Allies or competitors: Four state-owned banks occupy almost 60% of the business lending market. Are they not cramped in this niche?

And what will happen to them after the war

Since the beginning of January, one of the main topics in informal discussions of the realities of the financial market has been the future of state-owned banks. In 2022, they proved to be the most active part of the financial system, which, on the one hand, has priority rights to work with public sector employees and the military, and, on the other hand, has higher trust from legal entities in the turbulence of wartime. However, every businessman understands that when one owner concentrates four banks, whose main field of competition is budgetary flows, many questions arise.

The unprecedented amounts of foreign financial aid that have been already coming into the country and will increase even more after Ukraine's victory are added to the acuteness of these issues. It should be transformed into the recovery of the domestic economy in all areas.

In this regard, it is becoming increasingly clear that the state-owned bank segment is on the verge of significant changes. The most recent comments of those involved people in the industry (as well as, in some cases – their reluctance to make them public) indirectly confirm this conclusion.

Why did the share of state-owned banks in the Ukrainian financial sector grow steadily, while all the government's intentions to reduce it remained just intentions? How do they get along in the market, is there competition between them, and for which niches? How has their role been transformed since the beginning of the full-scale russian invasion, and what awaits them after the war is over? Mind tried to find answers to these questions.

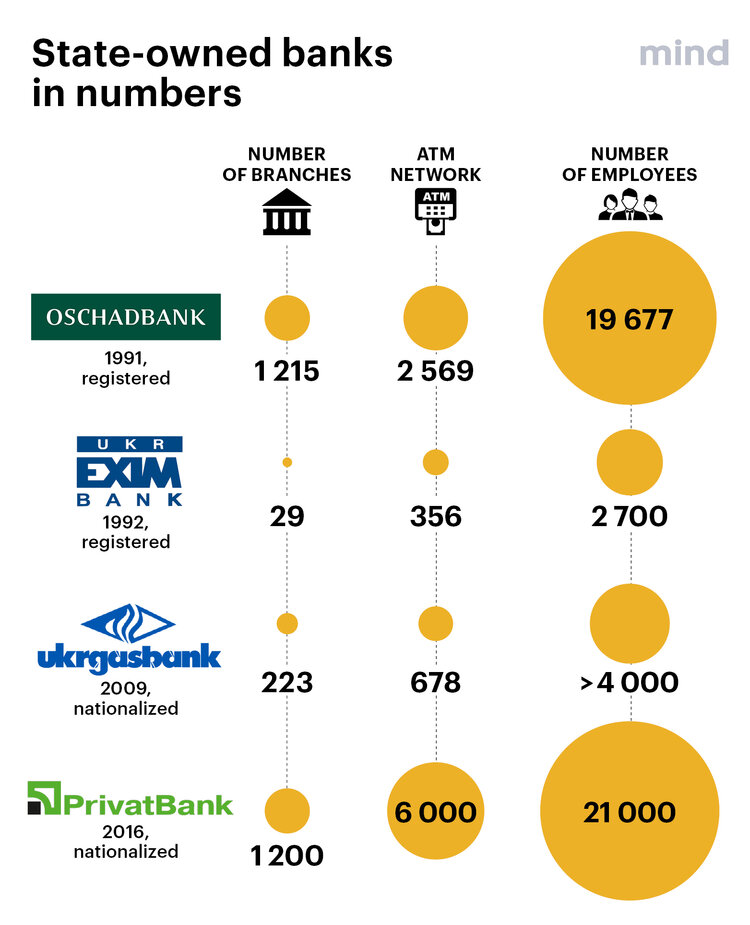

What share of the banking market is currently held by state-owned banks? During the war, banks with state capital became the top lenders to legal entities. The share of state-owned banks in this indicator increased from 47.8% to 56.2% during the year. "The war has shown that state-owned banks play a key role in lending to the economy during martial law. It is state-owned banks that are currently supporting lending to the security and defence sector and critical infrastructure. Private banks, according to the analysis of the ratio of interest income on certificates of deposit to interest income in general, are actively investing in certificates of deposit. For private banks, it is due to both a conservative approach to the risks of a country at war and restrictions of parent policies: they are prohibited from lending, for example, to weapons production and nuclear energy," says Viktoriya Strakhova, Supervisory Board Member and Presidential Representative at Ukreximbank.

The fact is that the parent structures of all international banks prohibit their subsidiaries from working with several potentially toxic sectors for their reputation, such as arms, tobacco, etc. And in times of war, high-risk segments such as agriculture, cargo transportation, and the public sector are also banned. It also limits the opportunities for foreign banks in Ukraine.

How is this lending market share distributed among the players? Ukreximbank is a clear leader in business lending. As of November 1, 2022, the net loan portfolio of legal entities in this institution amounted to UAH 82.1 billion. It is the largest volume not only among state-owned banks but also for the entire banking system of Ukraine. "The first three positions are occupied by state-owned banks," Ukrexim says. "If one takes the data from five years ago, the top three have looked somewhat different. As of January 1, 2018, Ukreximbank ranked second in terms of corporate loans with a portfolio of UAH 67.4 billion, while Oschadbank was in first place with UAH 70.7 billion. Raiffeisen Bank Aval was in third place with a portfolio of UAH 33.8 billion."

Currently, Oschadbank is also focused on lending money to entrepreneurs. In the segment of large corporate clients, the total amount of loan agreements concluded as of the beginning of 2023 is about UAH 14 billion. Most of the financing is directed to agriculture and agricultural processing, retail trade, and the fuel and energy sector.

The loan portfolio of small and medium-sized businesses exceeded UAH 17 billion. The agricultural sector traditionally accounted for the largest share of loans issued by SMEs (Small and medium-sized enterprises) in 2022 – 59%.

"In 2022, UAH 12.6 billion in loans were provided to small and microbusiness clients. More than 4,000 enterprises employing up to 100,000 Ukrainians received money for business development," says Nataliya Butkova-Vytvytska, Oschadbank Board Member in charge of micro, small and medium-sized businesses.

Why has the share of state-owned banks in the Ukrainian financial sector been growing since 2008? The global financial storm has shaken Ukraine's banking system. To prevent a "domino effect," the Cabinet of Ministers recapitalized three private problem banks – the largest Ukrgasbank and Rodovid Bank, as well as Kyiv Bank, which was a medium-sized bank. Whereas before that moment there were two state-owned banks in the country: the corporate, closed Ukreximbank and the retail (huge and largely outdated) Oschadbank, after the recapitalization the state became the owner of five banks at once.

The terms of the state's entry were different. The capital of Rodovid and Kyiv was denominated, while private minority shareholders remained in Ukrgasbank. Kyiv, the weakest and smallest bank, was merged with Ukrgasbank in 2015, and the troubled Rodovid was liquidated at the end of 2017.

At the end of 2016, the largest PrivatBank was nationalized. "Servicing the public sector is not our priority. The nationalization of the largest retail bank has strengthened the quality competition for retail customers and the formation of a fundamentally new market for servicing the public sector," assures Oleg Serga, Deputy Head of External and Internal Communications at PrivatBank.

According to him, PrivatBank currently serves more than 19 million customers in retail, 15.5 million Ukrainians use the Privat24 system, and in 2022, Privat's network of POS terminals provided goods and services worth UAH 550 billion. The bank serves 75% of Ukrainian entrepreneurs. In 2022, the loan portfolio to small businesses increased by UAH 10 billion.

How tense was the competition between the state-owned banks from the very beginning? Ukrgas skilfully used the difference in status (a bank with state participation rather than a state-owned bank) to compete for customers, which gave it more room for manoeuvre in decision-making. The bank initially focused on the energy market. Later on, it chose the eco-bank development model – working with companies and industries that minimize environmental damage.

Ukrgas has been actively lending to renewable generation projects, eco-friendly startups, and large enterprises, in particular, together with the EBRD and IFC, which have been adepts of green banking in the region for many years. Thanks to this strategy, the bank opened the door for its top management, headed by Kyrylo Shevchenko, to the top banking circles that are fighting for the "environmental cleanliness" of financial institutions.

Since 2009, the number of state-owned enterprises has increased among Ukrgas' clients. However, it had to fight for each client, and Oschad was always among its main competitors. Gradually, the bank attracted large energy companies, including Naftogaz of Ukraine.

Ukrgasbank also serviced local budgets throughout Ukraine, in particular in Kyiv, Lviv and other cities. Here, it competed primarily with Oschadbank. There were entire sectors that could only work with state-owned banks. First, we were talking about budget payments, including salaries and pensions, which began to be gradually concentrated in state-owned banks. "It is related to both national security and the stable operation of these institutions. There are also certain projects for which the NBU appoints authorized banks. Only state-owned banks meet a number of security and reliability requirements. It is not surprising, considering the consequences of the banking sector reform and their actual dominance," says Rostyslav Kravets, Chairman of Kravets & Partners Law Firm.

Who, when and how tried to sell state-owned banks to private owners? "Five years ago, the government first approved the framework for strategic reform of the state-owned banking sector, which reflected a vision of the place on the market and development directions for banks that historically belonged to the state or became its property as a result of crises. At the same time, a course was set to reduce the state's share in the banking market and to privatize it in the future," says Olena Korobkova, Chairman of the Board of the Independent Association of Banks of Ukraine (IABU).

The state strategy for the development of state-owned banks envisages a gradual reduction of the share of state-owned banks from 50% to 25%, with the main focus initially on PrivatBank. Since mid-2017, options for selling Privat after its recovery under the state's wing have been actively discussed. There is interest from global banking giants, but the possible sale is hampered by the incomplete clean-up of the bank's portfolio inherited from its former shareholders and litigations with them.

As for Ukrgasbank, during Kyrylo Shevchenko's presidency of the NBU, the process of the IFC (International Financial Corporation) becoming a shareholder of this bank was intensified. However, neither project was brought to a logical conclusion.

In the past, one of the bankers who supported the reduction of the share of state-owned banks by selling some shares to a strategic partner was Andriy Pyshny. Such a partner for Oschadbank could potentially be the EBRD, with which, during Pyshny's tenure at Oschad in 2016, relevant agreements were signed on the possible sale of the state-owned bank's stake.

What has changed since the beginning of the war? After the outbreak of full-scale russian aggression, the role and importance of state-owned banks in Ukraine increased rapidly. Large and medium-sized businesses began to actively switch to state-owned institutions, rightly considering them more reliable and predictable operators of financial flows.

"When the fighting started in Kyiv on February 24, 2022, we could not expect banks with foreign capital to keep their top managers in Ukraine and keep their servers running. And the operation of branches both in the capital and in the territories adjacent to the war zone. It is highly likely that they would have closed their branches, and no national bank would have forced the Austrians, French, Italians, and Germans to operate. Moreover, state-owned banks are now the first to enter the liberated territories," says Anatoliy Drobyazko, financial analyst and former advisor to the head of the National Bank.

The choice of candidates for the position of NBU governor is based on their experience in state-owned banks. Kyrylo Shevchenko, before he was offered the job of heading the NBU, was the head of the state-owned Ukrgasbank. The current governor of the National Bank, Andriy Pyshnyi, ran Oschadbank for many years, adhering to a rather tough position on protecting the interests of state-owned banks. "I believe that servicing state-owned enterprises is a matter of national security. For example, servicing the so-called salary projects of military personnel, employees of the Security Service, the Ministry of Internal Affairs, and the National Guard. After all, the personal data held by the bank, credit and transaction history can tell much more about a person than he or she does," Andriy Pyshny, the head of Oschad, emphasized in an interview back in 2016.

"In times of war, the economy is primarily supported by credit resources from state-owned banks as the main lenders to legal entities. In 2022, despite all the risks of the agricultural sector, they provided lending to it. Therefore, it is wrong to demand that the government rapidly reduce the share of state capital under these conditions," Anatoliy Drobyazko said.

Is there competition between state-owned banks now, and how does it manifest itself? "Many state-owned banks are a distortion of competition, but the war has turned everything upside down. The issue of competition is crucial, but today national security is in the first place. And the protection of strategically important information, strategically important enterprises that are clients of banks and affect the stability of the country," says Olena Korobkova.

According to her, state-owned banks overlap in certain market segments nowadays. "For instance, they all finance small and medium-sized businesses. All of them, except Ukreximbank, provide consumer loans. And they all compete with each other and with private sector banks by means of service conditions and competencies – understanding the needs and characteristics of certain categories of clients," Korobkova says.

As an example of competition between state-owned banks, it took Ukrgas 10 years of hard work to acquire the status of an authorized bank in the electricity market, while previously only Oschad had this exclusive right. It also took years for the state-owned Ukreximbank to win this right.

State-owned banks took over many of the clients of banks that were withdrawn from the market in 2014-2017. When the Kyiv municipal bank Khreshchatyk was liquidated in 2016, Oschadbank took over its best development – the Kyivan Card project. It was about serving several million citizens. Oschad also received the portfolio of Khreshchatyk's municipal clients, Ukreximbank received the servicing of Kyiv's city external debt, and Ukrgasbank received the internal debt of Kyiv city.

Back in the 1990s, Aval Bank was supposed to become a pension bank, but later other players took over this niche. Thus, in most Pension Fund branches, people are directed to Oschadbank or Privat when opening an account.

"Always, to get a place in a Pension Fund branch, meaning a place for a bank employee in a PF branch, you first need to be accredited by the Ministry of Finance and confirm it with a letter from the NBU every quarter regarding compliance with the standards. State-owned banks have advantages, and it is difficult for others to compete in this segment," says banker Olena Domuz. She was an advisor to the Minister of Finance in 2018-2019 and dealt with the issues of distressed assets of state-owned banks.

The fierce competition in the state-owned bank sector is evidenced by the story of the dismissal of high-level managers from Oschadbank, as previously reported by Mind.

Considering the nationalization of Ukrgas and Privat, each state-owned bank has found its own niche. "We can say that there is competition between Oschad and Privat for retail, and between Oschad and Ukrgas for energy and utility companies. Each state-owned bank has its own state-owned enterprises that it serves. In fact, this is a state monopoly, but during the war, it cannot be blamed. The relevant decisions of clients are made at the level of state-owned enterprises, ministries or even the Cabinet of Ministers," says Olena Domuz.

What should we expect from state-owned banks in the future? All state-owned banks are of interest to Ukraine's strategic investors and partners, and this interest should be manifested after the victory. Optimists believe that Ukraine will receive hundreds of billions of dollars in compensation for russia's aggression. Then the rapid post-war economic development should begin. Logically, international banking capital will want to participate in this process, in particular by buying one or even two state-owned banks.

So far, the "intermediate" scenario is being implemented.

Firstly, the market is waiting for news on Ukrposhta (Ukraine's national post), which has once again intensified its attempts to enter the banking market. For several years, the company's chairman, Igor Smelyansky, has been seeking the right to establish a postal bank. Perhaps we will soon hear good news on this topic. "We cannot comment until early February. Now is the time when there are no comments," Smiliansky said mysteriously in an interview with Mind.

According to Olena Domuz, if Ukrposhta intensifies the development of its bank, the first clients will be pensioners, veterans and IDPs who will receive payments through post offices.

Secondly, in October 2022, the Verkhovna Rada adopted the law "On Peculiarities of Withdrawal of a Systemically Important Bank from the Market under Martial Law" (2643-IX). The market said that this law was written for Alfa Bank, but later NBU officials said that there were no questions about the bank's solvency.

There is speculation that Ukrposhta is in a hurry to build a postal bank specifically for postwar recovery projects. Privat is traditionally the first in line for sale, and Oschadbank already has agreements with the EBRD to join the capital. After the sale of the two state-owned banks, the postal bank can occupy the niche of a state-owned retail bank. However, this scenario may not be realized quickly – in the 5–7 years after the end of the war.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]