The NJSC factor: How did Naftogaz's debut on the Ukrainian Energy Exchange go?

And why this event has not resolved the contradictions in the gas market yet

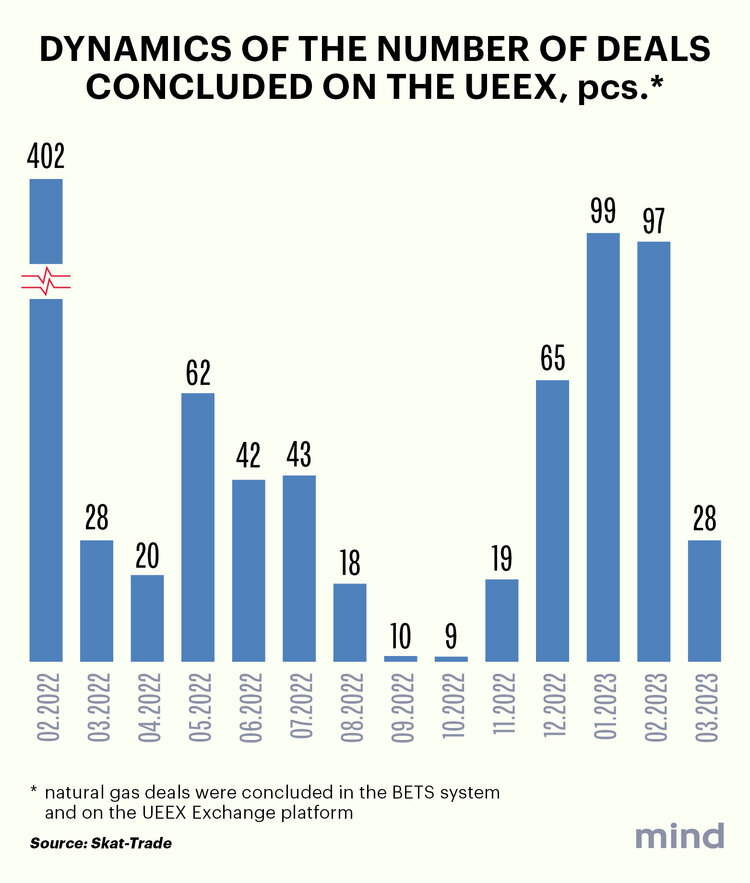

Yesterday, 26 April, Naftogaz of Ukraine entered the Ukrainian Energy Exchange for the first time to buy gas from private domestic producers. Before the full-scale invasion, companies from the state holding company's structure, not its head office, participated in the Ukrainian Energy Exchange trading. And this is one of the reasons why the information about the accreditation of Naftogaz on the exchange caused a resonance. Another reason is that the exchange expected a boost in activity from the emergence of such a large player and an increase in the number of transactions.

However, as the results of yesterday's auction showed, the "NJSC factor" did not work – at least for now, the market reacted to its offers with restraint. Mind looked into the reasons for this.

What did Naftogaz enter the exchange with? Naftogaz entered the UEEX with two starting positions – to purchase April's resources in underground gas storage facilities and May's resources in the Ukrainian gas transmission system. The starting prices were UAH 10,972 and UAH 10,791 per 1,000 cubic metres, respectively. The payment term was post-payment.

On 26 April, Naftogaz wanted to buy 12 million cubic metres of Ukrainian gas in total. However, these plans were not fulfilled. Naftogaz's 'yield' was eight times less – 1.6 million cubic metres. The company purchased 10 lots for 1.5 million cubic metres of May's resource and one lot for 100,000 cubic metres of gas for delivery in April. The weighted average price was UAH 10767 per 1000 cubic metres.

"It was only the first deal. In the future, we plan to make systematic purchases at the UEEX," said Oleksiy Chernyshov, CEO of Naftogaz.

Why is this event resonant even despite the modest result? "The resumption of Naftogaz's presence at the auction has a great positive impact on the development of the market as a whole, increasing liquidity. However, it is also a crucial step to support… national gas production," commented Oleksiy Dubovsky, Chairman of the UEEX Exchange Committee, on yesterday's auction.

How did other players react to it? The auction activity has shown that private producers are still cautious about cooperating with Naftogaz on the exchange.

Private producers still have questions about Naftogaz's ability to buy all private gas resources, the export of which has been banned by the government since the start of the Great War. The problem is the price of exchange transactions, which reflects the fall in demand due to the military operations in Ukraine and the economic downturn, but may not always guarantee adequate investment by extractive companies to increase production. In addition, as some gas market players suggest, "the UEEX is not an attractive instrument for all producers due to the insufficient development of exchange technologies."

Yesterday's auction also did not ease the tension between the extractive companies and the Cabinet of Ministers over the ban on exports of Ukrainian gas to Europe, where it can be sold for more money (and, by the way, the tax regulation allows a three-month delay in its return to Ukraine).

Why is gas export being discussed more and more actively? Currently, the domestic commercial market consumes significantly less gas than it produces. Therefore, there are conditions to start partial exports. Dmytro Sakharuk, the Executive Director of DTEK (which controls the largest private gas producer, Naftogazvydobuvannya), said this the day before. However, for exports, "it is necessary to create transparent and effective trade rules", which include exchange trading, involving "both exporters and importers, Ukrainian producers, Ukrainian traders so that the price is formed transparently".

"Our company currently has almost 1 billion cubic metres of unsold gas in its underground storage facilities. In fact, it is money that we could use for investment activities, including drilling new wells," said DTEK Executive Director.

And why is it currently banned? Mind has previously reported that the government and Naftogaz are against the resumption of Ukrainian gas exports until the war with russia is over. According to government officials, the country needs this resource to ensure a stable passage of the next heating season, which, due to russian aggression, risks being more difficult than the last one.

Moreover, the Ministry of Energy and Naftogaz are not relying on Ukrainian gas reserves alone in preparing for the next winter under martial law. Besides participating in the UEEX auction, Naftogaz also registered on the Aggregate EU, a digital platform for joint gas purchases, organized by the European Commission.

Deputy Energy Minister Mykola Kolisnyk announced his intention to attract loans for Ukrainian gas traders from the European Bank for Reconstruction and Development to help stabilise the market and create incentives for domestic gas production.

Gas United. Svitlana Dolinchuk's original Telegram channel:

- About the real gas business, based on common sense.

- How energy resources are traded in Ukraine and the world during the war.

- Facts, trends, comments.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]