Exchange rate is below 38 UAH/$ by summer. Why the hryvnia’s been still strengthening

And when the NBU can consider switching to a floating rate

The cash exchange rate since the end of April has settled in the range of 37.3-38 UAH/$. Stabilisation took place right after the meeting of the National Bank's Board on 27 April. Although in fact, no significant decisions were made by the NBU management. The regulator maintained the bank discount rate at 25% and left the monetary policy model unchanged, which is aimed at tying liquidity in the banking system and increasing the attractiveness of hryvnia instruments. At the same time, the National Bank once again gave the market a signal that it had not abandoned its intention to lift currency restrictions.

Experts believe that the market is entering a period of calm. The NBU has already managed to reduce the demand for currency and balance the demand with the supply. And, since the currency realisation will be very gentle and gradual, sharp exchange rate spikes in the next two to three months are unlikely.

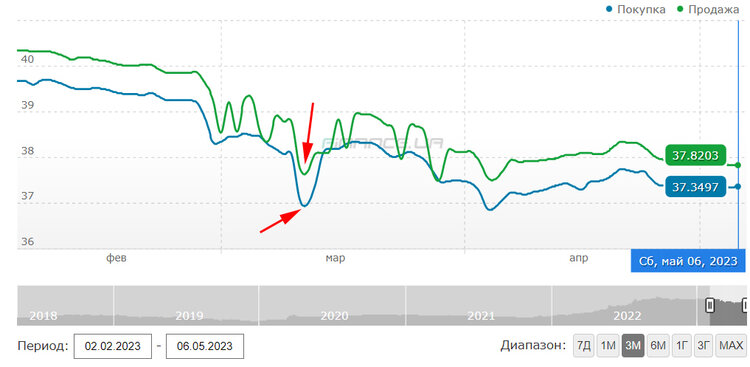

How was the cash exchange rate changing? The strengthening of the national currency began in late February. First, the rate dropped below 40 UAH/$, and in March it fell below 39 UAH/$. In April, the rate crossed another psychological barrier and strengthened below the 38 UAH/$ mark. On some days, the cash market was very close to the official rate of the National Bank – 36.6 UAH/$.

Change in cash exchange rate UAH/USD, February – May'23

Blue – sales, green – purchases. Source: data from finance.ua

Why is this happening? There is no miracle here. Substantial amounts of currency from depositors who opened conversion deposits in banks began to enter the cash market. As a reminder: these are deposits with a term of at least three months without the right to early termination, which allow individuals to buy non-cash dollars or euros.

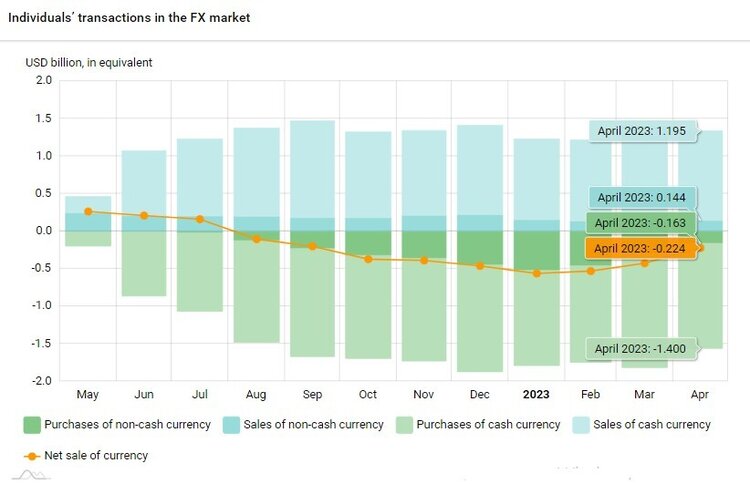

Since the beginning of 2023, the volume of cash currency sales to the population has been maintained at $1–1.2 billion per month. At the same time, the purchase of cash currency amounts to $1.2–1.4 billion. And the difference between the volumes of buying and selling (negative balance) gradually decreases. In other words, the cash market is levelling out.

Source: data from NBU

How does the updated monetary policy affect the currency market? On 7 April, the National Bank changed the conditions for certificates of deposit for banks, prompting them to raise interest rates for deposits in the national currency. This, in turn, allowed to partially switch the population's interest from dollars to hryvnia.

The NBU has lowered the rate for overnight certificates from 23% to 20% per annum and introduced new three-month CDs at a fixed rate at the level of the discount rate (25% per annum). However, banks can only purchase the second type of certificates in limited quantities and only those who actively increase their retail deposit portfolio with a term of at least three months.

"Keeping the discount rate at 25%, introducing additional instruments to protect citizens' savings from inflationary depreciation, and measures to activate competition among banks for term deposits have contributed to strengthening exchange rate stability," NBU Governor Andriy Pyshny assures.

Read also: A new reason for deposit rates to rise: NBU announces changes to bank reserve requirements

It is still too early, however, to judge how much the portfolio of term retail deposits will increase in banks. At the time of publication, the NBU had not released statistics for banking in April.

But overall, the volume of population funds in banks is growing – from 1 January to 1 April 2023, the increase is 1.2%, amounting to 945 billion UAH. In addition, from 7 April to 7 May, the profitability of deposits with a term of 6-12 months increased on average by 0.7–0.9 percentage points, reaching 13.2–15% per annum (according to the UIRD index). Some banks even offer depositors up to 18–20% per annum, which becomes an argument in favour of hryvnia deposits rather than dollars or euros.

What is happening in the non-cash market? The situation in the interbank market is even more tightly controlled by the NBU. More precisely, its influence is felt to a greater extent there, as the non-cash segment of the currency market directly depends on the interventions of the National Bank.

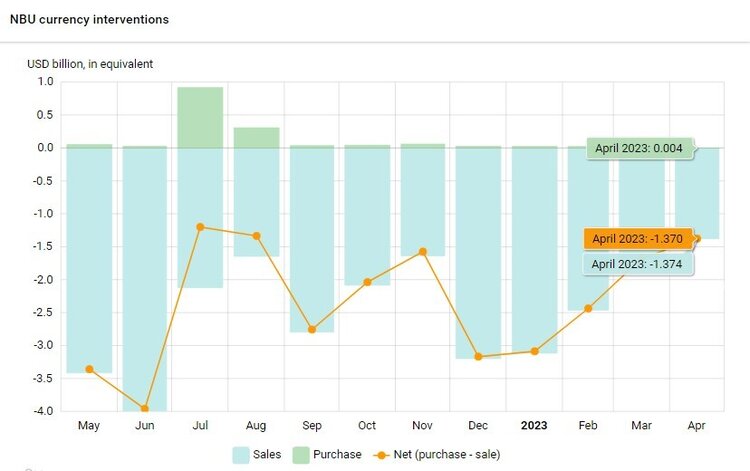

But an interesting trend can be observed here as well: the interbank market is moving towards balance. While the NBU spent about $3.2 billion to support the non-cash rate in December 2022 and January 2023, the volume of interventions had decreased almost 2.3 times by April – to $1.4 billion.

Source: NBU data

According to data on interbank operations, for April and the first week of May, the average daily volume of foreign currency sales was $180 million, while purchases amounted to $208 million. Thus, the negative balance was around $30 million. For comparison: in January (when, let us recall, the NBU spent $3.2 billion on interventions), the average daily currency sales in the interbank market amounted to $157 million, and purchases to $216 million. Accordingly, the negative balance was about $50 million.

There is no shortage of sellers in the interbank market. The sowing season is in full swing, and agricultural producers need funds for its financing. As clarified by the former head of the NBU Board, Bogdan Danylyshyn, by the end of April, only 1 million hectares had been sown, which is about 5% of the forecasted area of grain and industrial crops for the 2023 harvest on the territory controlled by Ukraine.

At the same time, pressure from importers on the interbank market has become slightly lower. This is mainly due to the reduced supply of energy products following the stabilisation of the electricity supply situation. In March, energy imports decreased by 14.5% compared to February.

However, the issue of blocking agricultural exports by some European Union countries remains unresolved. "After reaching agreements between Ukrainian and Polish officials and developing a system of measures to prevent unloading (of Ukrainian products – Mind) within the country, on the night of April 21, Poland allowed the transit of agricultural products from Ukraine," explained Bogdan Danylyshyn.

But the EU is seriously discussing the possibility of imposing an embargo on the supply of wheat, corn, rapeseed, and sunflower to five member states. This will undoubtedly affect the inflow of foreign exchange earnings in Ukraine and negatively impact the interbank market. For example, Deputy Minister of Economy Taras Kachka stated that Ukraine had already lost $143 million due to the ban by Poland. This is almost 4% of the monthly export.

What are the forecasts for the exchange rate by summer? Are serious shocks in the foreign exchange market possible in the coming months? Unlikely. There are risks (more on those below), but the NBU has enough levers to extinguish any panic moods.

"I think the cash exchange rate has already reached the limit of strengthening, and it will remain close to the mark of 37.5 UAH/$. There is enough currency supply, and the National Bank is trying in every way to redirect the population's demand to hryvnia instruments, which relieves pressure on the exchange rate," says Grygoriy Kukuruza, an economist at Ukraine Economic Outlook.

Moreover, after individual banks exhausted their limits on selling cash currency, the NBU increased the norms. From April 21, when calculating the volume of cash foreign currency that a bank can sell in the foreign exchange market, not 100% but 120% of the volume of non-cash currency purchases from the population, starting from April 13, 2022, will be taken into account.

According to Ukraine Economic Outlook estimates, the total limit in the system for banks to sell cash currency is $2.76 billion. From July 2022 to March 2023, net sales of cash currency by banks reached $1.7 billion in total. Accordingly, the current limits allow banks to maintain an adequate supply of cash currency to support the exchange rate.

There remains uncertainty in the interbank market related to revenues from agro-exports. In addition, the continuation of the "grain deal", which expires on May 18, is also in question. However, even in such an unfavourable scenario, the NBU has a reserve for interventions.

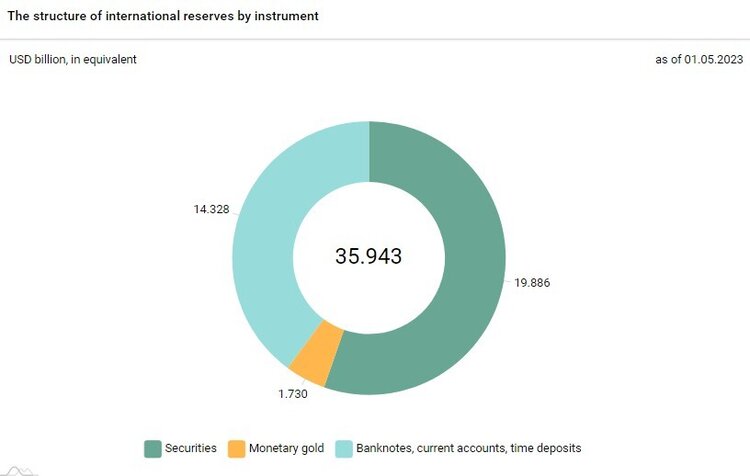

Just a few days ago, the regulator reported that international reserves as of May 1 amounted to $35.9 billion, which became a record for the last 11 years. Such growth in international reserves is associated with the inflow of financial assistance from abroad and the inflow of money from the placement of foreign currency domestic government bonds. In April alone, more than $5.8 billion was received into the NBU accounts.

Source: NBU data

Macroeconomic expectations are generally improving. In view of the rapid recovery of the energy system and soft fiscal policy, the NBU has raised its GDP growth forecast for 2023 from 0.3% to 2% and revised its inflation forecast for 2023 from 18.7% to 14.8%.

The NBU has not yet clearly stated its plans for transitioning to a free exchange rate. Mr. Pyshny himself warned that the transition to currency liberalisation "is not a matter of the immediate future." Therefore, it is unlikely to happen this summer or even this autumn.

Read also: Returning to free float: The NBU is gradually preparing to relax currency restrictions. How and when is it going to happen?

“The NBU makes it clear that it is not yet time for a floating exchange rate. Therefore, the market will experience calm and stability in the coming months. There remains the question of what to do with the liquidity surplus in the banking system, reaching UAH 520 billion. Most likely, considering the effectiveness of the updated monetary policy, the National Bank will decide how to "tie up" this money so that it does not spill into the foreign exchange market," summarises Grygoriy Kukuruza.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]