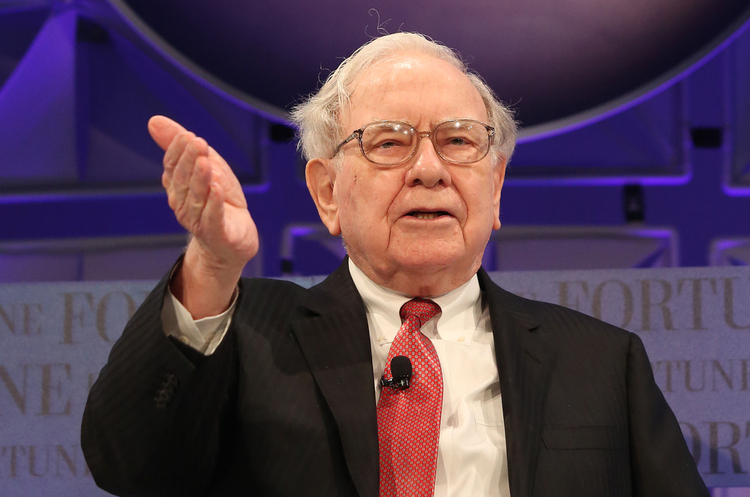

Berkshire hits record profits, but Buffett complains about lack of deals worth investing in

The famous investor believes that net profit is not the right indicator of performance, rather the opposite

Berkshire Hathaway Inc. Warren Buffett's company announced that its cash has reached a new record, while the legendary billionaire investor condemned the lack of significant deals that would enable his company to achieve "stunning performance".

Source. This was reported by Bloomberg.

Berkshire's cash reserves jumped to a record $167.6 billion in the fourth quarter of 2023 as the conglomerate struggled to find deals at attractive valuations.

The company also reported a fourth-quarter operating profit of $8.48 billion, up from $6.63 billion in the same period a year earlier, thanks to higher insurance and investment income amid higher interest rates.

"There are only a handful of companies left in this country that Berkshire can truly be interested in," Buffett, 93, said in his annual letter to shareholders,

which the company released along with its results on Saturday.

"There are essentially no candidates outside of the United States that are meaningful options for deploying capital into Berkshire. In general, we have no chance of impressive performance," he said.

Buffett recently concluded an $11.6bn deal to buy Alleghany Corp. and acquired shares in Occidental Petroleum Corp. an investment that he said he plans to hold "indefinitely" but does not plan to buy the company.

The investor also increased Berkshire's stake in five Japanese trading houses last year after their profits rose sharply, a move that fuelled their share price gains. It is noted that Berkshire's unrealised profit from these investments at the end of the year was $8 billion, or 61%.

The previous maximum of the company's net profit was recorded in 2021, when it reached almost $90 billion. However, Buffett considers net income to be a misleading measure of performance, as it includes gains and losses from holding shares such as Apple and Bank of America, regardless of what Berkshire buys or sells.

Last year, the company also bought back its own shares worth $9.2bn.

Berkshire Hathaway Group controls dozens of subsidiaries operating in various industries. It also owns significant stakes in a number of well-known companies, including the world's largest soft drink producer Coca-Cola and technology company Apple.

In his letter to shareholders, Buffett mentioned his "right-hand man" Charlie Munger, who died last year at the age of 99. According to Buffett, Munger was the architect of the company, and the American billionaire called himself a "general contractor" who implemented his partner's plan in his daily work.

Background. As reported, Warren Buffett's family spent $500 million to help Ukraine. Howard Buffett, one of Warren Buffett's three children, believes that it is impossible to reach an agreement in which Putin would keep his word.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]