Expensive pleasure: How beverage sugar can cause not only harm but also make money

Additional taxation of sugar-containing beverages will raise another UAH 6 billion to the budget but has little to do with the stated goal of the innovation – improving the health of the people

The Verkhovna Rada is considering a bill to introduce an excise tax on beverages with a higher sugar content of 25 grams per litre. If the law is passed and comes into force, it will automatically apply to most carbonated drinks, including the super-popular line produced by giants Coca-Cola and PepsiCo.

Initially, it was proposed to set the tax rate at UAH 5 per litre during the martial law period and at UAH 10 per litre after its end. However, a few days ago, a revised version appeared. It sets a flat rate of EUR 0.1 (UAH 4) per 1 litre of beverage. It was clarified that fizzy sweet drinks will not be subject to mandatory excise stamp labelling.

Draft Law No. 9032-1 was elaborated at the intersection of two committees – Finance, Taxation, and Customs Policy and National Health, Medical Care and Health Insurance. The drafters declare that taking care of the health of Ukrainians is the main goal of the tax innovation.

"The main goal of the draft law is to reduce the number of Ukrainians who regularly consume fizzy drinks. Accordingly, fewer of our citizens will get diabetes or gastrointestinal diseases. And the money from the new tax will be used to treat such diseases and provide healthy nutrition for schoolchildren," said Mykhailo Radutsky, Chairman of the Verkhovna Rada Committee on National Health, Medical Care and Medical Insurance, during the United News TV marathon.

According to a WHO study, 83% of people aged 18-49 drink sugary fizzy drinks every day in the world. In Ukraine, this figure is only 26% – not too alarming to consider the draft law on combating sugary drinks an absolute priority. And it makes us suspect that its main purpose is to raise additional revenues for the state budget. According to Radutsky, they are estimated at UAH 6 billion.

However, one cannot but admit that the taxation of sugary drinks is a fairly common practice in the world, and the WHO insists on further expansion.

"Taxes on sugar-sweetened beverages can be a powerful tool to promote health because they save lives and prevent disease, while advancing health equity and mobilising revenue for countries that could be used to realise universal health coverage," said Dr Rüdiger Krech, Director of Health Promotion at WHO.

Mind analysed the justification for taxing soda and what it could bring to the budget, business and public health.

Is the taxation of sugar-containing beverages a Ukrainian know-how? No, it is not. According to the WHO's Global Information on Nutrition Action (GINA) database, more than 85 countries currently levy taxes on unhealthy food and beverages.

In recent years, there has been an increase in the use of excise taxes on sugar-sweetened beverages (SSBs), which is in line with the trend towards healthier eating. The latter, however, has been somewhat curtailed in Ukraine by military realities.

How effective is it for public health to make bad habits more expensive? Since the taxation of sugar-containing beverages began to be actively used in the early 2000s, two decades ago, a clear evidence base for the effectiveness of tax measures should have been formed by now.

It has not happened.

The data from various studies on health impact is contradictory, mainly due to the time lag between policy implementation and observed health outcomes. Sometimes the ambiguous results are due to customer bias, and sometimes to the inability to obtain complete information.

As in the case of tobacco products, the observed decline in consumption is refuted by the argument that consumers simply switch to illegal products that are not accounted for.

The available data on the impact of SSB taxes on public health are derived from simulation studies. However, it can be considered more or less proven that sales of sugary drinks will decline as a result of higher prices.

According to the WHO manual on sugar-sweetened beverage taxation policies to promote healthy diets, an increase in the tax on sugary drinks that leads to a 20% increase in the price of the final product can lead to a reduction in consumption by about 20%, which prevents obesity and diabetes.

At the same time, a study of potential substitution effects conducted in the United States found that a 20 per cent SSB tax would reduce purchases by about 10 per cent, but calorie consumption would only decrease by 4.8 per cent.

In general, the data today indicates that the price elasticity of SSB typically ranges from -0.8 to -1.3. It means that a 10 per cent increase in the price of SSB is likely to result in an 8% to 13% reduction in purchases.

Since low-income consumers and young people are the most sensitive to the price parameter, they may benefit the most from tax increases.

In Mexico, two years after the introduction of a tax on sugary drinks, households with the least resources reduced their purchases of fizzy drinks by 11.7%, while the figure for the general population was 7.6%.

In Ukraine, legislators assure that additional taxation will lead to a 21% reduction in consumption of taxable beverages and, consequently, a shift to healthier alternatives (water).

Yet some positive health effects have been proven? Yes. The level of dental caries reacts even to short-term changes in the consumption of sugary drinks.

What are the global risks of tax innovation? The worst-case scenario is that corporations will consider the investment climate unfriendly, turn around and leave the market.

However, it has never happened in any country in the world where a sugar tax has been introduced.

How much money does a sugar tax raise? Since legislators – not only in Ukraine but globally – are usually guided by considerations of public benefit, the effect is measured not in direct budget revenues but in healthcare savings.

According to estimates cited by the WHO, a 1-cent-per-ounce tax on sugary drinks in the United States would result in more than $17 billion in healthcare cost savings over 10 years.

In China, a 1 yuan ($0.16) per litre tax on sugary drinks would generate an estimated 73.6 billion yuan ($11.8 billion) in 2014.

Between 2011 and 2030, the gross domestic product (GDP) loss due to diabetes worldwide (direct and indirect costs) is expected to be $1.7 trillion, with $900 billion in rich countries and $800 billion in low- and middle-income countries. This figure can be reduced by making the population adopt a healthier diet.

In Ukraine, based on the consumption of the taxable beverage group in 2019, budget revenues from the tax could range from UAH 5.1 to 7.8 billion per year.

What is it proposed to spend the money on? According to Ukrainian MPs, 50% of the excise tax will be used to implement programmes to prevent and treat diseases caused by regular consumption of sugary carbonated drinks. The other half will be spent on a child nutrition programme in schools.

In the US city of Philadelphia, SSB tax revenues were used to fund universal pre-schools.

In France, SSB tax revenues are used to support social security (including health and medical care).

In Portugal, revenues are used to support the national health service.

In Mexico, the pesos from the drink were partially used to install drinking water fountains in schools.

How to track the targeted spending of this tax? There is no way.

Is there really an obesity problem in Ukraine that needs to be combated with greater urgency? According to the State Statistics Service, 16% of Ukraine's adult population is obese, compared to the global average of 8%. However, our country ranks 60th in the world in terms of the prevalence of obesity.

In 2008, the average weight of adult Ukrainians was 73 kg, and in 2021 it was 75 kg.

Since 1975, the prevalence of obesity has almost tripled globally, with around 41 million children under the age of five being overweight or obese in 2016.

The number of obese children and adolescents has increased tenfold in 30 years, from 11 million in 1975 to 124 million in 2016. The prevalence of overweight in preschool children is growing fastest in low- and middle-income countries.

More than 4.5 million people die each year from obesity or being overweight.

What is the situation with diabetes? In Ukraine, more than 1.4 million people are registered as having diabetes; about 190,000 patients are dependent on insulin.

Diabetes is the third most common disease in Ukraine, after cardiovascular disease and cancer.

Is all evil really from fizzy drinks? Not all, but sugary fizzy drinks make a significant contribution to the problem of diabetes and obesity.

It's all about the digestibility of this "liquid sugar" – people usually don't feel that they are exceeding the WHO recommended limit of 10% of their daily energy intake (equivalent to about 12 teaspoons of sugar for adults). At the same time, the desirable goal is to consume sugars below 5% of daily calories, or about 6 teaspoons of sugar per adult.

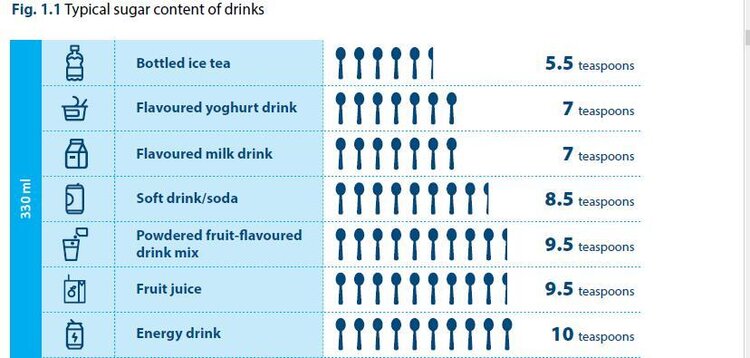

On average, one can of sugary drink contains about 40 g of free sugars, which is equivalent to about 10 teaspoons of sugar.

People who regularly consume 1–2 cans of sugary drinks a day or more have a 26% higher risk of developing type 2 diabetes than people who are not sugary drinkers.

In addition, regular consumption of SSBs, including soft drinks, flavoured milk, energy drinks, vitamin water, fruit juices and sweetened iced tea, is associated with an increased risk of tooth decay, weight gain and obesity in both children and adults, cardiovascular disease, stroke, and cancer.

How satisfied are the countries that have introduced soda tax? The most positive example that is traditionally raised by the initiators of taxation of sugar-containing beverages is Mexico.

In January 2014, the government of this country added a 1 peso per litre excise tax on any soft drink with added sugar (powder, concentrates or finished beverage) to a special production and services tax paid by the producer, which generates approximately +10% of the price for the consumer.

A study conducted by the Mexican National Institute of Public Health and the University of North Carolina after the first two years of the tax's implementation showed that consumers purchased sugary drinks that were taxed on average 7.6% less frequently in 2014-2015.

The poorest households reduced consumption by 11.7%. At the same time, according to the study, the number of purchases of tax-free beverages, especially bottled water, increased by 2.1%. Over the first two years, more than $2.6 billion was raised.

What is the WHO's position? The organisation calls on countries to introduce or increase existing taxes on SSBs to raise the prices of unhealthy products, reduce demand and reduce consumption.

Who is in opposition to this policy? Commercial organisations in the food and beverage industry, including retailers, HoReCa and producers themselves.

The industry's arguments against the SSB tax policy can be divided into five categories:

- doubts about the positive impact on public health;

- lawsuits and threats of lawsuits;

- rhetoric that tax increases hurt the poorest segments of the population;

- impact on employment in the beverage industry;

- the risk of import from regions with more lenient taxation.

In the US, two major soft drink companies spent $60 million together in 2009-2010 lobbying for the abolition of SSB taxes.

One of the most common ways is through the organisation and sponsorship of various sports marathons and campaigns to promote physical activity. In this way, the industry tries to make people responsible for their own health.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]