AI madness: 5 results of the artificial intelligence 'gold rush'

The AI boom is similar to the gold mining boom in the Wild West in 1849. There are only a few miners now, and everyone wants to get rich by selling shovels

The phenomenally successful launch of the chatbot ChatGPT in November 2022 drew increased attention to artificial intelligence. Millions of people, influenced by dreams of a metaverse, fears of job loss, and the syndrome of lost benefits, rushed to search for 'gold' in the AI fields. Their money quickly swelled the budgets of a few AI developers and flowed into the pockets of AI equipment suppliers, AI investors, and tech giants who put the label "AI" on everything that moves.

Mind suggests learning about five takeaways from the AI frenzy occurring in 2023, which analysts liken to the 'gold rush' of the 1840s, as well as to the even bigger boom of the 1990s dot-coms and the mini-bubbles that have recently burst in the cryptocurrency, 3D printing, and medical cannabis markets.

ChatGPT attracted 100 million users and $10 billion from Microsoft

The chatbot ChatGPT was launched in November 2022 and within two months, garnered 100 million active users, becoming the fastest-growing application in history. For comparison: TikTok took 9 months to reach 100 million people, and Instagram took two and a half years.

The significance of the established ChatGPT record was underscored by a historic deal. In January 2023, OpenAI – the developer of this chatbot – received $10 billion from the corporation Microsoft. This catalysed further investments in AI.

"Aside from the bad jokes, bad poetry and clunky LinkedIn-style articles it can churn out, it is being used and abused by students, lawyers, CEOs and programmers. Naturally, investors want to find the companies that will win from what is being talked up as the biggest technological development since the internet. There are two problems. The first is that AI might once again be overhyped. The second is a dearth of places to invest, leading to some extraordinary stock surges," describes the Wall Street Journal the hype in the AI field.

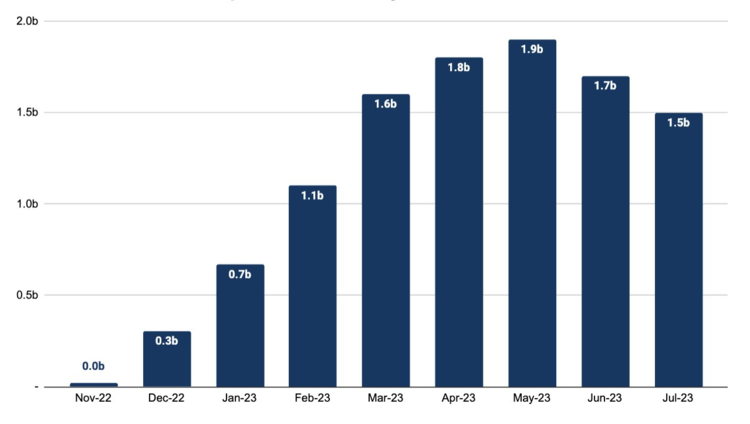

Interest in ChatGPT peaked in May 2023 and started to decline. In June, the number of visits to its website dropped by 9.7%, and in July, it decreased by an additional 9.6%. For an unclear reason, the quality and accuracy of ChatGPT's responses are deteriorating. Researchers suppose that the chatbot is 'going silly' as it's programmed to continuously learn from the information input by users, many of whom are not well-informed.

Dynamics of visits to the ChatGPT website

Loss-making C3.ai increased by 260% in 2023

Artificial intelligence has become a fashionable topic, attracting low-intelligence players in the stock market. This conclusion is drawn by the Wall Street Journal, citing as evidence the fact that C3.ai emerged as the first publicly traded AI company whose shares increased by more than 200%.

Thanks to the abbreviation "ai" (artificial intellect) in its name, the market value of C3.ai exceeded its annual sales by 17 times and continues to rise even after the company reported a loss of $269 million on revenue of $267 million for the financial year ending 30 April.

"C3.ai is a classic for investors who like themes. It is on its fourth iteration, having tried business models in carbon emissions, energy management and the 'internet of things' – each with a company name change – before alighting on AI. Investors focused on growth will love it, as revenues have almost tripled in four years (although its shares plummeted after slightly disappointing forecasts on Wednesday). Investors who care about the business should look at what it’s spending to get those sales: It recorded losses of 36 cents for every dollar of sales in the year to April 2019, before its IPO, but in the past year lost just over $1 for every dollar of sales. At worst they are trying out the old joke in real life, losing money on every sale but trying to make it up in volume. At best, C3.ai’s ability to scale subscriptions into profit is unproven," writes the Wall Street Journal.

The value of C3.ai shares

AI startups received $40 billion in investment in half a year

In the first half of 2023, venture capitalists poured over $40 billion into early-stage AI companies, according to research company PitchBook.

Notably, during this period, investors cooled off significantly towards other startups. Financing for cryptocurrency and Web3 companies, in particular, saw a sharp decline from $16 billion in the first half of 2022 to $3.3 billion in the corresponding period of 2023.

"The bifurcation is huge. There is a general euphoria that, 'wow, generative AI has revolutionary potential.' [As a result], some generative AI startups with no revenue at all can now raise Series A rounds at valuations of around $250 million," quoted PitchBook Sundeep Peechu, a general partner at Felicis Ventures.

Indeed, generous funding and a $200 million valuation from Sequoia fund were received by the AI startup LangChain with minimal sales volume. Meanwhile, the startup Rewind, which managed to accumulate only $700,000 in revenue in a year, was valued at $350 million by the NEA fund.

Compared to 2022, the median pre-money valuation of early-stage AI companies jumped by 16%. However, other startups raising funds in Series A and B rounds, according to PitchBook's calculations, have decreased in value by approximately 24%.

AI startups that raised the most funding in January-July 2023

| Startup | Investment, $bn | Business valuation, $bn | |

| 1 | OpenAI | 11,3 | 29 |

| 2 | Anthropic | 1,5 | 4,1 |

| 3 | Inflection AI | 1,5 | 4 |

| 4 | Tempus | 1,3 | 8,1 |

| 5 | Dataiku | 0,847 | 3,7 |

| 6 | Highspot | 0,644 | 3,5 |

| 7 | AlphaSense | 0,620 | 2,5 |

| 8 | Shield AI | 0,573 | 2,4 |

| 9 | Builder.ai | 0,450 | 2 |

| 10 | Cohere | 0,445 | 2,1 |

Source: Insider Monkey

'The shovel salesman' NVIDIA grows to $1 trillion

It's been long noted that 'gold rushes' only guarantee solid profits for shovel salesmen. Learning that the AI 'shovels' are the scarce H100 and A100 graphical processors produced by NVIDIA, investors rushed to buy its shares. From October to June, the corporation's value increased by 200%, reaching $1 trillion, landing it in the top 5 most valuable tech companies. Currently, this top 5 list looks as follows:

- Apple – $2.78 trillion;

- Microsoft – $2.4 trillion;

- Alphabet – $1.64 trillion;

- Amazon – $1.43 trillion;

- NVIDIA – $1.05 trillion.

"How absurd [is this]? NVIDIA is now trading at 37 times its revenue (P/S) and 202 times its earnings (P/E). Read that again – this is not any small-cap upstart. It’s the 4th largest company in the S&P 500 generating more than $5 billion in earnings and is now trading at 200 times its earnings. For context, the stock price must stay the same and then the company has to 6x its earnings just for it to trade at the same P/E as Apple," states the Market Sentiment.

A similar growth was observed by analysts in 2000 when Cisco's shares – a provider of essential services for dot-coms – soared to a value of $0.5 trillion, making it the most valuable company in the world. Investors were convinced that this 'shovel salesman' was changing the world and valued the company at 200 times its profit.

However, by 2002, Cisco's shares had plummeted by 80%, and even after 20 years, they still cost 40% less than during the dot-com bubble. Over those 20 years, Cisco increased its revenue sevenfold and earned $12 billion in profit in 2022. But those investors who bought Cisco's shares in 2000 still won't be able to sell them without a loss for quite a while.

50 AI investors enriched by almost $1 trillion

In January-June 2023, AI investors became $3 trillion richer, Investor's Business Daily reports. The top 50 most successful investors earned $927.6 billion on AI companies' stocks.

Among the list of winners is Oracle's founder Larry Ellison, who invested in AI companies at their inception. His portfolio increased by $41 billion in 2023, reaching $134.7 billion, and Oracle's stocks appreciated by 43%.

Mark Zuckerberg earned even more – $55.4 billion. His company, Meta, had been investing resources in artificial intelligence developers for a decade. The AI stock portfolio assembled by Zuckerberg inflated Meta's market value by 132% in 2023.

"Don't feel too bad if you didn't found an AI company or invest in one early. Odds are if you're invested in S&P 500 ETFs that own AI stocks, you're taking part too," quips Investor's Business Daily.

Five exchange-traded funds have captured a lion's share of the AI market's harvest. Vanguard alone earned $242 billion in revenue from investments in stocks of companies like NVIDIA, Super Micro Computer, and ServiceNow in 2023. Its closest competitors, BlackRock and State Street Global Advisors, made $206.9 billion and $94.8 billion respectively from AI investments.

Winners among buyers of AI companies' shares

| AI investor | Share growth this year ($bn) | |

| 1 | Vanguard Group (many investors) | 242,9 |

| 2 | BlackRock (many investors) | 206,9 |

| 3 | State Street Global Advisors (many investors) | 94,8 |

| 4 | Fidelity (many investors) | 76,0 |

| 5 | Capital Research and Management (many investors) | 60,8 |

| 6 | Meta (Mark Zuckerberg) | 55,4 |

| 7 | Amazon (Jeff Bezos) | 43,5 |

| 8 | Oracle (Larry Ellison) | 41,0 |

| 9 | Alphabet (Larry Page) | 23,5 |

| 10 | NVIDIA (Jensen Huang) | 22,4 |

Source: investors.com

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]