Returning to free float: The NBU is gradually preparing to relax currency restrictions. How and when is it going to happen?

And why bank depositors would benefit from it

On 17 March 2023, the Board of the National Bank of Ukraine held a regular meeting to discuss monetary policy, foreign exchange market stability, and the macroeconomic situation in general. The regulator did not make any landmark decisions this time. The NBU did not touch the key policy rate, did not revise the official hryvnia exchange rate, and did not dare to liberalise the FX market. At the same time, the NBU board announced a plan to further tie up bank liquidity, which will help curb devaluation and become an important prerequisite for easing currency restrictions.

Mind explored what the NBU intends to do to ensure exchange rate stability and why banks will have to increase the attractiveness of hryvnia deposits for the public.

Discount rate. The NBU Board did not change the discount rate, which remains at 25%. As a reminder, this level of the key policy rate has been in place since 3 June 2022.

The NBU remains of the view that the discount rate performs its function in the current macroeconomic environment, and there are no substantial reasons to revise it at this time.

Inflation rates. The NBU notes that there is a clear "disinflationary trend". In particular, the growth rate of consumer prices is slowing down: in February, inflation was 24.9% year-on-year. In January, for comparison, this figure was 26.6%.

When speaking at a briefing held by the NBU following the board meeting, NBU Governor Andriy Pyshny said that the slowdown in inflation was due to an increase in the supply of food and fuel, the recovery of the energy system after the attacks, weak consumer demand, and fixed utility tariffs.

"The complete cessation of emission financing of the budget since the beginning of the year also had a positive impact. Inflation will continue to decline, in particular due to the NBU's measures," Pyshny said.

Budget deficit and its financing. Continuing with the issues related to the emission, Andriy Pyshny said that the NBU does not intend to return to the "printing press". According to the head of the National Bank, the issue will be replaced by:

- a revitalised domestic borrowing market, primarily due to the liquidity available to banks;

- an inflow of international funding and assistance. Moreover, the amount of aid should be even higher than the projected $38 billion.

"I see opportunities to increase the presence of banks in the domestic debt market. Since the beginning of the year, the Ministry of Finance has already raised UAH 115 billion on the domestic market. In 2022, it was UAH 164 billion. Additionally, the NBU, the Ministry of Finance, and the government are working to ensure that the share of grants in international aid is as significant as possible," Pyshny explained.

Domestic government bonds in circulation

Source: NBU data

A new loan from the IMF. Pyshny said that he and other NBU representatives had just completed another round of talks with the IMF mission in Warsaw, Poland. However, the head of the National Bank did not give details of the outcome of the talks with the IMF. He only assured that great progress had been made in the negotiations and promised that there should be "good news at the beginning of next week (20 March – Mind)."

Little is known about the future of the loan. Most likely, there will be a new four-year cooperation programme, which provides for the allocation of funding in the amount of $15.6 billion. This was reported by the Financial Times on 16 March.

New monetary policy "design". The NBU Board paid the most attention to this area. The starting point will be 7 April. That's when the NBU intends to take new steps to unwind bank liquidity, or, as it is commonly called, to "tie it up".

Mind wrote that for the sake of exchange rate stability, the NBU will continue to redirect the free hryvnia that is "drifting" in the banking system into term instruments. In fact, this will happen in early April.

The revised monetary policy has two main areas of focus.

First, banks will be offered a three-month certificate of deposit with a yield equal to the discount rate (25%). However, the ability to place funds in such certificates will depend on the size of the banks' portfolios of hryvnia retail deposits with an initial maturity of three months or more and the success of building up such portfolios. "We will limit the amount of investments in this certificate," warned NBU Deputy Governor Sergiy Nikolaichuk.

Second, the rate on the overnight deposit certificate will be reduced to 20% from the current 23%.

In addition, from 11 May on, the preferential mandatory reserves of banks for term deposits on the accounts of individuals will apply only to deposits with an initial maturity of three months or more.

The NBU expects that banks will improve deposit terms for households in return for the possibility of investing their money in the profitable certificates offered by the NBU.

"We intend to persuade banks that they must treat the amount of liquidity they have received due to non-market circumstances responsibly. And they must make an adequate offer to their depositors," said Andriy Pyshny.

Accordingly, in April-May, the yield on deposits with a maturity of 6-12 months is expected to increase. According to the Ukrainian Index of Retail Deposit Rates (UIRD), the average yield on hryvnia deposits has increased by 0.14-0.3 pp since the beginning of March, depending on the term of placement.

Ukrainian Index of Retail Deposit Rates (UIRD)

| Date | 3 months | 6 months | 9 months | 12 months |

| 01.03 | 11.86 | 12.75 | 11.93 | 13.33 |

| 02.03 | 11.86 | 12.75 | 11.93 | 13.33 |

| 03.03 | 12.00 | 12.86 | 11.93 | 13.44 |

| 06.03 | 12.00 | 12.86 | 11.93 | 13.44 |

| 07.03 | 11.77 | 13.23 | 12.85 | 13.9 |

| 08.03 | 12.31 | 13.04 | 12.85 | 13.9 |

| 09.03 | 12.31 | 13.23 | 11.93 | 13.82 |

| 10.03 | 12.00 | 12.93 | 11.93 | 13.55 |

| 13.03 | 11.98 | 12.81 | 11.61 | 13.54 |

| 14.03 | 12.00 | 13.11 | 12.37 | 13.8 |

| 15.03 | 11.92 | 12.96 | 12.37 | 13.63 |

| 16.03 | 12.00 | 12.92 | 11.85 | 13.63 |

Source: NBU data

The NBU's future plans. Why is the NBU taking all these measures at all?

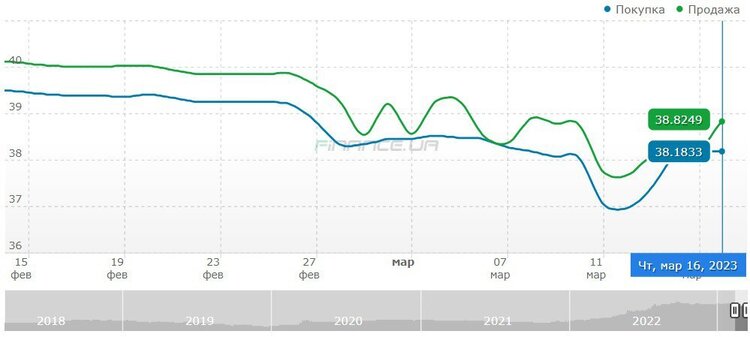

On the one hand, the NBU wants to maintain exchange rate stability and ensure that the cash and non-cash hryvnia exchange rates converge. By the way, after a two-week strengthening, the national currency weakened slightly and by 17 March its exchange rate was in the range of UAH 38.2-38.8 per dollar.

Cash dollar exchange rate

Green – selling, Blue – purchase. Source: finance.ua data

Tying up bank liquidity will help minimise the risk of hryvnia flowing into the foreign exchange market, which in turn will also contribute to exchange rate stability. At the same time, the NBU retains deposits intended for the purchase of non-cash foreign currency by individuals, which helps the regulator to curb demand for the dollar.

"We see the effectiveness of this instrument. About $1.3 billion has been accumulated on three-month deposits for the purchase of foreign currency, and about $160 million on deposits for the purchase of foreign currency at the official exchange rate," said Yuriy Geletiy, Deputy Governor of the NBU, during a briefing.

By the way, another "side effect" of all these measures, expected by the NBU, is a further slowdown in inflation.

On the other hand, the NBU wants to prepare the background for lifting currency restrictions. "We need to move to a strategy that involves returning to the practice of market-based regulation. This means reducing administrative influence (on the foreign exchange market – Mind), returning the parameters of currency liberalisation. But first, we need to create the preconditions for this," explained Andriy Pyshny.

The logic of the NBU's actions is clear. It is necessary to use the "mismanaged" liquidity of banks and to interest the population in profitable deposits. This will remove risks for the exchange rate. And only then can the restrictions be gradually lifted.

But we should not forget that, apart from this, the main risk remains – the war risk. And no one can predict when exactly the level of its impact will decrease. That is why the NBU does not make any specific promises about the timing of currency liberalisation. According to Pyshny, a return to the operational model of monetary policy that was in place before the full-scale invasion is possible if "...the financial system and economy are normalised."

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]