More than a third of loans in commercial banks are non-performing. Who is at risk, and what can be done

How the banking sector will take away such debts

According to the NBU, by the end of 2022, the share of non-performing loans (NPLs) in the loan portfolios of commercial banks reached almost 37%. Thus, since March 1 (essentially since the beginning of full-scale hostilities in Ukraine), the share of toxic debts has increased by almost 10 percentage points.

The rise in NPLs was quite predictable amid the destruction of businesses, damage to infrastructure, especially energy infrastructure, and falling domestic demand. By the way, the NBU warned in the summer of 2022 that loan risk was the main threat to the banking system. According to the NBU, at least 20% of borrowers could become bankrupt, which would create serious problems for banks.

Mind has analysed what is happening to banks' loan portfolios and how the market will get rid of not-performing loans.

How did the NPL situation change in 2022? In fact, banks entered 2022 with the lowest amount of toxic loans in the last four years. As of January 1, 2018, the share of NPLs in the banking sector was 55%, and as of January 1, 2022, it was 30%.

State-owned banks have done the most serious work to clear non-performing loans. Their NPL portfolio decreased from UAH 398 billion to UAH 254 billion between 2018 and 2022. Private banks (including those with foreign capital) concentrated UAH 187 billion of NPLs, and by 2022 this amount had more than halved to UAH 90 billion.

Read also: Allies or competitors: Four state-owned banks occupy almost 60% of the business lending market. Are they not cramped in this niche?

A significant increase in NPLs in 2022 began in the summer. As of May 1, the share of non-performing loans in banks was about 27% (UAH 310 billion), by the end of the summer it increased to 31% (UAH 340 billion), and by December it reached 36.8% (UAH 430 billion).

Volume and share of non-performing loans in banks in 2022, UAH billion

| As of January 1, 2022 | As of December 1, 2022 | |

| All loans, including: | 1150 | 1169 |

| non-performing loans | 345 | 430 |

| share of non-performing loans, % | 30,02 | 36,75 |

| Loans to the corporate sector, including: | 836 | 871 |

| non-performing loans | 302 | 353 |

| share of non-performing loans, % | 36,10 | 40,51 |

| Loans to individuals (including individual entrepreneurs), including: | 256 | 239 |

| non-performing loans | 43 | 77 |

| share of non-performing loans, % | 16,86 | 32,04 |

Source: NBU data

Which banks have the most difficult NPL situation? According to the NBU, the NPL portfolio by December 2022 was distributed as follows

- state-owned banks – UAH 324 billion, or 75.4% of all NPLs

- private banks with foreign capital – UAH 57 billion, or 13.3% of all NPLs;

- other private banks – UAH 49 billion, or 11.3% of all NPLs.

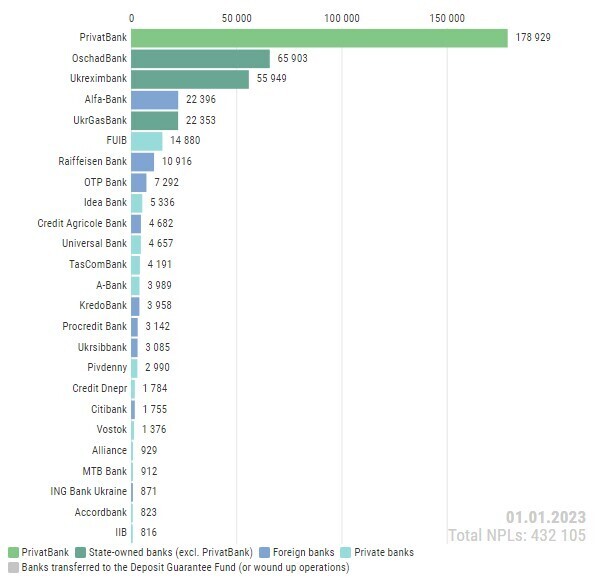

PrivatBank is the main collector of NPLs in the banking system. It has accumulated about UAH 188 billion of toxic debts, which is 44% of all NPLs. However, most of this amount was inherited by the bank from its former owners, whom it is still suing to this day. In 2022 (after February 24), the real growth of Privat's NPL portfolio amounted to UAH 13 billion, or 7.4%. The five largest NPL holders also include Oschadbank, Ukreximbank, Sense Bank, and Ukrgasbank (see the graph).

Top 25 banks by non-performing loans

Source: NBU data

What is the structure of NPL by type of borrower? In December 2022, the share of NPLs for legal entities amounted to 40.5%, and for individuals – 32%.

Businesses repay loans worse than individuals. It is because, firstly, the share of corporate borrowers is significantly higher. Banks granted 75% of all loans to businesses, and 21% to households. There are also interbank loans and loans to local authorities, but their amount is insignificant.

Secondly, businesses are facing more severe debt repayment problems due to energy shortages, collateral destruction, etc. And since companies have a lot of long-term loans, the process of collecting them is quite complicated for banks. The loan portfolio of individuals generally consists of short-term loans, which are often issued at tens or even hundreds of per cent per annum. Accordingly, banks initially insure themselves against the risk of non-repayment, so the inability to "squeeze out" debts from such borrowers is not so much of a concern to lenders.

How do different sectors of the economy service their debts? According to data provided to Mind by the Investohills group of companies, businesses that have difficulty repaying loans can be divided into three groups.

- The first group is companies that have found themselves (their assets, production facilities) in the areas where hostilities are ongoing or in the areas under occupation. They do not service their loans at all. These borrowers include all categories of business – from metallurgical enterprises, machine builders and the chemical industry to retail and agricultural enterprises.

- The second group includes the most solvent borrowers. They include trade companies (both wholesale and retail), agrarians, energy companies, and partly industry and logistics.

- The third group is businesses that for various reasons cannot fully repay their loans (damaged equipment, lost sales markets, reduced production due to power outages), but are trying to repay at least part of their debts to banks. This category includes many developers, food companies, machine-building companies, and service companies.

"In general, 75-80% of borrowing companies are currently paying off their loans. In fact, this is the most solvent part of the economy, which continues to function and earn some money," says Andriy Volkov, founder and managing partner of Investohills Group.

How do banks deal with NPLs? In the current environment, banks have several ways to stop the growth of NPLs and deal with the bad debts that have been accumulated.

The first way is to make allocations to provisions. This is a kind of financial cushion that banks are required to form in accordance with the NBU's requirements. It is needed in case a loan becomes uncollectible, and the bank is forced to write it off. Then it will have a reserve to cover this write-off. According to the NBU, by December 1, 2022, banks had transferred UAH 113 billion to provisions. A year earlier, these allocations amounted to UAH 8.3 billion. That is, 13.6 times less.

Read also: Mind nominations 2022: Сompanies and persons that impressed during the year. Banking

However, provisioning has a downside. Provisions are direct losses of banks that negatively affect their final financial result. And it is already noticeable. The net profit of the banking sector in January–November 2022 amounted to UAH 19.4 billion. It is 3.4 times less than a year earlier. At the same time, the number of unprofitable banks in the first 11 months of 2022 exceeded two dozen.

The most unprofitable banks in January – November 2022

| Bank | Financial result for 11 months of 2022 |

| Ukreximbank | - UAH 7.7 billion |

| Sense Bank | - UAH 5.1 billion |

| Ukrgasbank | - UAH 3.8 billion |

| ProCredit Bank | - UAH 1.5 billion |

| Idea Bank | - UAH 0.5 billion |

Source: NBU data

In addition, provisions do not relieve the bank of its loan debt. NPLs continue to hang on its balance sheet. "Provisions are just a bank's response to bad debts. And even if the bank has written off NPLs from its balance sheet, these debts continue to exist. Therefore, something needs to be done with them," explains Vadym Berezovyk, director of ProFin Consulting.

Read also: Sense Bank (formerly Alfa-Bank) Chairwoman of the Board: "Our shareholders had no plans to hide behind anyone"

The second way is to clear non-performing loans. It can be done in two ways:

- restructuring of the loan, easing its terms. For example, the bank may grant a deferral of repayment of the loan principal, agreeing to pay only interest, extend the term of the loan agreement, temporarily reduce the interest rate, etc. The main task in this case is to negotiate with the borrower to pay at least something. In this way, the bank tries to prevent the loan from transforming from a non-performing loan to a bad loan (overdue for more than 90 days);

- enforcement of the loan, including through the courts. In this case, the bank seeks to realize the collateral, and seize the company's accounts and assets. In other words, the bank does everything it can in order to recover the loan or part of it.

According to experts, under martial law, banks are still more inclined to the first option. Because many borrowers simply have nothing to take away. The collateral has been destroyed and there is almost no money. It is better to try to negotiate than to sue for months or even years. At least while there is a war going on and the entire economy is operating under permanent force majeure.

The third way is to sell loan portfolios to debt enforcement agencies. In other words, the bank transfers the right to squeeze out money from the debtor to collectors for a fee.

The nuance is that today there are very few people willing to buy loan portfolios. And few people are willing to sell them either. After all, non-performing loans go under the hammer at a big discount, up to 80-90% of their value. As a result, if a bank sells a pool of loans worth, say, UAH 100 million, it can get UAH 10 million for them. And it is not a sure thing. So there are few such deals. Among the largest are 362 loan lots worth UAH 2 billion put up for sale by Ukreximbank in September 2022 and 9 lots totalling UAH 963 million, which Ukrgasbank announced its intention to sell in late January.

Bad bank against toxic loans: Ukrainian version. Ideas to create a so-called bad asset bank, or bad bank, are also periodically raised. It is a special financial institution owned by the state that buys out toxic debts from commercial banks, helping them get rid of NPLs. In other words, the state acts as a kind of doctor for the banking system, preventing the critical accumulation of bad debts.

However, all this is done at the expense of the budget. And the state treasury for 2023 is set to run a deficit exceeding 20% of GDP. The state budget will definitely not have the money to finance the bad bank event. Moreover, many experts doubt whether such an idea will be successful.

According to Bogdan Danylyshyn, former Chairman of the NBU Council, for a "bad bank" to be truly effective, Ukraine first needs to create a functioning market for distressed assets that will attract professional investors. "Otherwise, banks' NPLs will continue to be sold for a pittance," Danylyshyn believes.

By the way, there has already been an attempt to create a bad bank in Ukraine on the basis of the Rodovid Bank, nationalised in 2009. However, for the bank to be able to fully accumulate distressed assets and work with them, the Verkhovna Rada had to pass the draft law "On the Sanation Bank." The Parliament failed to do so, and as a result, Rodovid Bank went into liquidation, and Deputy Governor of the NBU Kateryna Rozhkova called the idea of turning it into a bad bank a failure.

What should banks prepare for in 2023? The volume of non-performing loans will grow. "The war is on, and uncertainty for the economy and business is very high. It is clearly premature to say that the growth of toxic loans has stopped, and it (the current level of NPLs – Mind) is not the limit," Vadym Berezovyk is sure.

Andriy Volkov agrees with him, saying that the state of many industries continues to deteriorate. This trend has especially intensified after the start of regular shelling of energy infrastructure. "In the spring of 2023, we may see a critical accumulation of non-performing loans. As a result, those companies whose assets have been damaged by the hostilities or are stuck in the occupied territories risk becoming insolvent," says Andriy Volkov.

The National Bank reports an increase in the degree of credit risk. According to the NBU's updated forecast, which was published in December 2022, up to 30% of borrowers may be on the verge of default. Accordingly, their loans will be recognized as bad.

It means that banks will have to do a lot of work to eliminate non-performing loans. Otherwise, some financial institutions risk losing their place in the market.

"Banks will be forced to carry out additional short-term restructurings, and sometimes immediately recognize the loss of some loans. However, even with a higher level of provisioning, most banks will be able to maintain a positive financial result or return to it over the next few quarters," the NBU predicts.

If you have read this article to the end, we hope that means it was useful for you.

We work to ensure that our journalistic and analytical work is of high quality, and we strive to perform it as competently as possible. This also requires financial independence. Support us for only UAH 196 per month.

Become a Mind subscriber for just USD 5 per month and support the development of independent business journalism!

You can unsubscribe at any time in your LIQPAY account or by sending us an email: [email protected]