The inflationary rally is coming to an end: Why price growth has slowed down globally and in Ukraine

And what inflation forecasts the National Bank of Ukraine gives for 2024-2025

The new financial crisis, as it seems, has not been as devastating as anticipated. The International Monetary Fund (IMF) has raised its forecast for global GDP growth in 2023 to 3%. This is 0.2 percentage points better than in the previous forecast. Similar rates of global economic growth are expected in 2024.

Furthermore, the IMF anticipates a slowdown in the pace of global inflation in 2023 to 6.8%, compared to 8.7% in 2022, and to 5.2% in 2024. "Underlying (core) inflation (not accounting for the impact of administrative and seasonal factors) is projected to decline more gradually," the IMF notes in its report.

The Fund considers the success of central banks in different countries in combating inflation as one of the key drivers that helps 'stimulate' economic activity and address the crisis.

The growth rates of consumer prices in the world's largest economies – the United States, the Eurozone countries, the United Kingdom, and China – have indeed declined. However, even in Ukraine, which is at war, the price situation in 2023 turned out to be much better than expected. And although there are purely internal reasons for this, the level of inflation in our country is influenced by global trends. And so far, they are working in favour of our economy.

Mind has investigated what is happening with prices in the world, and how this affects Ukraine.

What are the inflation rates in the major economies? Over the past few months, many countries with developed economies have experienced a sharp decline in inflation rates.

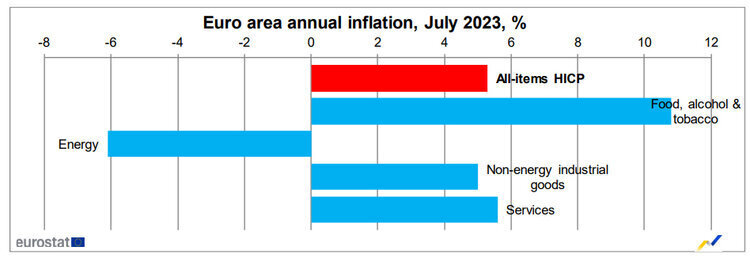

1. In the Eurozone countries, inflation stood at 5.3% in July, which is 0.2 percentage points lower than in June. According to Eurostat, this value became the lowest since the beginning of 2022. The statistical agency of the Eurozone explains this trend with a gradual decrease in energy prices. For instance, in July, they became cheaper by 6.1% (compared to a 5.6% decrease in June). Meanwhile, in the Eurozone countries, food products, tobacco products, and alcohol became more expensive in July (year-on-year) by 10.8%, industrial products increased in price by 5%, and services by 5.6%.

Source: Eurostat data

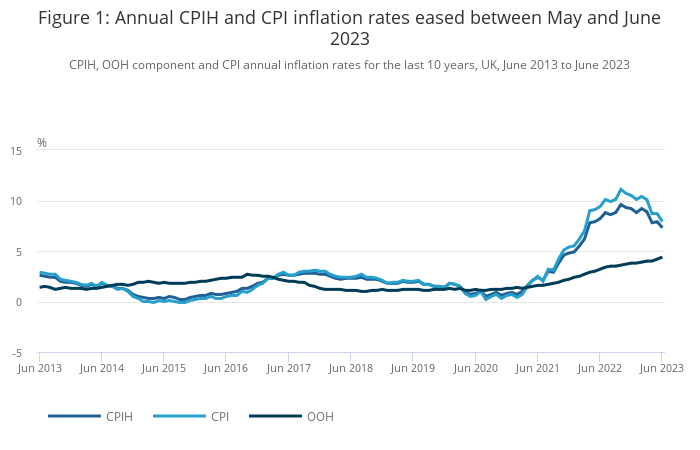

2. In the United Kingdom, inflation in June (data for July has not been released yet) reached 7.9%, compared to 8.7% in May, which, according to the UK's Office for National Statistics (ONS), became the lowest value in a year. The core inflation stood at 6.9%, while in May, it was at 7.1%. Similar to the Eurozone, prices in the UK are slowing their growth due to the decrease in fuel prices (primarily petrol and diesel), which cost 23% less in July compared to the previous year. Meanwhile, both food products and services continue to become more expensive.

Source: ONS data

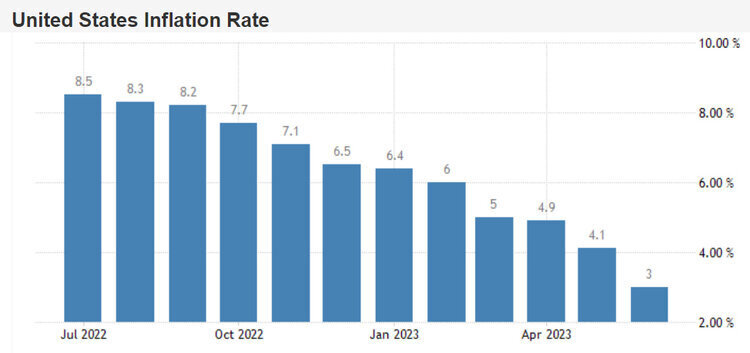

3. According to estimates from the US Bureau of Labour Statistics, inflation in June (data for July has not been released yet) stood at 3% on an annual basis, reaching the lowest point since March 2021. Meanwhile, core inflation slowed down to 4.8% from 5.3% in May and 5.5% in April. Unlike Western Europe, the driver of price growth in the US is fuel, as well as the increase in housing rent costs. By the end of July, for instance, the average cost of petrol in the states exceeded $1 per litre, which became the highest price of 2023.

Source: Tradingeconomics data

4. The inflation situation in China is not ordinary. As reported by the National Bureau of Statistics of China, in June (data for July has not been released yet), consumer prices remained unchanged. This means that inflation was at 0% year-on-year. In May, by the way, prices had increased by just 0.2%. Therefore, June's inflation became the lowest since February 2021, when deflation was observed in China. In June, the most significant price increases in China were observed in fresh vegetables and eggs (+2.3%). However, non-food items decreased in price by 0.7%, and transportation services became cheaper by 6.5%. Core inflation in China stood at 0.4% in June, which is 0.2 percentage points lower than in May.

Source: Tradingeconomics data

Why are inflation rates slowing down worldwide? One of the main reasons for the balancing of the inflation situation is the tightness of central banks' monetary policies, which has resulted in high interest rates. On the one hand, these rates restrain lending, consumption, and economic growth; on the other hand, they curb inflation.

The Federal Reserve System of the United States increased its key policy rate by 0.25 percentage points at the end of July. Its range now stands at 5.25–5.50%. This is the highest rate value since 2007. The cycle of interest rate increases in the United States has been ongoing for about a year. During this time, the Federal Reserve revised the key policy rate 11 times. Moreover, the Federal Reserve's leadership does not rule out that this won't be the last increase.

A similar behavioural model has been adopted by the European Central Bank (ECB) as well. On 2 August, the ECB raised its three key rates (for loans, marginal lending, and deposits) by 25 basis points each, to 4.25%, 4.5%, and 3.75% respectively. Like the Federal Reserve, the ECB does not currently plan to stop. Christine Lagarde, the President of the ECB, stated that it's too early to claim that peak rate levels have been reached, so the ECB will continue with its rate hikes.

On 4 August, the Bank of England also raised its key policy rate for the 14th consecutive time. The current rate level is 5.25%, which is a 15-year-high. The last time this indicator was at a similar level was in the spring of 2008 – during the acceleration of the previous financial crisis.

Central banks clearly point out the correlation between high interest rates and the decrease in inflation rates. For example, the Chairman of the Federal Reserve Jerome Powell expressed satisfaction with the fact that inflation had significantly decreased from the peak levels of 2022. Additionally, the Federal Reserve improved its inflation forecast for the end of 2023 from 3.3% to 3.2%. The ECB believes that its monetary policy significantly contributes to slowing down inflation rates. According to their forecast, prices in the Eurozone will increase by 5.4% in 2023 (compared to 8.6% in 2022).

What else influences inflation? Monetary policy is not a panacea. Slowing down the rise in energy prices has been a significant success for many economies, especially for the European Union and the United Kingdom, which heavily depend on energy production imports. The Bank of England, for example, believes that inflation in the country will continue to decrease, primarily due to the expected slowdown in energy price growth.

In August 2022, the price of a barrel of Brent crude oil on exchanges exceeded $100. By the beginning of August 2023, the oil price was in the range of $85–86 per barrel, which is 15% lower than a year ago. According to the IMF forecast, prices in 2023 are expected to drop by around 21% after increasing by 39% in 2022.

Source: MarketWatch data

The cost of gas on the global market has changed even more dramatically. If in March 2022, the price of natural gas on the TTF hub (Netherlands) reached $3,800 per 1,000 cubic metres, by the end of July 2023, it had plummeted below $300 per 1,000 cubic metres. This led to an excess of gas reserves and a collapse in prices.

However, it's not a reason to be overly pleased. The level of price growth worldwide is still significant. As noted by UN experts in their economic forecast for 2023–2024, inflation remains persistently high in many countries due to disruptions in local supply chains and the high cost of imports.

Central banks acknowledge that they still have a lot of work to do. The target inflation rate in the United States, the Eurozone, and the United Kingdom is 2%. Even with the slowdown in price growth, this indicator will be exceeded two to three times in 2023.

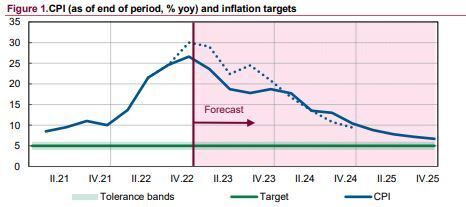

What is happening with prices in Ukraine? In Ukraine, inflation is also surpassing forecasts. For instance, the initial version of the 2023 state budget projected inflation at a level of 30% for the year 2023. In December 2022, the National Bank was predicting inflation of 21% for 2023. The Memorandum between Ukraine and the IMF, published in the spring of 2023, mentioned a figure of 20% for the conclusion of 2023. In May, the NBU revised its inflation forecast for 2023 to 14.8%, and by the end of July, to 10.6%.

According to the State Statistics Service, inflation in Ukraine since the beginning of 2023 has not exceeded the 2% mark (compared to the previous month) even once. In the annual context, the picture is not so rosy. However, a downward trend is still evident: inflation year-on-year was 26% in January and 12.8% in June.

Inflation rate in Ukraine in 2023

| Period | To the previous month, % | To the same month of 2022, % |

| January | 0.8 | 26.0 |

| February | 0.7 | 24.9 |

| March | 1.5 | 21.3 |

| April | 0.2 | 17.9 |

| May | 0.5 | 15.3 |

| June | 0.8 | 12.8 |

Source: State Statistics Service data

Analysing the situation with prices, the NBU states in its inflation report, published on 3 August, that the significant slowdown in the pace of consumer price growth in the first half of 2023 is largely attributed to market saturation of food and fuel, as well as the decrease in global energy prices. In other words, global trends have not bypassed Ukraine either.

Among the internal factors influencing prices, the NBU identifies the adaptation of the Ukrainian economy to wartime conditions, the fixation of tariffs for housing and communal services, and the actions of the National Bank aimed at increasing requirements for mandatory bank reserves and altering the design of monetary policy. These measures have helped balance the foreign exchange market and achieve hryvnia strengthening.

The exchange rate stability, in turn, has led to a slowdown in inflation and an overall improvement in inflation expectations. However, it is worth noting that, unlike other central banks, the NBU has already initiated a cycle of lowering the key policy rate: as of 28 July, it stands at 22%.

What will inflation in Ukraine depend on in 2024-2025? The inflation forecast of the NBU for the upcoming years is quite optimistic. In 2024, consumer inflation will decrease to 8.5%, while core inflation will reach 7%. In 2025, consumer inflation will further slow down to 5% +/- 1 percentage point, which is the upper boundary of the target range, and core inflation will drop to 3%.

Source: NBU data

The NBU specifies that in its calculations, it has taken into account the consequences of the attack on the Kakhovka Dam, the cessation of the operation of the 'grain corridor', and the lowering of military risks until mid-2024.

Furthermore, its assessments consider the following conditions:

- the continued slowdown in the growth rates of global prices (positive factor);

- establishment of new logistics chains and the revival of production (positive factor);

- reintroduction of pre-war fuel taxation (negative factor);

- reduction in the yield of certain types of vegetables and fruits due to the Kakhovka Dam incident (negative factor);

- adjustment of administratively regulated prices and tariffs during the wartime period (negative factor).

In light of this, it can be concluded that while global trends do influence inflation in Ukraine, they are not of decisive importance. Far more crucial factors include the duration of military actions and the speed at which the economy will recover from the inflicted damages.

If the NBU's expectations, which align with the IMF's forecasts, prove true and the military conflict subsides by the summer of 2024, the targeted inflation level of 5% by 2025 is entirely attainable. Otherwise, the situation in the global economy (no matter how positive it might be) won't be able to neutralise the military risks. As a result, the unfavourable scenario described by the IMF for Ukraine would materialise: inflation could rise to 18% in 2024, decrease to 12% in 2025, and only return to the target level of 5% by 2027.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]