Ukraine’s port infrastructure under fire, and the sea blocked: What possibilities are left for agricultural exports in Ukraine?

russia engaged in a battle with humanitarian infrastructure and severely damaged transhipment capacities in Ukrainian ports, as well as effectively resumed the blockade of the sea

For several consecutive days, russia has been attacking Ukraine's port infrastructure, which is involved in grain exports by sea. Judging from Ukrainian companies urgently evacuating their employees from port facilities, it is presumed that the attacks will continue soon.

At this point, up to 40% of the infrastructure of the port of Chornomorsk has been damaged, with the oil and grain terminals being targeted. Assets of companies such as Kernel, Viterra, CMA CGM Group, grain shipments, and onshore agricultural facilities have been affected. During the night of July 24, hostile drones turned their attention to the infrastructure of the Danube ports. According to the Operational Command South, in the vicinity of the port of Reni, a grain warehouse was destroyed, reservoirs for storing other types of cargo were damaged, and a fire broke out in one of the production buildings.

As a reminder, on July 18, russia officially denied the extension of the 'grain deal'. The russian ministry of defence warned that from July 20, all ships heading to Ukrainian ports in the Black Sea would be considered carriers of military cargo, making them potential targets for attack.

Also, parts of the northwestern and southeastern regions of the international waters of the Black Sea have been declared temporarily hazardous for navigation.

The Ukrainian authorities believe that russia will not dare to attack ships; however, given the circumstances, it's unlikely that anyone will risk verifying the validity of this optimism anytime soon.

In response, the Ministry of Defence of Ukraine issued a warning stating that from 00:00 on July 21, 2023, all vessels in the Black Sea's waters heading towards the seaports of russia and Ukrainian seaports located in the temporarily occupied territory of Ukraine by russia may be considered by Ukraine as transporting military cargo.

Furthermore, shipping in the areas of the north-eastern part of the Black Sea and the Kerch Strait has been prohibited by Ukraine as hazardous from 05:00 on July 20, 2023. The relevant navigation information for mariners has already been published. Consequently, russia is also unable to bring in ships, including oil tankers, which traditionally follow the Novorossiysk-Dardanelles route.

Mind disscted the options available to Ukraine for grain exports.

Have the losses from the destruction in the ports been calculated yet, and how long will it take for the restoration? The total amount of losses is being accumulated. As the attacks are ongoing, the current scale of the damages is not yet final.

"The company’s transfer silo complexes, as well as the stored grain in the port of Chornomorsk, were significantly damaged. Initial estimates indicate that it will take a considerable amount of time to restore the assets to working condition," stated Kernel's message on the Warsaw Stock Exchange. The shares of the agricultural holding plummeted on the following day after the attack on July 18th, from 13.53 PLN to 12.34 PLN. For a while, they managed to recover from the drop, but ultimately, shares were traded around 12.7–12.9 PLN, approximately 5% lower than the opening price.

Given the assumption that ships will still risk entering the ports, is loading without terminals possible? Yes.

There are mobile terminal solutions that allow loading grain without a fixed structure. This format takes more time, but due to its mobility, it is virtually immune to missile attacks.

On what terms can russia conclude 'grain deal 2.0'? vladimir putin stated that he would consider the possibility of returning to the agreement if all its conditions are met:

- lifting sanctions on the supply of russian grain and fertilisers to the global markets;

- reconnecting banks to SWIFT;

- abandoning all trade restrictions;

- resuming the supply of spare parts for agricultural machinery;

- resolving the issue concerning the freight and insurance of russian vessels.

Additionally, russia wants the Togliatti-Odesa ammonia pipeline to resume operations and the "russian assets associated with agriculture" to be unblocked.

"In case all these conditions are met, we will immediately return to this agreement," reassures putin.

Are these conditions feasible? In full scope – absolutely not.

It remains to be presumed that the list was declared in an expanded format from the very beginning, in order to leave room for negotiations and the possibility of reaching a compromise. The most likely action that the USA and EU might take is the reconnection of russian banks to SWIFT.

The talks between Recep Tayyip Erdoğan and putin during the latter's visit to Turkey in August will be indicative.

Is the 'grain deal' beneficial for russia economically? No. Ukrainian and russian grain have always been direct competitors, so eliminating Ukrainian goods from the global market benefits russia even apart from the war. Additionally, reducing the supply will stimulate an increase in global prices, which is also favourable for sellers.

putin indirectly acknowledged this, stating that the 'grain deal' caused direct losses to russian farmers amounting to $1.2 billion.

In the Kernel's view, further attacks on Ukrainian ports, increased risks at production complexes, and the inability to export grain by sea routes will lead to a 30–40% price increase for corn and wheat in the short term. There is also a risk of certain Ukrainian oilseed processing plants shutting down and a reduction in sunflower and rapeseed processing by over 30%. This will significantly impact global oil prices, leading to a further 20–25% increase.

Despite the sanctions, in the 2022/2023 marketing year, russia achieved record grain exports of 60 million tonnes, some of which were stolen from Ukraine. The forecast for grain exports from russia for the current season is over 55 million tonnes, making competitors irrelevant.

It is also crucial to understand that the Black Sea Grain Initiative is practically the only legitimate topic for russia's official negotiations with the West; therefore, this card will be played to the maximum.

Why did russia initially agree to the 'grain deal'? A year ago, the deal was made under the pressure of the global community due to a real threat of famine in African countries that couldn't afford grain at peak prices. russia also likely counted on the easing of sanctions, which was promised by the UN but didn't happen. Additionally, the influence of Recep Tayyip Erdoğan was a significant factor – actually, only it remains relevant today.

The price factor and famine can no longer be used as arguments – the markets take into account the Ukrainian aspect, and global grain prices have been decreasing for almost a year. In June 2023, the average value of the FAO Food Price Index was 122.3 points, which is 1.7 points (1.4%) lower than in May and a substantial 37.4 points (23.4%) lower than the peak levels reached in March 2022.

Everything can change within the next two months when the prospects of harvests in major producing countries and China become clear.

What are the risks of shipping in the Black Sea? The US authorities warn that russia might escalate its attacks and target civilian vessels in the Black Sea, apart from Ukraine's grain infrastructure.

The White House representative Adam Hodge says that information available to American officials indicates that russia has placed additional naval mines near Ukrainian ports. "We believe that this is a coordinated effort to justify any attacks against civilian ships in the Black Sea and lay blame on Ukraine for these attacks," he said.

British intelligence also believes that after russia's withdrawal from the 'grain deal', the russian Black Sea fleet will actively participate in disrupting all trading operations.

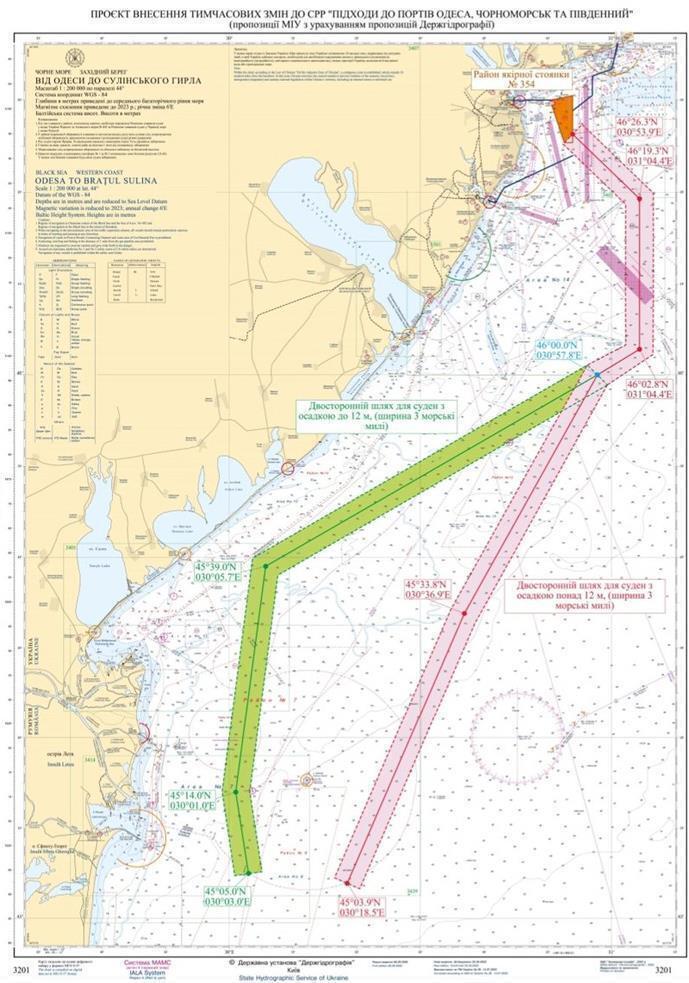

Is there a possibility of exporting from Ukrainian ports to the Black Sea? In theory, yes. Ukraine is establishing a temporarily recommended navigational route to support the export of agri-food products.

A project of temporarily recommended navigational route to Odesa, Chornomorsk, and Pivdenny ports.

This is mentioned in an official letter of Kyiv to the International Maritime Organisation.

"Its purpose is to facilitate the unblocking of international shipping in the northwestern part of the Black Sea," explained Vasyl Shkurakov, the Acting Minister for Communities, Territories, and Infrastructure Development of Ukraine, in the letter.

It is noted that this route will lead to the territorial waters and exclusive economic zone of Romania. To make it operational, the support of the Armed Forces of Ukraine is required.

As per the Strategic Communications Directorate of the General Staff of the Armed Forces of Ukraine, despite russia's withdrawal from the grain export agreement through the ports of Odesa, Ukraine is willing to chart its economic course with the political consent of partner countries, including Turkey, and the trust of insurers.

According to President Volodymyr Zelensky, Ukraine is exploring the possibility of a secure operation of a 'grain corridor', including potential convoy escorts.

The assumption that the clever and wise President of Turkey would engage in direct conflict and use his own ships to defend Ukrainian grain after a year and a half of full-scale war sounds rather implausible. A much more likely scenario involves negotiations and diplomatic efforts.

Are there any possibilities to use the ports in Mykolaiv? No, the situation there is even more complicated.

One of the largest strikes on the Nika-Tera port was carried out by the russians on June 4, 2022. As a result, three warehouses with a total area of 13,349 square metres and a total storage capacity of 105,000 tonnes for grains, oilseeds, and their processed products were completely destroyed.

The restoration works of the Nika-Tera port are currently not underway, as Mykolaiv is constantly under attack, and the port is completely closed for ships.

So, does overland export remain the primary channel for selling agricultural products? No. The most active overland export cannot replace the sea, although it may seem possible 'on paper'.

"This season, our export potential due to lower harvests in 2022 and 2023 will be significantly lower – around 43–47 million tonnes or 3.6–3.9 million tonnes per month. In the best months of the previous season, we could export almost 3.7 million tonnes without the 'grain corridor'. Therefore, assuming that we can reach an agreement with our western neighbours to resume the transit of our agricultural products and if we slightly expand our export capabilities, we can easily export this year's harvest without this 'corridor,'" believes Oleksandr Parashchiy, Head of Research at Concorde Capital.

But grain logistics do not work so straightforwardly. There are seasonal peaks that automatically create huge queues at checkpoints. Additionally, this logistics is significantly more expensive. So, thoughts like "maritime export is not that necessary" can be categorised as "green grapes".

Maritime export is crucial, primarily for sending abroad oils, which are currently the most profitable positions among all agricultural products.

But can exports be carried out through western borders? The possibility of unrestricted transit raises doubts.

Five Central European members of the European Union – Bulgaria, Hungary, Poland, Romania, and Slovakia – have jointly appealed to the EU to extend the ban on the import of Ukrainian grain after 15th September, at least until the end of the current year.

"Together with the agriculture ministers of the frontline countries, we have signed a position in which we want the ban on grain imports to last at least until the end of this year. We will defend this position jointly," commented Robert Telus, the Minister of Agriculture of the Republic of Poland.

He mentioned that grain transit from Ukraine increased from 114,000 tonnes in February to 260,000 tonnes in June. "Therefore, the EU's decision to open the borders from 15th September is essentially unjustified," Telus added. Poland, in the meantime, exported about 4.5 million tonnes of grain over the past months and officially got rid of the surplus of the product.

Poland's Prime Minister Mateusz Morawiecki, who was present at the meeting of representatives from the five countries, categorically opposed the border opening. "According to the EU's decision, we have to open the borders on 15th September. We do not agree with this. We are ready to work on a joint solution. Whether we arrive at a satisfactory solution or we close the border," he said.

What is the likelihood that the restrictions on Ukrainian grain in the EU will remain? High.

The European Commission has shown weakness, thereby opening Pandora's box: the demands of Eastern European farmers will only increase. The Poles, to reinforce their arguments, are once again starting to block border crossings with Ukraine and are also demanding the introduction of restrictions on other goods, including frozen berries.

What can Ukraine do? According to Yuliya Svyrydenko, Minister of Economic Development and Trade, Ukraine can implement retaliatory measures to continue restrictions on agro-export to the EU.

"We firmly believe that September 15 is the final critical date. After that, there can be no extension of these restrictions that were imposed on Ukraine," she said.

Yuliya Svyrydenko emphasised that the ban on exporting wheat, barley, rapeseed, and sunflower seeds to the mentioned five countries is "discriminatory by our closest neighbours, especially when Ukraine has an enemy at sea."

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]