announced the introduction of temporary measures regarding the import of wheat, maize, rapeseed, and sunflower from Ukraine to the markets of Poland, Bulgaria, Hungary, Romania, and Slovakia, as well as the payment of compensation to local farmers.

These restrictions were imposed following complaints from some EU countries that the surplus of Ukrainian grain was lowering prices for local agricultural products and affecting farmers' income.

The restrictions were extended until September 15th at the beginning of June.

What about the export of oil categories? Sunflower export has shockingly increased by 268%. In terms of volume, the export amounted to 2.4 million tonnes, compared to approximately 1 million tonnes in the previous season.

The main buyers are Bulgaria, Romania, and Hungary.

Thanks to Ukrainian raw materials, Bulgaria is breaking records in sunflower oil production in the current 2022/23 marketing year. The growth of sunflower import by the country is +28%, with Ukraine's share in sunflower import exceeding 66%. The export of oil from Bulgaria has reached a record mark of 433,000 tons (+59% compared to the same period last year)..

.

What are the forecasts for the 2023/24 marketing year? Grain harvest in 2023 is expected to decrease significantly, even compared to the previous war year. The optimistic estimate is 48 million tonnes, but it is likely to be revised downward. This significantly reduces the resource for export, especially if there is a trend of Ukrainians returning from abroad and the capacity of the domestic market gradually increases.

Furthermore, the Istanbul Agreement that allows grain exports from Black Sea ports is set to expire on July 18th. Most market participants lean towards the belief that it will not be renewed.

This further narrows down logistic possibilities and forces exporting companies to already consider options for transhipment through Danube ports. However, developing this channel within the range of the upcoming season will be challenging to compensate for the lost opportunities of the ports of Greater Odesa..

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]