The exchange rate in Ukraine is approaching 37 UAH/$. What is the reason for the UAH strengthening and how long will it last?

And what the National Bank does to keep the exchange rate stable

As spring arrives, the hryvnia exchange rate on the cash foreign exchange market falls below 39 UAH/$ for the first time in three months. On 1 March, the national currency was in the range of 38.3–38.5 UAH/$, and in the following days the spread widened slightly, reaching 39.3 UAH/$. However, by 10 March, the hryvnia had strengthened again, and the average purchase rate was close to 38 UAH/$. Some banks even offered UAH 37.7–37.8 per dollar.

In 2023, the foreign exchange market started with a range of UAH 40–40.8 per dollar. Thus, the revaluation at the beginning of March was about 6%. Mind examined the reasons for the hryvnia's appreciation and what the exchange rate will be like in the coming months.

Obvious reasons for the hryvnia's appreciation. When analysing the factors influencing the currency market that lie on the surface, the trend towards revaluation has been in place for a long time. Since the beginning of February, the cash exchange rate has been moving towards UAH 40/$, and in the second half of this month it went below this mark.

Changes in the cash hryvnia to dollar exchange rate in February–March 2023

Green is purchase rate, blue – sale rate. Data by finance.ua

One of the main reasons is the growing supply of cash currency. For example, in February, foreign currency purchase and sale transactions in the cash market almost reached parity.

FX purchase and sale transactions by individuals

Data by the NBU

A large amount of foreign currency enters the market due to the conversion deposits that banks started opening for individuals in July 2022. As a reminder, if a customer wants to purchase non-cash foreign currency (for example, from their card), they must leave the purchased currency on deposit for at least three months.

In December 2022, the public bought $450 million using this instrument, and in January–February 2023, another $930 million. When the deposit expires, the depositor can withdraw the currency in cash, which is most often the case, and it enters the cash market, helping to "bring down" the fever.

"Conversion deposits in the current environment allow us to meet about 50% of the demand in the cash market. When the deposit expires, the client withdraws the dollars and takes them to an exchange office or bank cash desk, thus fuelling the cash market with 'fresh' currency," explains Grygory Kukuruza, economist at Ukraine Economic Outlook.

The cashless market is positively influenced by business. First of all, farmers who are preparing for the new sowing season and are also dumping dollar reserves. At the same time, the demand for foreign currency from importers, on the contrary, has fallen.

"Currently, farmers and small businesses that have earned money from selling the previous harvest are actively selling foreign currency. On the other hand, the demand for foreign currency from retail importers who imported energy equipment has fallen sharply. The market has already been saturated with it," comments financial analyst Andriy Shevchyshyn.

This course of events not only reduced the overall pressure on the exchange rate, but also gave the National Bank a small respite: in February, the NBU spent $2.5 billion on interventions, which is $600 million less than in January and $700 million less than in December 2022.

By the way, the campaign against shadow gambling and cryptocurrency tax avoidance also affects the FX market, as these areas create excessive demand for cash.

The volume of foreign exchange interventions by the NBU

Data by the NBU

Not obvious reasons for the hryvnia's appreciation. The NBU is seriously concerned that there is too much liquidity in the banking system. And it is doing its best to redirect the free hryvnia to instruments that will prevent it from entering the foreign exchange market.

The NBU, for example, has introduced so-called benchmark government bonds for banks. These are government bonds that banks can use to cover up to 50% of their required reserves. At the last auction held by the Ministry of Finance on 7 March, banks bought UAH 15.9 billion worth of such securities.

Benchmark government bonds allow the NBU to unwind funds held in deposit certificates, which in turn makes it possible to avoid emission financing of the state budget. Abandoning the printing press is very important for the NBU and for the government.

The hryvnia in issue is not only a driver of inflation, but also a cause of exchange rate fluctuations in the cash market. This, by the way, was warned about in the summer of 2022 by former NBU Governor Kyrylo Shevchenko. He said that in the first months of the war, the NBU was forced to spend a decent amount of reserves to "sterilise" about 70% of the hryvnia printed.

With regard to households' funds, the NBU's task for the next few months is very simple: to transfer money from current and card accounts to deposit accounts. For example, when looking at the amount of funds held by individuals in banks as of 1 February 2023, UAH 591 billion of the total amount of UAH 929 billion is held in unfixed deposits. The client can withdraw these hryvnias at any time and go buy dollars with them.

Increasing the attractiveness of deposits can be done through enhancing their profitability. Obviously, it is impossible to raise interest rates overnight. However, the NBU is forcing bankers to transfer their reserves from certificates of deposit, which yield 23%, to less profitable government bonds (18.5-19.7% per annum at initial placement) and is tightening reserve requirements at the same time.

As a result, the flow of banks' funds into bonds may indirectly affect the growth of deposit rates. By the way, this growth is indeed happening. According to the Ukrainian Index of Retail Deposit Rates (UIRD), the yield on hryvnia deposits with maturities of 3-6-9-12 months increased by 0.3-0.9 pp in February and the first third of March.

Changes in the yield on hryvnia deposits in February-March, % p.a.

| Date | Deposit term | |||

| 3 months | 6 months | 9 months | 12 months | |

| 01.02 | 11.46 | 12.46 | 11.62 | 12.90 |

| 08.02 | 11.64 | 12.64 | 11.99 | 13.19 |

| 15.02 | 11.54 | 12.54 | 11.56 | 12.97 |

| 23.02 | 11.77 | 12.54 | 12.42 | 13.13 |

| 03.03 | 12,00 | 12.86 | 11.93 | 13.44 |

| 06.03 | 12,00 | 12.86 | 11.93 | 13.44 |

| 04.03 | 11.77 | 13.23 | 12.85 | 13.90 |

| 08.03 | 12.31 | 13.04 | 12.85 | 13.90 |

| 09.03 | 12.31 | 13.23 | 11.93 | 13.82 |

According to the UIRD

"The NBU will urge banks to withdraw funds from certificates of deposit more actively, and will also try to 'tie up' the free hryvnia of the people. In other words, so that individuals do not keep their money on current accounts, from where it can enter the foreign exchange market at any time, but invest it in term instruments, for example, in hryvnia deposits for a period of six months to a year," confirms Grygoriy Kukuruza.

Sure, we shouldn't expect all banks to raise rates to 20% per annum or more. But there are many offers at the level of 15-17%. And taking into account bonuses (for opening a deposit for a long term, no right of termination, etc.), the yield can reach 18-19%. Based on the inflation forecast of 18.7% for 2023, such conditions for hryvnia deposits may be of real interest to the population. Thus, the NBU has a chance of achieving its goal, and the pressure on the exchange rate will decrease.

What is likely to happen to the exchange rate in the next 3-6 months? There are currently no global threats to the hryvnia's stability.

The cash market will continue to receive foreign currency from conversion deposits. At the same time, the effect of the NBU's measures to reduce bank liquidity will begin to show. "This is due, among other things, to the fact that from 11 March, new regulatory requirements for provisioning for hryvnia and foreign currency accounts will come into force for banks," comments Andriy Shevchyshyn.

The National Bank Governor Andriy Pyshny expressed hope that the decline in banks' income due to the increase in deductions would encourage them to raise interest rates on hryvnia deposits more actively. As we remember, this is a factor that will play in favour of the hryvnia.

"As the NBU clearly aims to bring the card and cash exchange rates closer together, the cash market is likely to remain in the range of UAH 37.5-38/$ in the next 3-6 months," says Mr. Kukuruza.

The NBU has more concerns on the non-cash market, as the interbank market cannot reach a balance without the currency coming from the gold and foreign exchange reserves. Even though the business of selling foreign currency earnings has intensified.

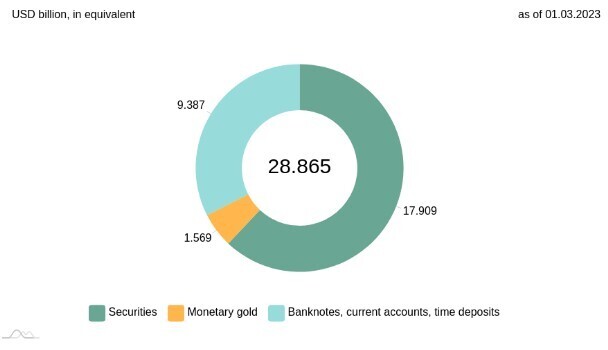

"The dominance of demand for foreign currency is due to the persistence of a significant deficit in foreign trade in goods and services, which in January 2023 amounted to more than $3.4 billion," Bogdan Danylyshyn, former Head of the NBU Council, wrote on his Facebook page, adding that in February Ukraine also paid off just over $870 million of its external debt. As a result, the National Bank's reserves fell by 3.5% to $28.9bn in February. In other words, the "burning" of FX reservesis in full swing. Moreover, the NBU will continue to spend $3-4 billion a month (on average) on interventions.

Foreign exchange reserves of the National Bank of Ukraine

According to the NBU

"Among the risks to the hryvnia are blocking grain exports, which would worsen the already weak exports, and the termination or change in the pace of financial support. But the likelihood of these events occurring is very low," says Andriy Shevchyshyn.

The Ukrainian government is already negotiating the extension of the grain deal. As for financial assistance, foreign partners are thoroughly keeping their promises. In January–February, they received about $6.8 billion.

Therefore, selling foreign currency from reserves is an unpleasant but not fatal phenomenon. There is enough money for the National Bank's interventions. Therefore, the non-cash foreign exchange market will remain calm within the corridor around the official exchange rate of UAH 36.57–36.93/$. And this situation will remain at least until the end of spring for sure.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]