Real estate, land and non-performing loans. What assets of bankrupt banks are being sold by the Deposit Guarantee Fund

And why the demand for loan portfolios has fallen since 2022

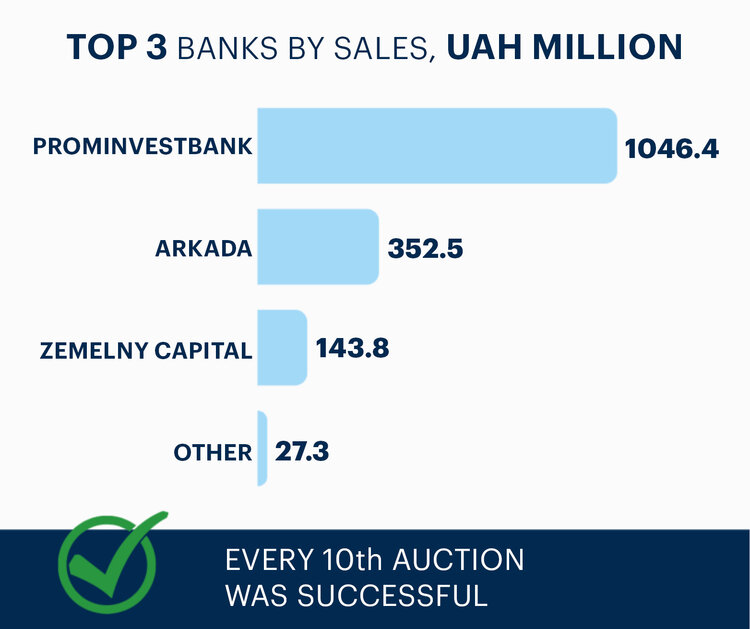

The Deposit Guarantee Fund (DGF), authorized to resolve insolvent banks, reported that about 10% of auctions for the sale of bank assets were successful in March. Of the more than 1,400 electronic auctions held by the DGF, only 138 resulted in a winner. The amount of assets sold was about UAH 371 million. In February, the DGF sold assets worth UAH 140 million, and in January – UAH 877 million. Thus, since the beginning of the year, the fund has sold assets of bankrupt banks worth just over UAH 1.38 billion.

Mind has been looking into what kind of lots the DGF is selling and how well it is doing.

Where does the money come from on the accounts of banks in liquidation? Banks in the process of liquidation receive funds from several sources. These include:

- sale of assets of insolvent financial institutions;

- repayment of loan debts;

- lease of property managed by the fund;

- payments from correspondent accounts of other banks;

- enforcement proceedings in court decisions.

To clarify, the funds do not go to the DGF, but to the banks. The DGF acts as a supervising administrator that oversees the process of removing insolvent banks from the market, and acts as a plaintiff in courts to seek the repayment of various debts, including those from former bank owners.

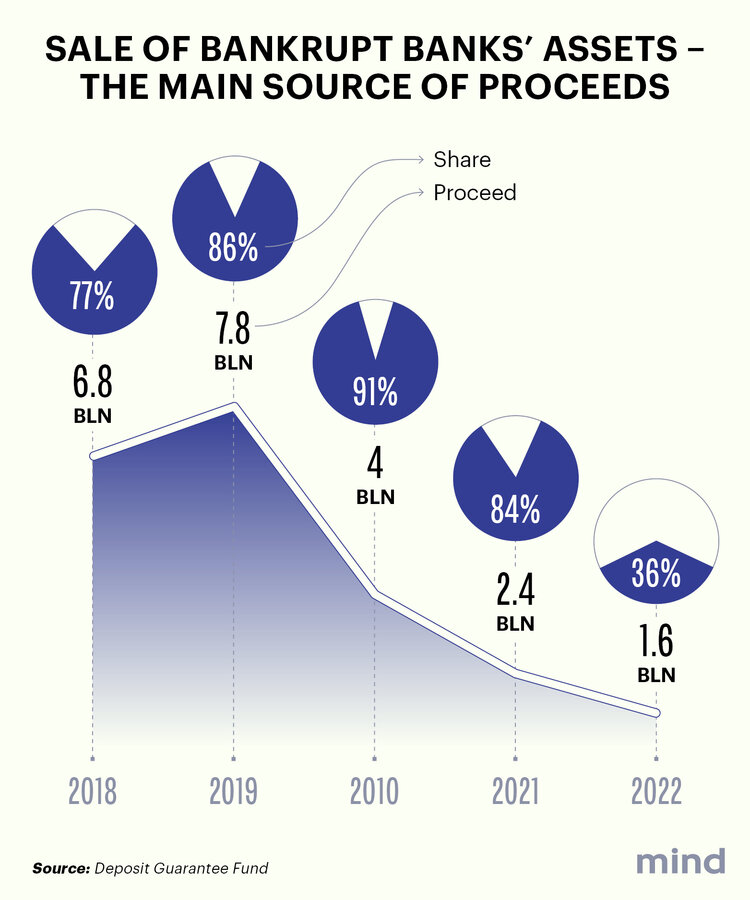

The fund also sells the property. It is the sale of assets of bankrupt banks (including loan portfolios) that generates the largest amount of revenue. According to the statistics provided by the DGF, the sale of assets generated:

2022 was, of course, an exceptional year, as no asset sales auctions were held at all until the summer due to the war. Even so, more than a third of the funds received by the bankrupt banks came from the sale of the property at auctions.

How are NPLs sold? If one follows the trend of recent years, it is clear that the amount of assets sold by insolvent banks in monetary terms has regularly decreased. Even if we do not take into account 2022.

And this is a completely natural process, as the DGF is gradually clearing out bank balance sheets. The most attractive assets are expected to go under the hammer first. These include real estate, land plots, other fixed assets and loan claims (loan portfolios, also known as NPLs).

There are fewer and fewer liquid lots left, so there is not much to sell. Moreover, many of the assets are subject to litigation, which can last for years. So, while the fund is seeking the right to auction off another plant or a claim on a bad loan in court, it cannot put them up for sale.

It is also worth considering the fact that the DGF is gradually completing the process of removing banks with large concentrations of assets from the market. In particular, the DGF liquidated the following medium and large banks in 2020-2021 (there were no significant liquidations in 2022)*:

- Brokbusinessbank;

- Forum

- Kyiv

- Khreshchatyk Bank

- Kreditprombank;

- Financial Initiative

*The above list is not complete.

Fortunately, no new insolvent financial institutions that are important players in the banking system have emerged so far. During 2022-2023, the NBU sent Megabank, Sich Bank, IBox Bank, and Forward Bank for liquidation. However, their assets do not even reach 1% of all assets of solvent banks.

What assets does the fund sell most successfully? It has already been said that banks’ tangible assets and loan claims are in the greatest demand among potential buyers. According to the DGF's reports, in recent years, the structure of assets sold has been changing:

30-35% were miscellaneous property (fixed assets);

70-80% were loans.

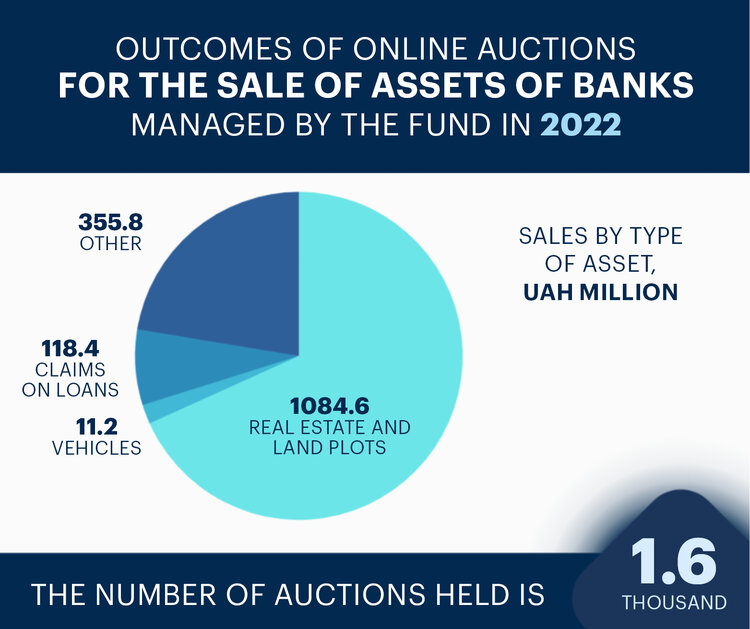

In particular, according to the DGF, in 2022, out of 154 successful auctions (during which the winner was determined), 88 auctions sold real estate and land plots, 32 auctions sold vehicles, and the fund sold loan claims at the 21 auctions.

In other words, in 2022, the activity of buyers willing to acquire non-performing loans declined significantly. It is because the prospects for further debt collection in wartime are extremely unclear.

Let's model a simple situation. An investor buys the loan portfolio of a bank that has gone bankrupt for a notional amount of UAH 100 million. This loan portfolio includes loans to five companies. Of these, two borrowers are bankrupt, and three borrowers have lost their property (real estate, production facilities) as a result of hostilities or the occupation of part of Ukrainian territory. Thus, even if the buyer of the NPL portfolio receives a loan portfolio at a discount of 96-98% of its value (for a notional few million hryvnias), it is far from certain that it will be able to recover its investment.

That is why the fund is now mostly selling tangible assets. For example, in January-March 2023, the DGF sold three large facilities and one loan at auction:

- a suburban complex of Prominvestbank in Koncha-Zaspa (Kyiv Oblast) with a spa centre, hotel, and restaurant – the sale price was UAH 311 million;

- the building and other property of a lyceum in the Desniansky District of Kyiv, which was on the balance sheet of Prominvestbank – the sale price was UAH 108 million;

- a former branch of Sich Bank in the centre of Kyiv with an area of 493 sq m – sale price UAH 33 million;

- a claim on one of the loans to the International Reserve Bank (formerly Sberbank), which was secured by a 22,500 sq m property complex in Kyiv – sale price UAH 130 million.

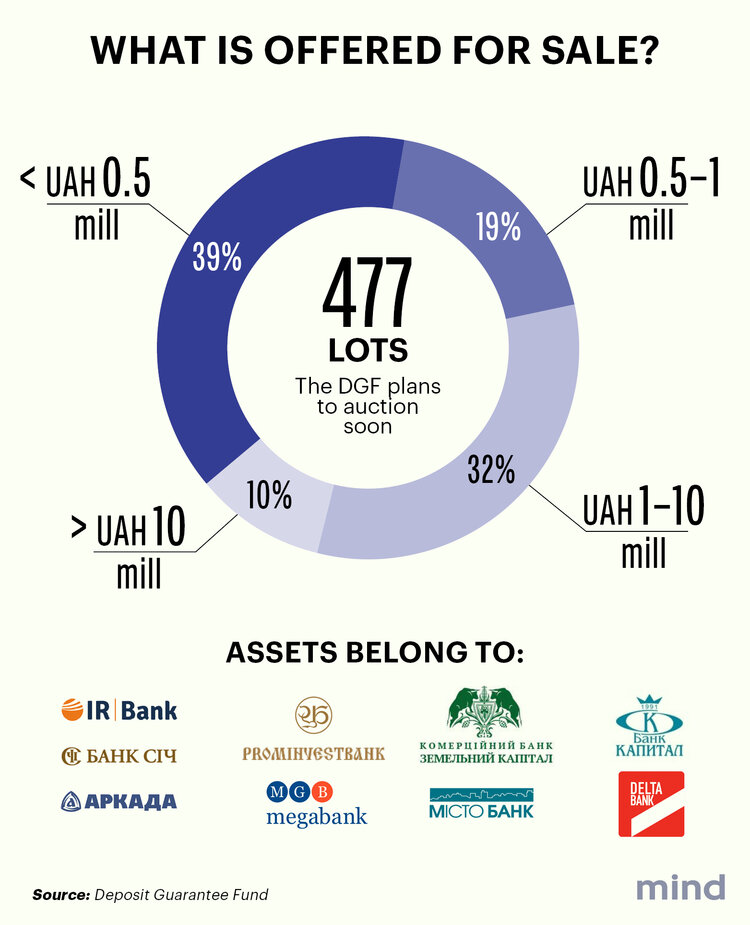

What is the DGF going to sell in the near future? As of 11 April 2023, 447 lots for the sale of assets of bankrupt banks have been placed in Prozorro.Sale system, and bids are being accepted. Among them:

- 68 auctions for the sale of real estate (non-residential premises, offices, parking spaces);

- 40 auctions for the sale of land plots;

- 312 auctions for the sale of claims under loan agreements.

At the same time, 39% of the announced auctions have a starting price of less than UAH 500,000, 19% of lots have a starting price in the range of UAH 500,000 to UAH 1 million, 32% of the planned auctions have a starting price in the range of UAH 1 to UAH 10 million, and about 10% of lots have a starting price of more than UAH 10 million.

As for the current week (10-14 April), the DGF intends to sell the assets of nine banks with a starting price of UAH 6.7 billion. Of this amount, UAH 6.3 billion is to be sold in the form of loan claims, and UAH 406 million in the form of real estate, land plots and other fixed assets.

Among the banks whose assets are to be sold are International Reserve Bank, Megabank, Prominvestbank, Zemelny Capital, Sich, Capital, Misto, Delta Bank and Arkada.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]