The American banking crisis after the fall of Credit Suisse has spread to Europe

European stocks hit their lowest level in over a year

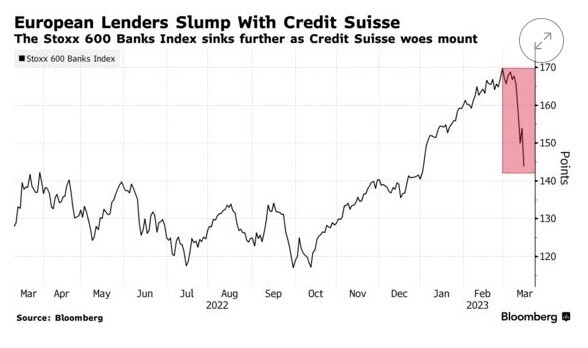

European bank stocks accelerated their decline on Wednesday on concerns about Credit Suisse Group and fell to their lowest levels in a year.

Source: Bloomberg

The Stoxx Europe 600 index fell by 2.9% by the close of trading in London, the biggest drop since early March 2022.

Shares of Swiss Credit Suisse, one of the world's top 50 banks, fell by 24%, which led to a trading halt on the stock exchange and dragged down the entire European banking sector.

Shares of another Swiss bank, UBS, fell by 7%, Societe Generale – by 10%, Deutsche Bank – by 8%, Commerzbank – by 9%, Raiffeisenbank and Santander – by 6%, UniCredit – by 7%.

Credit Suisse shares fell after a series of negative news about the bank. The bank recognized the ineffectiveness of the group's internal control over financial reporting in 2021 and 2022. It emphasized that "significant resources may be required to address these deficiencies."

During the year, CHF 51 billion (about 28%) was withdrawn from the bank.

At the same time, the main shareholder of Credit Suisse, the National Bank of Saudi Arabia, said it was not ready to allocate additional funding to save the Swiss bank.

"The answer is absolutely not, for many reasons, except for the simplest one – regulatory and legal," said Ammar Al Hudairi, the head of the Central Bank of Saudi Arabia, to Bloomberg.

The panic in European bank stocks comes amid the banking crisis in the United States: Silicon Valley Bank, Silvergate Bank and Signature Bank have collapsed in recent days, and local depositors have withdrawn tens of billions of dollars from regional banks.

Background. As reported, the US indices are falling amid the problems of Credit Suisse – a negative signal from a large bank will cause a ripple effect throughout the financial sector.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]